Oil edged up from near the lowest levels in a month as tensions once again flared in the energy-rich Middle East, returning the spotlight to the fragility of a truce between Israel and Iran.

West Texas Intermediate creeped higher to trade near $66 a barrel, while Brent was above $67. Volumes were trending lower ahead of Friday's July 4 holiday in the US.

Investors are watching closely to see whether Iran's inventories of near-bomb-grade uranium have been depleted and whether its moves to cut off communication with key United Nations watchdog officials will trigger another wave of US strikes. President Donald Trump has said the US will “be there” unless Iran backs away from its nuclear program.

So far, the conflict has not disrupted oil flows in the world's oil-rich region but the mere possibility of supply interruptions has some traders taking on a wait-and-see approach and remaining on the sidelines.

Aside from geopolitics, macro factors also lent conflicting signals to oil. The demand outlook for the US darkened slightly after factory activity contracted in June for a fourth consecutive month, although the labor market showed signs of strength.

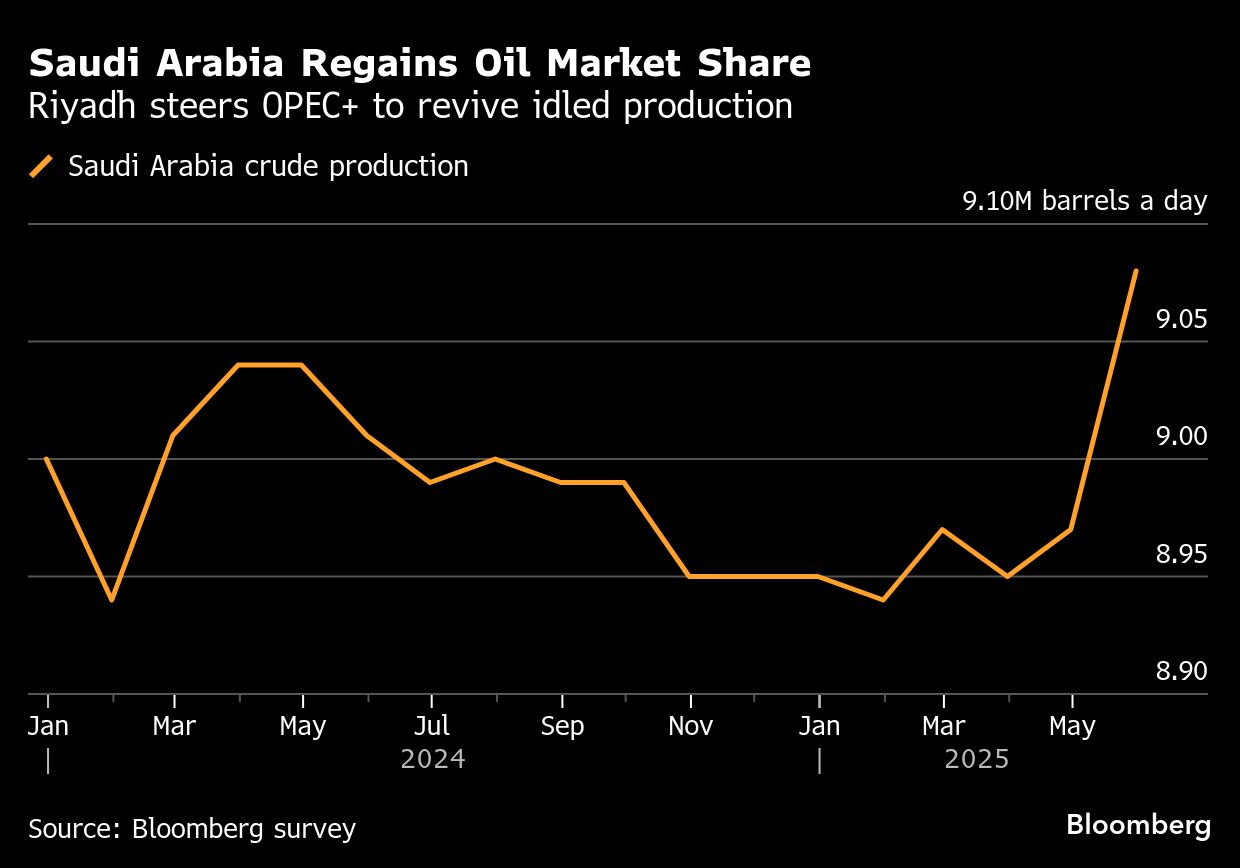

The Middle East developments took the focus from an upcoming meeting between the Organization of the Petroleum Exporting Countries and its allies. The group is expected to agree to a fourth monthly major supply increase during discussions on Sunday, according to a Bloomberg survey, as de facto leader Saudi Arabia continues its bid to reclaim market share.

Oil lost almost 10% last quarter in a volatile three months that saw prices drop sharply in April on President Donald Trump's tariff plans, and surge in June after Israel attacked Iran, before erasing gains as hostilities eased. One gauge of implied volatility on Tuesday fell to the lowest since June 10, just before Israel launched its aerial campaign against Iran.

“There is no doubt traders are still suffering from the recent whiplash, which may lower liquidity in the short term,” said Ole Hansen, head of commodities strategy at Saxo Bank.

The market's attention is now returning to the interplay between the peak summer demand season, and OPEC and its allies adding barrels back to the market. For now, refined products markets remain strong, bolstering the incentives for refiners to turn crude oil into fuels.

Trump also reiterated plans to fill up the Strategic Petroleum Reserve when “the market is right,” but didn't specify a timeline.

To get Bloomberg's Energy Daily newsletter in your inbox, click here.

Prices:

WTI for August delivery climbed 0.84% to $65.66 a barrel as of 1:10 p.m. in New York.

Brent for September settlement eased 0.7% to $67.22 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.