- Oil prices fell for five consecutive days, the longest decline since January

- WTI crude traded near $65 a barrel after hitting its lowest close since June

- Trump doubled tariffs on Indian goods to 50% over Russian energy purchases

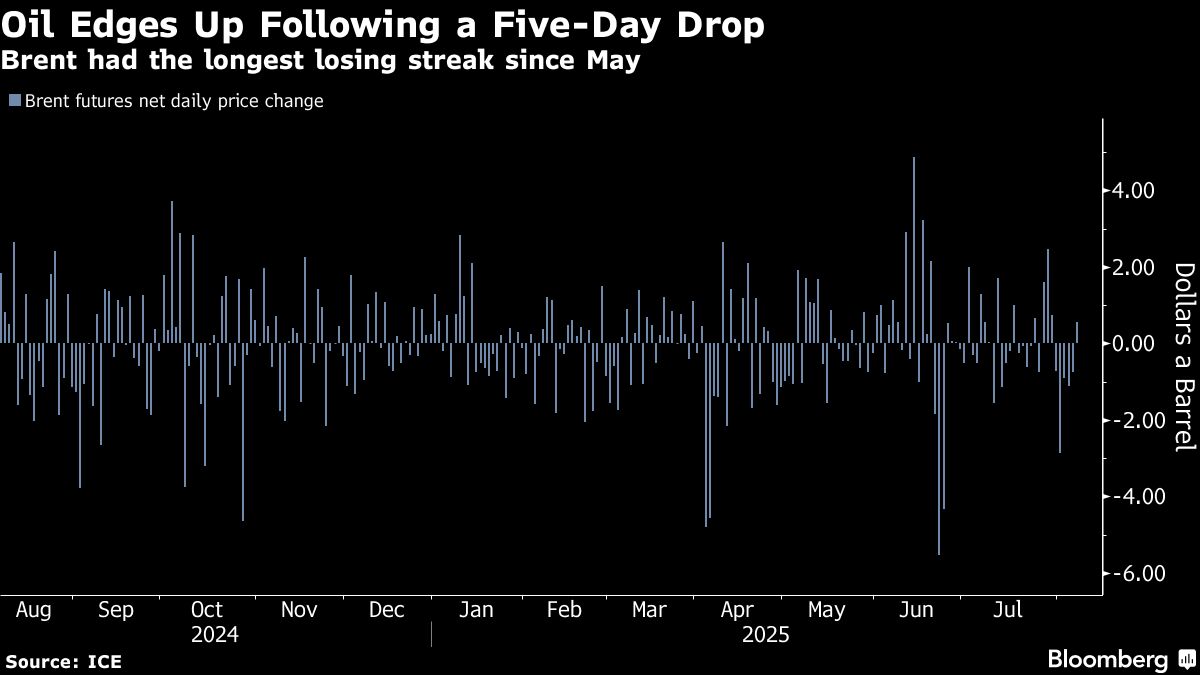

Oil climbed after a five-day drop — the longest losing run since May — as investors tracked US efforts to punish buyers of Russian crude, and a diplomatic push by President Donald Trump to end the Ukraine war.

Brent rose above $67 a barrel, paring a little of the 8.7% loss over the prior five sessions, while West Texas Intermediate was near $65. On Wednesday, Trump doubled tariffs on Indian goods due to the nation's Russian energy purchases, with implementation to begin in three weeks. While there's been no move yet against China, another importer, Trump said that was possible.

On the diplomatic front, the US president said there was a “very good chance” he would meet soon with Russian President Vladimir Putin and his Ukrainian counterpart, Volodymyr Zelenskiy, in another bid to broker peace. He also said there would be “a lot more” penalties related to oil-buying.

Crude has moved lower in August following a run of three monthly gains. Traders are positioning for a potential glut later this year after OPEC+ returned millions of barrels of shuttered capacity to the market. In addition, there are concerns about a slowdown in economic growth and weaker energy consumption as Trump's broader trade tariffs exact a toll, with a globe-spanning swathe of punitive levies coming into effect on Thursday.

“The current production and inventory surge will continue capping Brent in the early $70s, and once we have a solution to the current Russia-Ukraine peace issue, we expect to see a sharp move lower,” said Robert Rennie, head of commodity and carbon research at Westpac Banking Corp.

“However, it remains to be seen whether a possible meeting between Trump and Putin takes place next week,” he added. “If the meeting does not take place, or takes place with no agreement, meaning secondary tariffs kick in, we could yet see a pop higher.”

US data on Wednesday showed nationwide crude inventories fell 3 million barrels last week as refiners ran at the highest levels for the season since 2019. Still, crude holdings at the key Cushing hub extended a rebound from critical lows, expanding for a fifth week. That's the longest run of builds since 2023.

In Asia, meanwhile, Saudi Arabia raised crude prices for a second month, signaling confidence in demand for its barrels as OPEC+ continues to ramp up supply. Last weekend, the cartel decided to add about 547,000 barrels-a-day of production back into the market for September.

Prices:

Brent for October settlement gained 0.6% $67.26 at 2:49 p.m. in Singapore.

WTI for September delivery added 0.6% to $64.72 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.