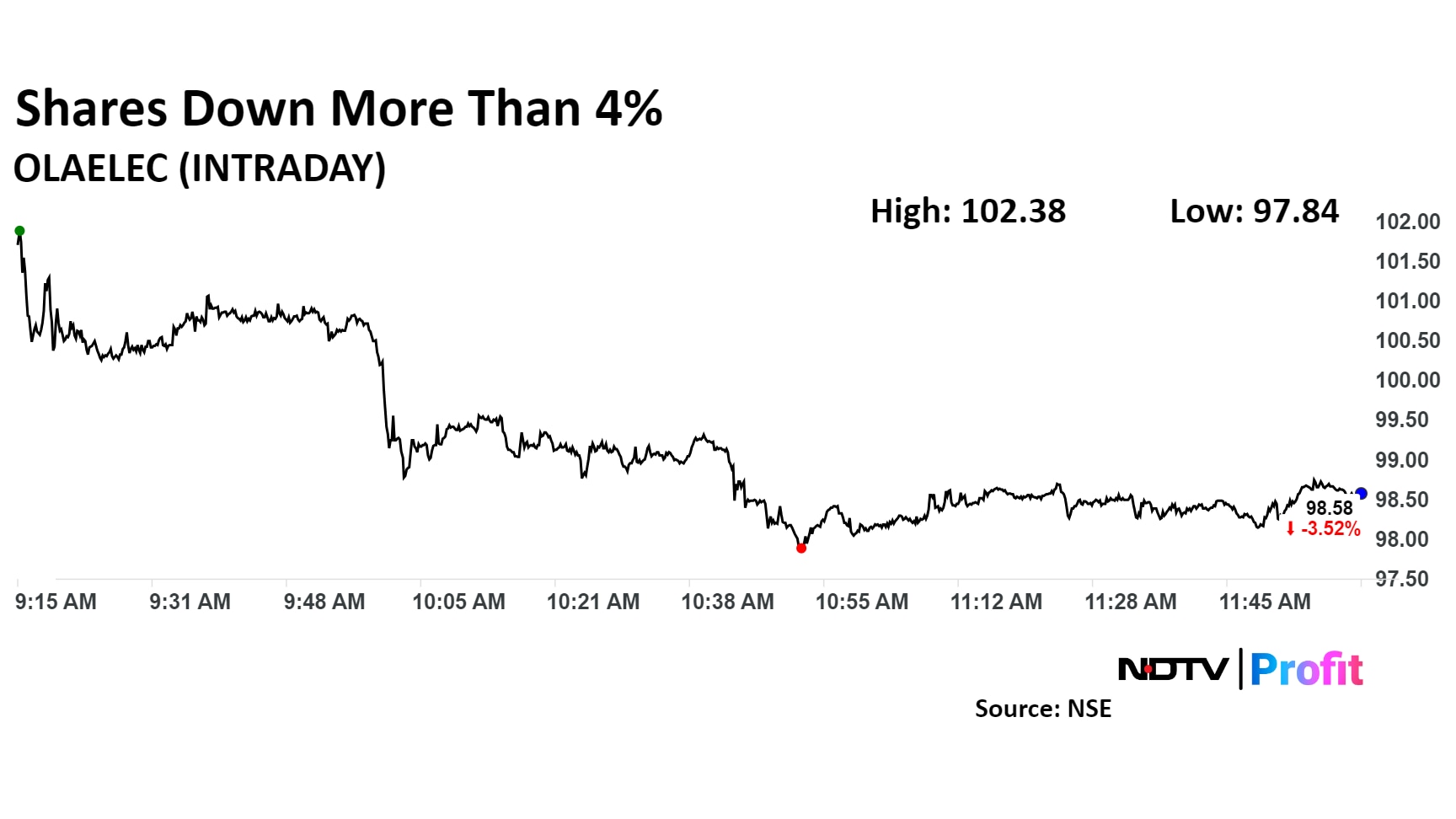

Shares of Ola Electric fell more than 4% on Monday, continuing a downward trajectory that has seen the stock decline nearly 9% over the past week and over 21% in the past month. In its last session on Friday the stock closed in the red, down 1.27%.

This recent slump highlights a troubling trend for the company, which once experienced a significant surge following its IPO. Ola's shares had gained over 107% within two weeks from its listing before entering a consolidation phase.

The latest sales data from the VAHAN portal paints a stark picture for Ola Electric. In September, the company sold 22,800 units, a notable decline from 27,586 in August and a staggering 45% drop from July's sales of 41,732 units. This downward trend is particularly concerning as Ola Electric had previously positioned itself as a leader in the burgeoning electric vehicle market.

A report by NDTV Profit has also brought to light the ongoing service challenges faced by Ola Electric, India's largest electric two-wheeler manufacturer.

Interviews with over a dozen customers in major markets like Mumbai and Bengaluru revealed persistent issues with the Ola S1 scooters, including malfunctioning hardware and glitching software. These problems have led to an overwhelming backlog of service requests, with estimates suggesting that nearly 100,000 complaints are logged nationwide each month.

Quickly after the news broke, founder Bhavish Aggarwal announced Ola Electric's HyperService for customers. Aggarwal said Ola aims to double the company owned service network to 1,000 centres by December this year.

A report from Bernstein highlighted the overall challenges facing the electric two-wheeler segment in India. The report notes that while the market is undergoing a significant transformation—with traditional manufacturers and new entrants vying for a share—profitability remains a pressing concern across the industry.

Major players, including TVS, Bajaj, and Ather Energy, are diversifying their product lines but face a tough road ahead in establishing sustainable business models.

The scrip fell as much as 4.25% to 97.84 apiece. It pared losses to trade 3.44% lower at Rs 98.67 apiece, as of 11:59 a.m. This compares to a 1.08% decline in the NSE Nifty 50 index.

It has risen 8.19% in the last 12 months. Total traded volume so far in the day stood at 0.7 times its 30-day average. The relative strength index was at 42.

Out of five analysts tracking the company, four maintain a 'buy' rating, and one suggests 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 43.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.