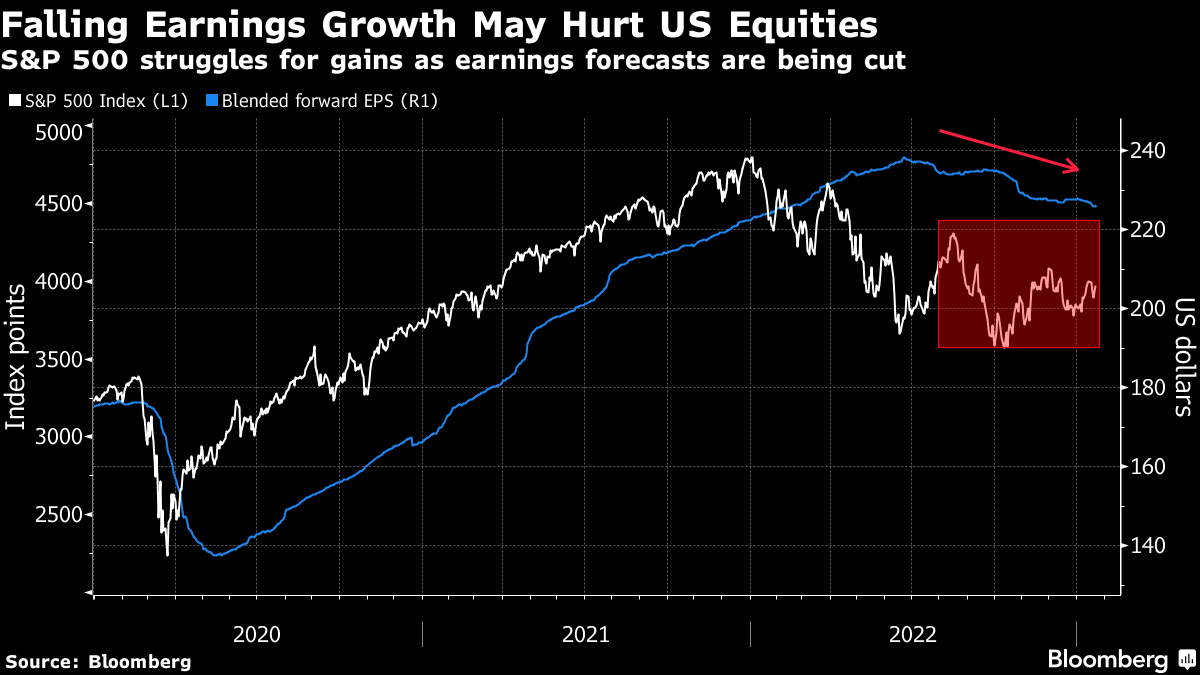

(Bloomberg) -- The improving sentiment toward US equities is at odds with a backdrop of weakening economic data and earnings, according to Morgan Stanley strategist Michael Wilson.

One of the most vocal bears on US stocks warned on Monday that plunging forward-looking indicators will translate into an earnings recession and will end up hitting US markets. Recent optimism around a less hawkish Federal Reserve, China reopening and a weaker dollar is already priced into share prices, he wrote in a note.

“The question is when will equity indices price the current weakness in the leading data and the eventual weakness in the hard data?,” said the strategist, who ranked No. 1 in last year's Institutional Investor survey. “We think it's this calendar quarter.”

Wilson's view serves as a warning sign after the S&P 500 Index rose nearly 11% since mid-October in its recovery from last year's bear market. The gauge looks expensive compared with average historical levels given that earnings estimates have been falling for months.

Earnings are also a concern for JPMorgan Chase & Co. strategist Mislav Matejka, who notes that the environment will be particularly challenging this year, with corporate pricing power starting to reverse, just as margins are near record-high in the US and in Europe.

“Even if companies do not disappoint for the fourth quarter 2022, we do not believe EPS upgrades will come in the first half of this year,” Matejka wrote in a note.

--With assistance from .

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.