Shares of Manappuram Finance Ltd. rose as much as 6.9% as the management sees little impact from the Reserve Bank of India's new risk weight norms and stays confident on maintaining a 20% growth in its Asset Under Management in the current fiscal, according to brokerages.

Morgan Stanley, IDBI Capital Equity Research, and Axis Securities, too, do not expect Manappuram Finance facing much impact from tougher consumer lending norms by the RBI.

Growth momentum is likely to continue as the non-bank lender diversifies its loan portfolio and maintains robust assets under management, the brokerages said.

Here's What Brokerages Say About Analyst Meet

Morgan Stanley

Reiterates 20% annual loan growth, 20% return-on-equity guidance for the current fiscal.

Does not expect heightened bank competition in gold loans as a result of higher risk weights on unsecured loans.

On non-gold non-MFI business underwriting quality, the management is confident about keeping credit costs at 1–1.5%.

Maintains 'overweight' rating with a target price of Rs 200.

IDBI Capital Equity Research

First half of the fiscal reflected improved margin despite intense competition impacting AUM growth.

Sees potential to report return on assets above 3.5%.

The overall AUM growth seen at 20% on year for the fiscal.

Overall gold loan growth seen at 8–10% year-on-year for the fiscal.

Yield on the gold-loan to remain at current level of 22% going forward

Sees increase in borrowing cost by 15–25 basis points in both incremental, and existing borrowing

Expects Manappuram Finance to pass borrowing cost increase succcessfully

Maintains 'buy' rating with a target price of Rs 205.

Axis Securities

Expects gold loans to grow by 8% year-on-year in the upcoming quarters.

Non-gold loan portfolio growth to outperform its gold loan portfolio.

Sees achieving a 50% portfolio mix moving forward.

Maintains 'buy' rating with a target price of Rs 160.

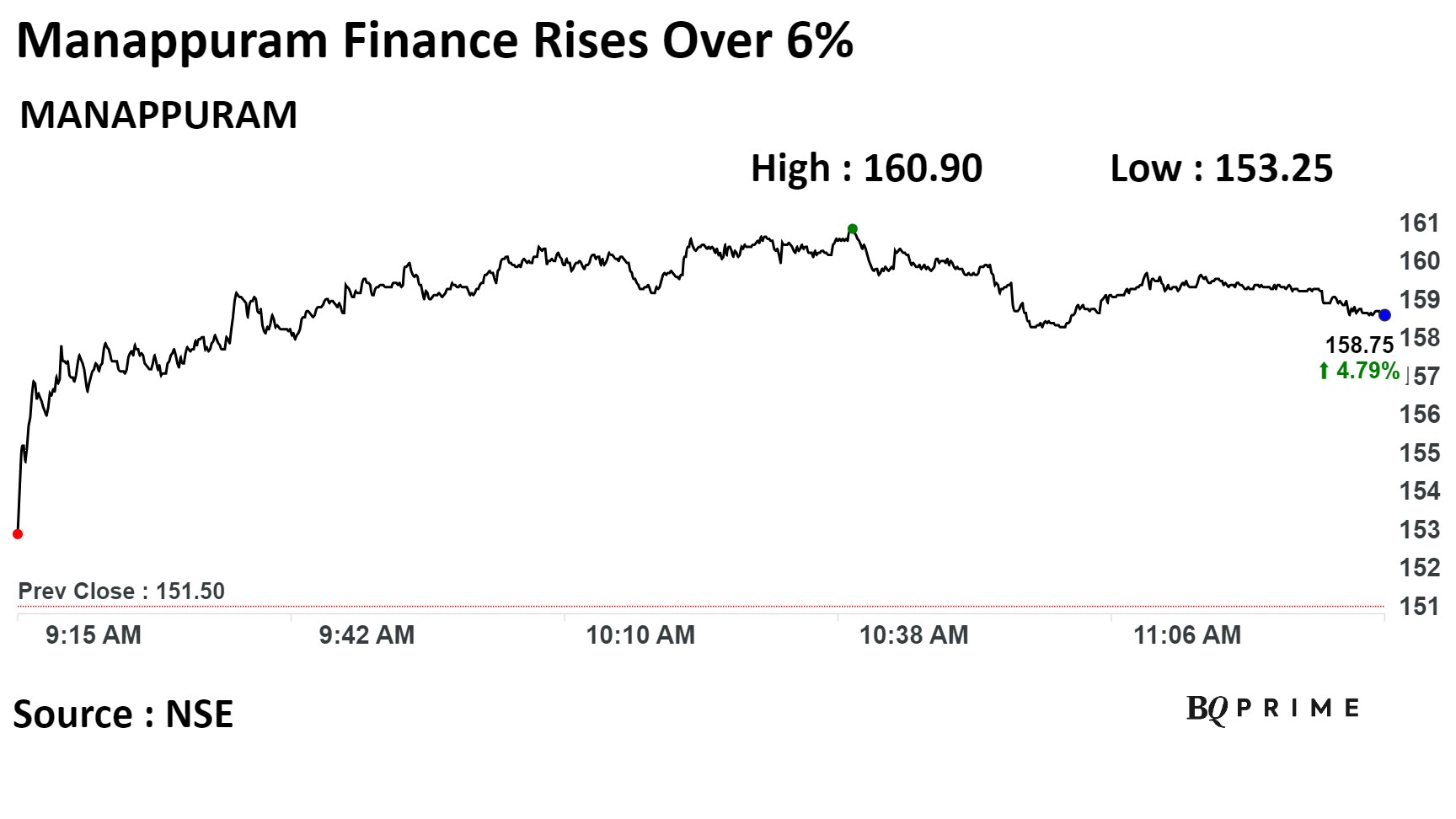

Shares of Manappuram rose as much as 6.9% during the day on the NSE to Rs 160.9 apiece, the highest since Nov. 16. It was trading 5.08% higher at Rs 159.20 apiece, compared to a 0.64% advance in the benchmark Nifty 50 as of 11.30 a.m.

It has risen 40.47% on a year-to-date basis. The total traded volume so far in the day stood at 3.8 times its 30-day average. The relative strength index was at 64.68.

Fifteen out of the 19 analysts tracking Manappuram maintain a 'buy' rating on the stock, one recommends a 'hold' and three suggest a 'sell,' according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 9.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.