Non-Banking Financial Companies witnessed a sudden decline in their stock prices on Wednesday following concerns raised by the Reserve Bank of India regarding perpetual lines of credit extended by retail NBFCs, as reported by NDTV Profit. The RBI has reportedly conveyed to some lenders that such products should be slowed down, people in the know told NDTV Profit.

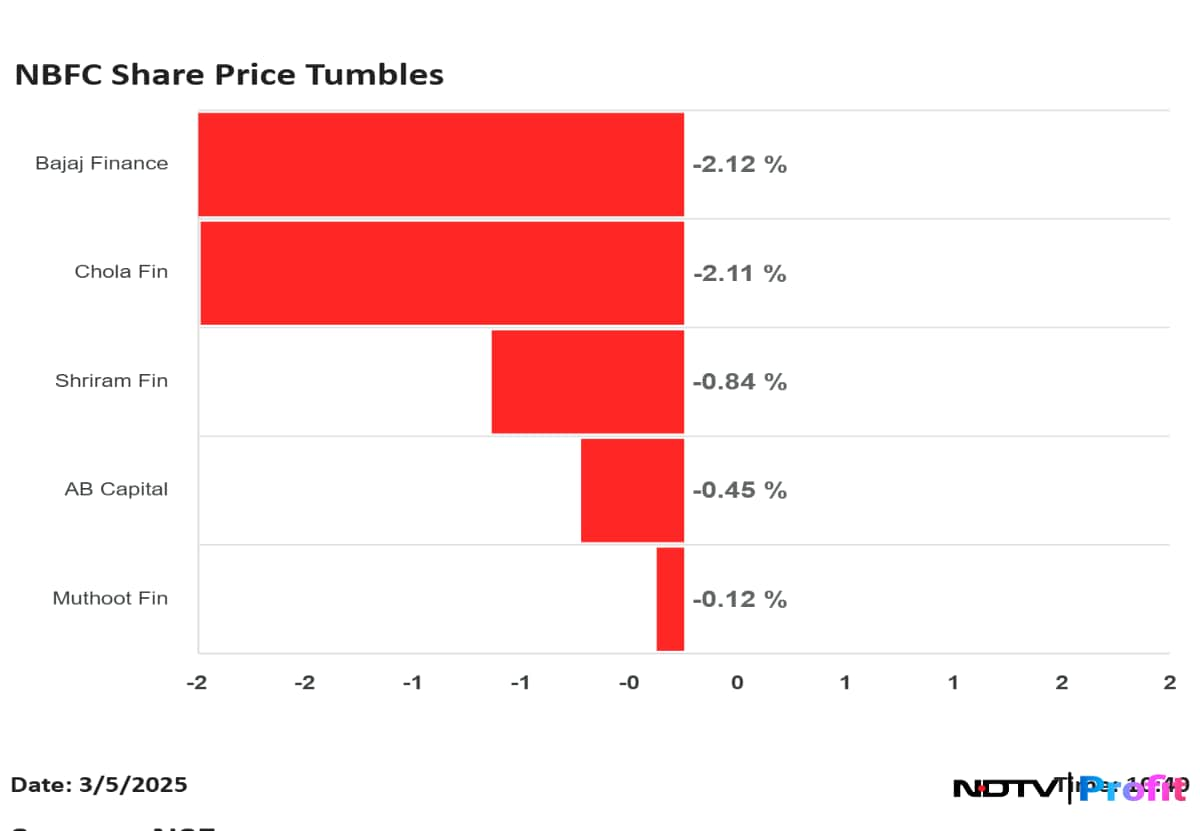

Several major NBFCs experienced notable drops in their stock prices. Bajaj Finance Ltd. saw a significant drop, falling by 4.25% to Rs 8,221 apiece but it later pared losses to trade 2.16% lower during early trade.

Shriram Finance Ltd. declined by 1.80% to trade at Rs 621 apiece. Meanwhile, AB Capital saw a decrease of 2.58%, and Cholamandalam Investment and Finance Co. Ltd. dropped by 3.83% to trade at Rs 1,394.05 apiece. Muthoot Finance also saw a decline, with its stock falling by 2.08% to trade at Rs 2,164.95 apiece.

The RBI has expressed discomfort with lenders extending lines of credit without adequate visibility on the borrower's repayment capacity.

Perpetual lines of credit allow borrowers to roll over existing credit, which the RBI fears could lead to evergreening – a practice where new loans are used to pay off old ones, potentially masking the true financial health of borrowers.

The market reacted swiftly to the news, with investors pulling back from NBFC stocks amid fears of tighter regulatory scrutiny and potential impacts on the profitability of these financial institutions. The RBI's stance indicates a move towards more stringent oversight to ensure the stability and transparency of the financial system.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.