Shares of Manappuram Finance Ltd. rose 6% on Friday to hit a fresh life high as US-based Bain Capital is set to take over a controlling stake in the company.

The gold loan firm on Thursday said that Bain Capital will buy an 18% stake worth Rs 4,385 crore, through a preferential allotment of shares. The private equity firm will acquire 9.29 crore shares at a price of Rs 236 per share and 9.29 crore warrants in Manappuram Finance.

Bain Capital will make an additional open offer for 26% of the company's stake at the same share price, the company said in a statement on Friday.

This is the largest such transaction involving a gold loan company. Manappuram Finance is one of the two largest gold loan firms in India, with the other being Muthoot Finance.

Post the transaction, Bain Capital's stake post the investment will vary between 18.0% and 41.7% on a fully diluted basis. This includes the fully convertible warrants being issued to the investor. The transaction does not involve any sale of shares by the existing promoters. The transaction is dependent on regulatory approvals and other closing requirements.

The brokerages view this as a positive move and expect the share prices to partly reflect these changes. While Jefferies has increased the target price to Rs 235 from Rs 205, CLSA has hiked the target price to Rs 270 from Rs 225.

However, Jefferies highlighted execution challenges in ramping up the gold loan business and strengthening the franchise in non-gold segments. Going forward, clarity on the new management team, growth strategy, and improved execution visibility will be crucial for any further re-rating of the stock, the brokerage added.

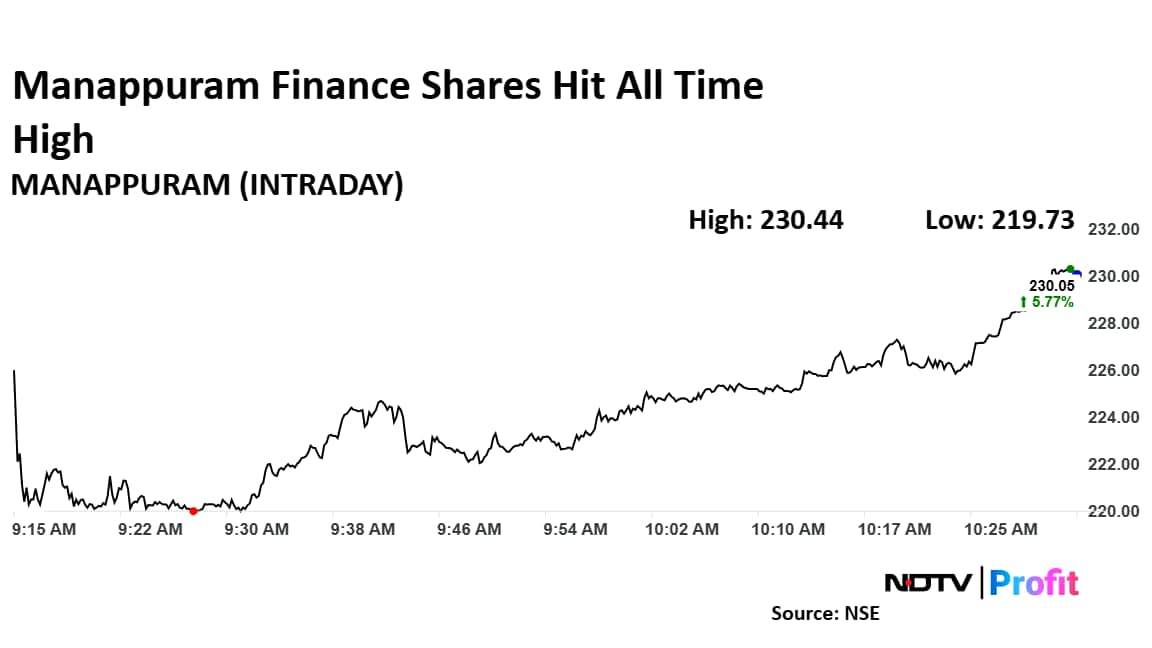

Manappuram Finance Share Price

Shares of Manappuram Finance rose as much as 6.16% to Rs 230.90 apiece hitting a fresh life high. It pared gains to trade 6.12% higher at Rs 230.76 apiece, as of 10:36 a.m. This compares to a 0.46% advance in the NSE Nifty 50.

The stock has risen 31.37% in the last 12 months and 18.55% year-to-date. Total traded volume so far in the day stood at 8.4 times its 30-day average. The relative strength index was at 70, indicating it was overbought.

Out of 17 analysts tracking the company, eight maintain a 'buy' rating, six recommend a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 5.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.