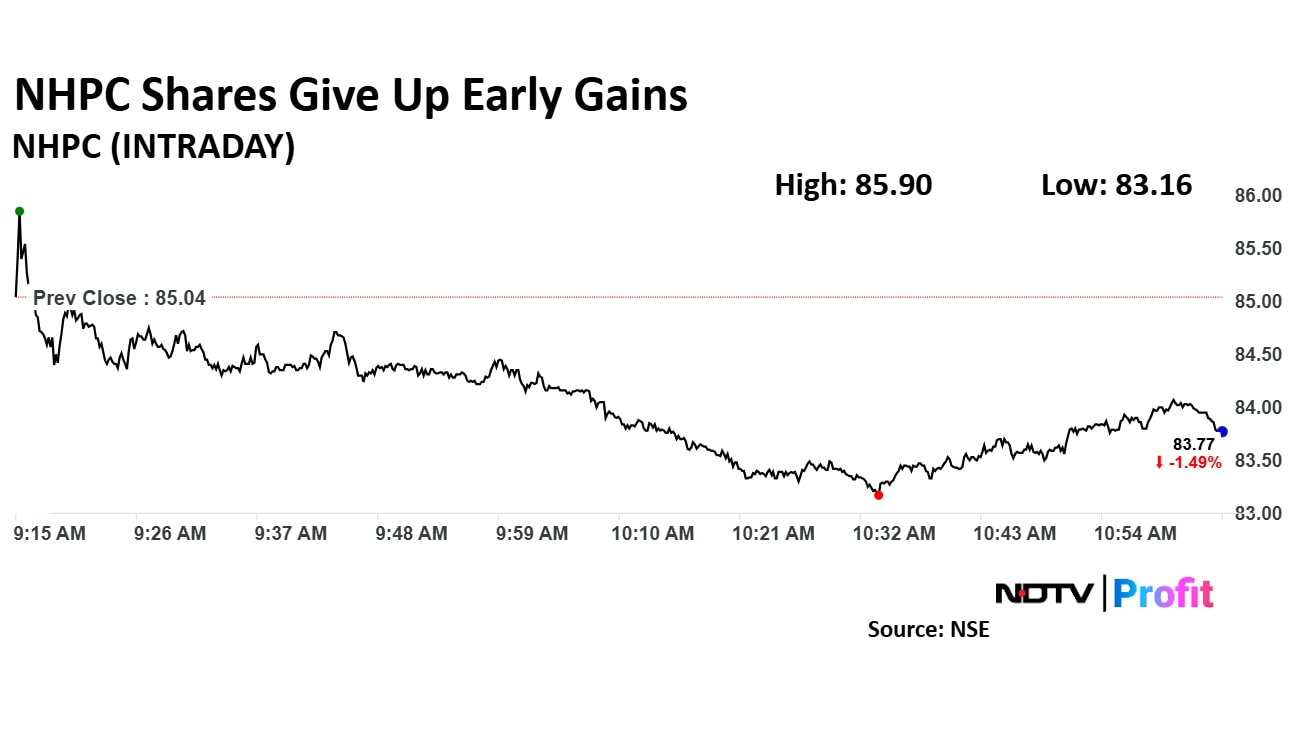

NHPC Ltd. share price see-sawed after its board of directors approved revising the borrowing plan for the current fiscal. The stock rose around 1%, before erasing gains and falling over 2%.

In a meeting on Thursday, the NHPC board approved raising up to Rs 6,900 crore via non-convertible debentures by March 2025. As part of this plan, the company will also raise up to Rs 2,600 crore through AE-series bonds on private placement basis.

NHPC's borrowings as of September 2024 stood at Rs 34,143.07 crore, as per the financial results posted by the company last month. They company saw its consolidated net profit drop 37% in the second quarter of the current financial year, missing analysts' estimates.

The government-run power company posted a profit of Rs 1,069.3 crore in the September quarter. This was against a profit of Rs 1,693.3 crore in the last year. Analysts polled by Bloomberg had estimated a profit of Rs 1,178 crore, which the company missed.

NHPC, a 'Mini Ratna' company, is the flagship hydroelectric generation company promoted by the government of India. It was incorporated in 1975, and become the largest hydro electric generating utility in the country with an installed capacity of 5,526 mega watt as on November 2012.

NHPC Share Price Today

NHPC stock rose as much as 1.01% in early trade to Rs 85.90 apiece, before falling 2.2% to 83.16 on the NSE. It was trading 1.39% lower at Rs 83.86 apiece, compared to a 1.2% decline in the benchmark Nifty 50 as of 11:05 a.m.

It has risen 30.33% in the last 12 months and 29.63% on a year-to-date basis. The relative strength index was at 54.31.

Of the 10 analysts tracking the company, five have a 'buy' rating on the stock, one recommends a 'hold' and four suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 96, implying a upside of 13.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.