Shares of Larsen & Toubro Ltd. rose nearly 3% on Monday, after the infrastructure major's board gave its nod for a Rs 12,000-crore fundraise plan.

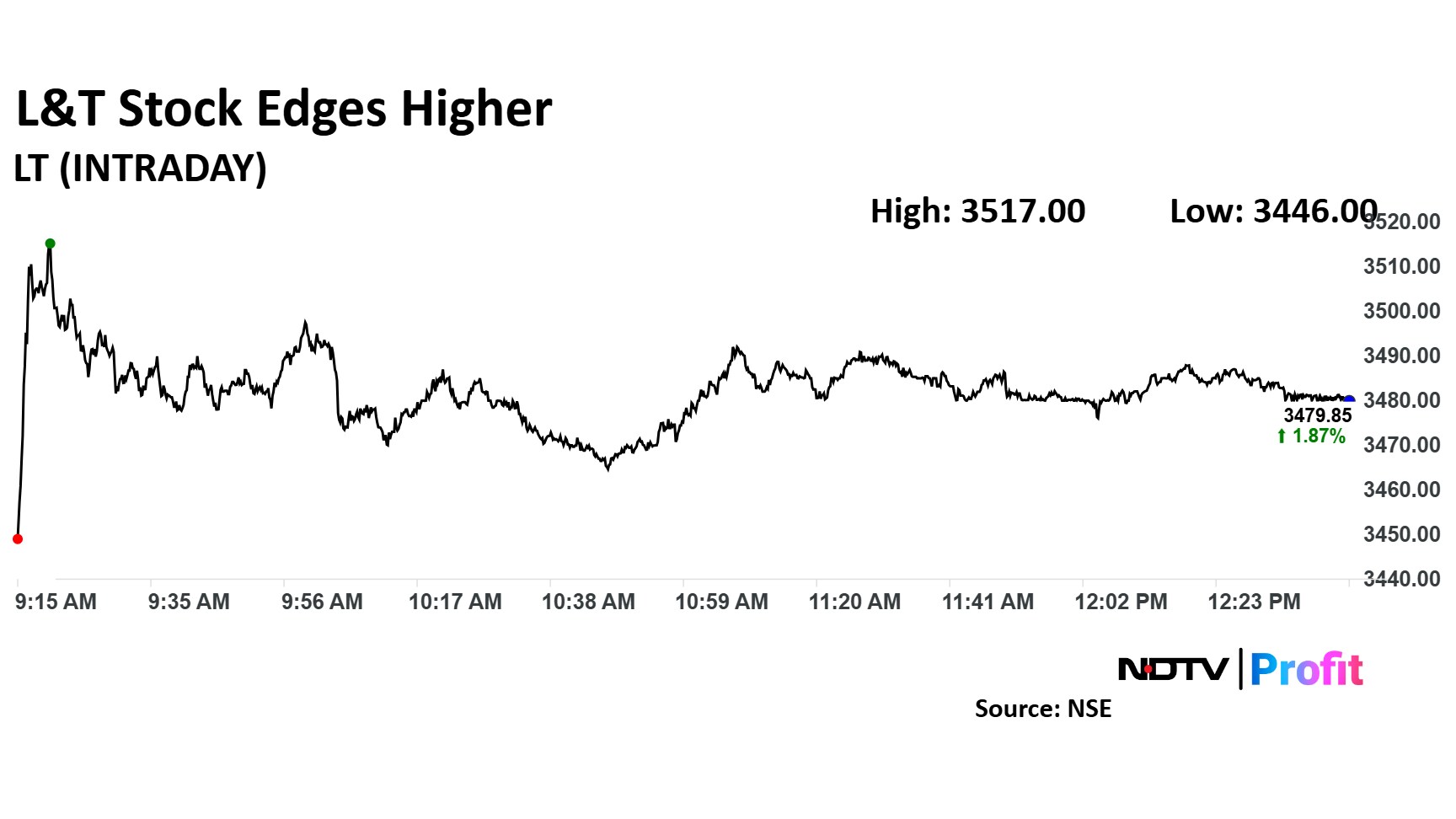

In the first half of trading, the scrip peaked to a high of Rs 3,517 apiece on the National Stock Exchange, up 2.9% as against the preceding session's close.

The jump in shares was driven by the board's approval on Friday for "long term borrowings of up to Rs 12,000 crore". The targeted amount can be raised through "external commercial borrowings, term loans, non-convertible debentures or any other instrument as may be appropriate," according to an exchange filing.

In another development, L&T had on Friday also announced the elevation of Subramanian Sarma, whole-time director and president - energy as the company's deputy managing director and president. The appointment will come into effect from April 2, for a period lasting till Feb. 3, 2028.

L&T's board also approved the reappointment of whole-time directors S V Desai and T Madhava Das for around a five-year period starting July 11.

Notably, L&T had posted a consolidated net profit of Rs 3,359 crore in the quarter ended Dec. 31, 2024, higher by 14% as compared to the year-ago period. The company's revenue from operations in the same period rose 17.3% year-on-year to Rs 64,668 crore.

L&T Share Price

Shares of L&T were trading 1.88% higher at Rs 3,480 apiece on the NSE at 12:40 p.m., compared to a 1.2% climb in the benchmark Nifty 50.

The stock, however, has fallen 5.09% on a year-to-date basis and by 5.16% over the past 12 months.

Among the 35 analysts tracking the stock, 29 have a 'buy' rating, and three each suggest 'hold' and 'sell'. The average of 12-month analysts' price target implies a potential upside of 16.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.