Shares of Netweb Technologies Ltd. fell nearly 11% to hit an over seven-month low on Monday, despite the company reporting a 17.9% rise in net profit, driven by demand in artificial intelligence-related projects.

The domestic IT server maker recorded a consolidated net profit of Rs 30.3 crore for the quarter ended December, compared to Rs 25.7 crore in the same quarter of the previous fiscal, according to its stock exchange notification.

Revenue increased by 33% year-on-year for the three months ended December, reaching Rs 334 crore. Operating income, or earnings before interest and taxes rose 23.1% year-on-year to Rs 40.8 crore. The Ebitda margin contracted by 100 basis points to 12.2% from 13.2% in the same period the previous year.

The jump in revenue comes on the back of over two-fold increase in income from AI systems during the nine months ended December 2024, the company said in a regulatory filing on Saturday. The segment's contribution to the operating revenue increased to 14.7% during the same period.

The company's order book stood at Rs 360.3 crore as of December 2024. In addition, the company's net debt as of December 2024 stood at Rs 73.72 crore.

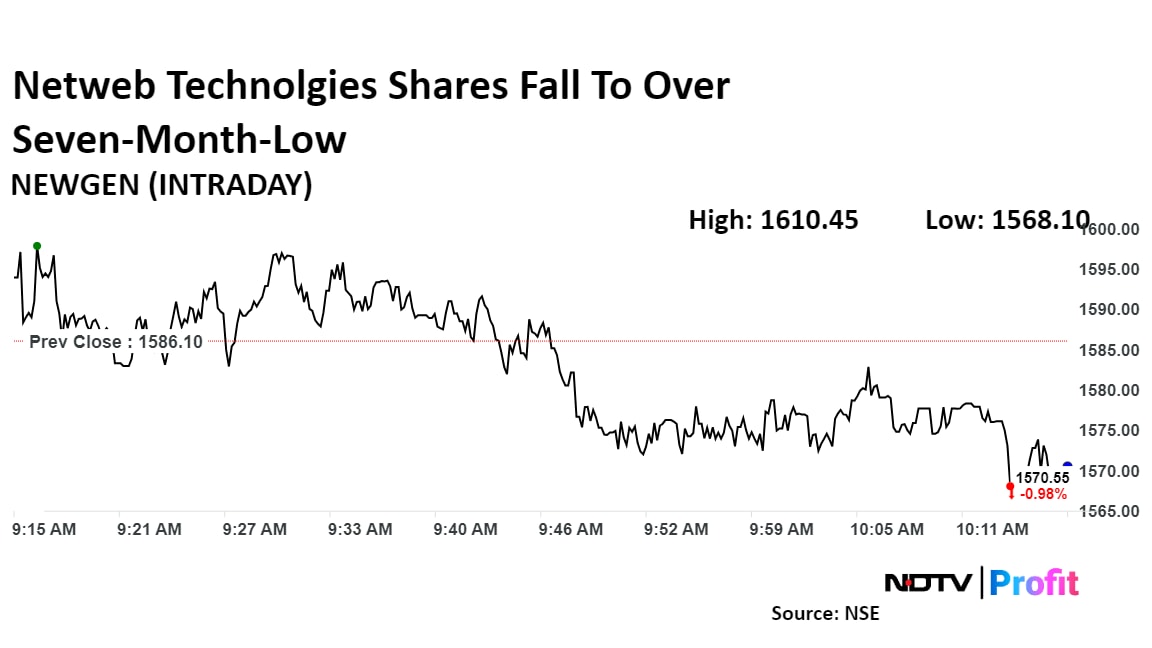

Netweb Technologies Share Price Today

Shares of Netweb Technolgies fell as much as 10.83% to Rs 2,085 apiece, the lowest level since May 2024. They pared loss to trade 9.03% lower at Rs 2,127.25 apiece, as of 10:15 a.m. This compares to a 0.11% advance in the NSE Nifty 50.

The stock has risen 50.50% in the last 12 months. Total traded volume so far in the day stood at 9.6 times its 30-day average. The relative strength index was at 25 indicating that the stock was oversold.

The two analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 34.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.