Ola Electric Mobility Ltd. shares have hit a fresh all-time low extending its decline for the eight consecutive sessions. The shares have fallen over 18% in the same time span.

The decline comes despite a rising Nifty Auto index, which has gained significantly over the past year. The stock has declined over 75% from its post-listing high of Rs 157 and is down over 50% from its IPO price of Rs 75 per share.

Ola Electric's retail sales have recently dropped, pushing the company down the market share rankings. Competitors like TVS Motor, Bajaj Auto, and Ather Energy have successfully gained ground cruising past Ola's initial dominance.

Recurring reports of service backlogs, spare-part availability issues, and customer complaints have significantly damaged investor and consumer sentiment. While the company has deployed a task force to address these concerns, the impact is yet to be reflected in its stock performance.

As per Ola Electric founder Bhavish Aggarwal's social media posts, he has also been involved in these efforts on the ground. According to highly placed sources, internal targets have been set to dramatically reduce wait times as the company works to rebuild confidence and strengthen its position in India's competitive EV market.

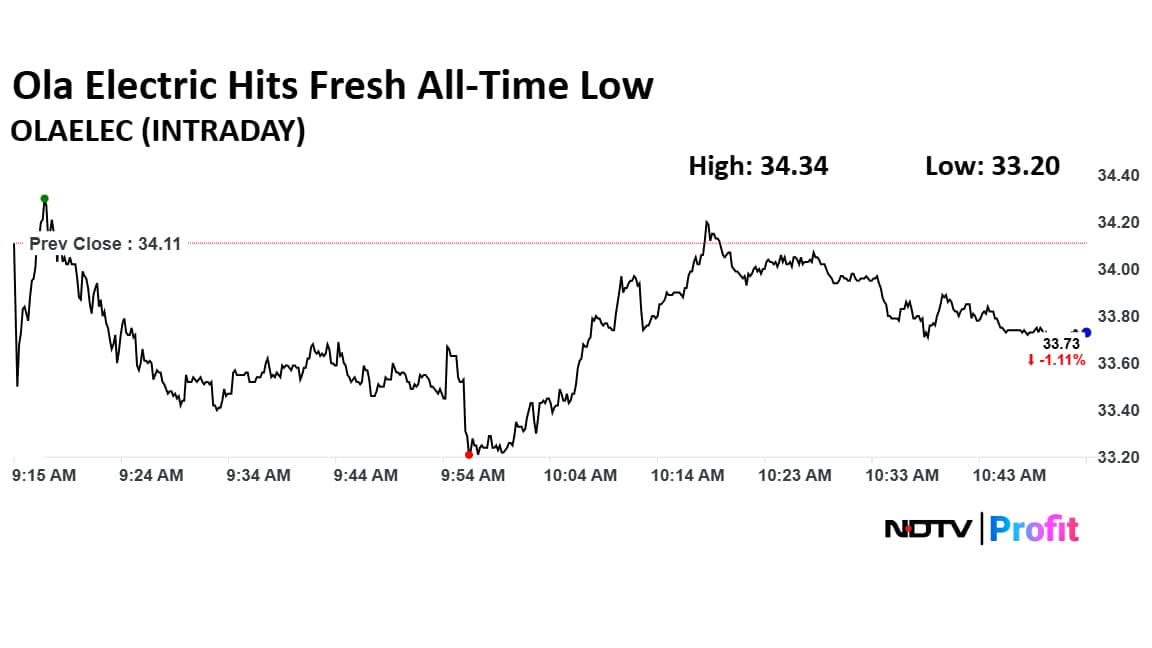

Ola Electric Share Price Today

The scrip fell as much as 2.67% to Rs 33.20 apiece on Tuesday hitting a fresh all-time low. It pared gains to trade 1.26% lower at Rs 33.68 apiece, as of 10:51 a.m. This compares to a 0.63% decline in the NSE Nifty 50 Index.

It has fallen 63.47% in the last 12 months and 60.69% year-to-date. Total traded volume so far in the day stood at 1.22 times its 30-day average. The relative strength index was at 36.01.

Out of eight analysts tracking the company, three maintain a 'buy' rating, one recommends a 'hold,' and four suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target of Rs 45.88 implies an upside of 35.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.