- Nifty 50 is projected to reach a new high of 26,333, an 8% rise from the last close

- The index is testing key support between 24,000 and 24,043, defined by the 200 DMA

- A breakout from the February/April double bottom pattern supports the target of 26,333

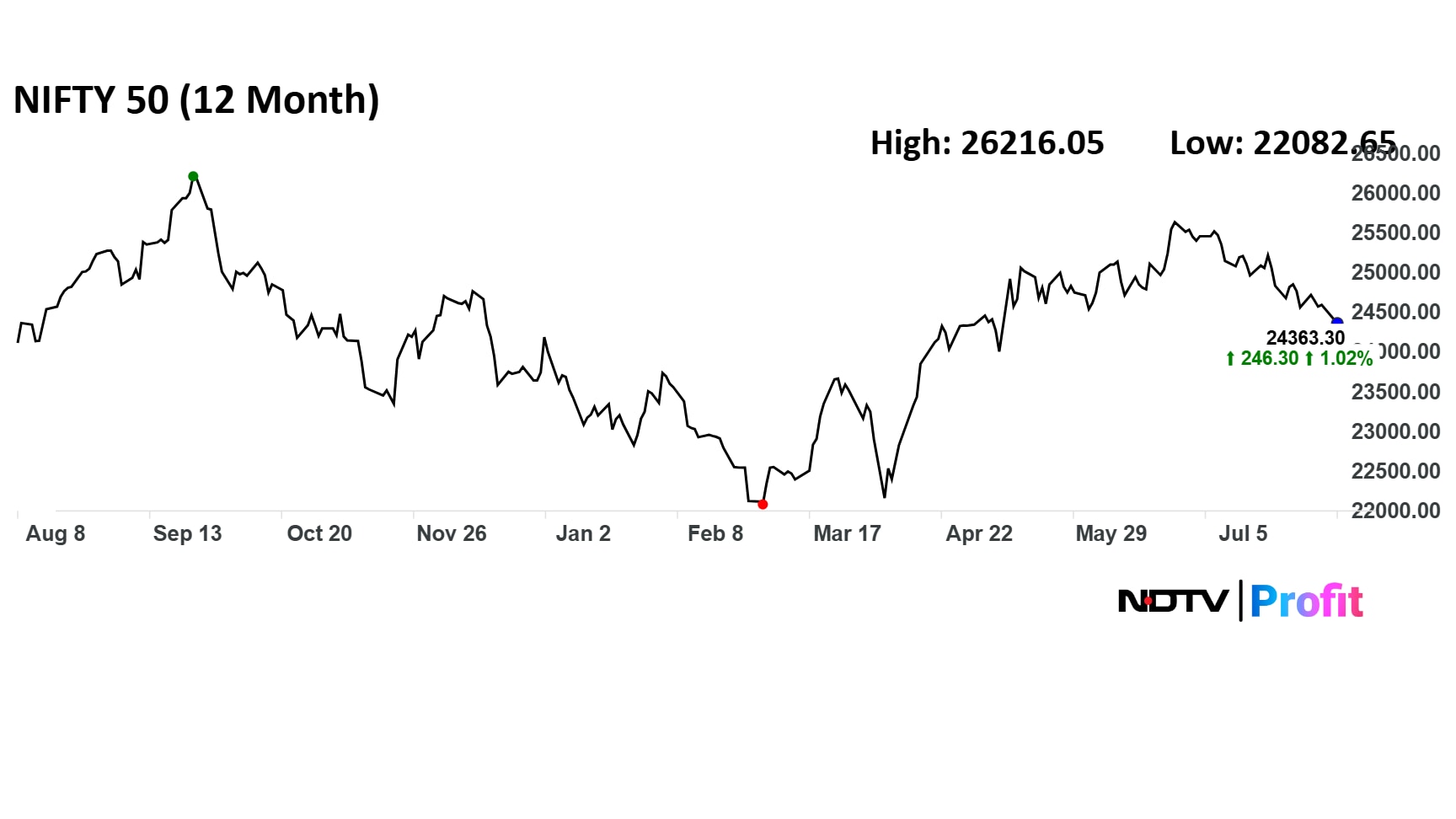

The Nifty 50 is seen to hit a new record of 26,333 based on certain technical parameters, according to CLSA's technical analyst Laurence Balanco. That represents an upside potential of 8% over the previous close.

The benchmark index has continued its downward trajectory after breaking below its 50-Day Moving Average, positioning the market for a pivotal test of key support levels, Balanco said in a recent note.

These Nifty support levels are defined by the 200 DMA and the upper boundary of the February and April double bottom pattern, located in the 24,000-24,043 zone.

The CLSA analyst said as long as the price action moves as per this critical support zone, there is potential for the upside and the continuation of March's breakout from the February/April double bottom pattern that still supports an upside target of 26,333 — essentially a retest of the 2024 highs.

The 50-stock index had hit an all-time high of 26,216 on Sept. 26 last year. A correction thereafter took it to as low as 22,082.

The 50-stock Nifty had hit an all-time high of 26,216 on Sept. 26 last year.

Challenges

Laurence Balanco noted that one challenge facing the Indian stock market is its relative underperformance compared to China. Examining the ratio of the India ETF to the China ETF, a clear downtrend is evident since the breakdown of the 2024 double top pattern.

The ratio has continued to weaken, with rallies encountering resistance at the falling 200 DMA and is now approaching its March relative lows. A decisive breakdown below this level could exacerbate the relative underperformance of the Indian market, the CLSA analyst said.

The Nifty ended 0.95% lower at 24,363 on Friday, clocking its longest weekly losing streak in over five years.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.