Larsen & Toubro Ltd.'s Heavy Engineering division has secured multiple high-value orders in the third quarter of FY25, ranging between Rs 1,000 crore and Rs 2,500 crore. These orders span across both international and domestic markets, reinforcing the company's stronghold in the heavy engineering sector.

In the global market, L&T has secured an order for the supply of LNG equipment for a large-scale project in the USA. The order leverages L&T's advanced manufacturing capabilities and expertise in delivering high-quality LNG equipment.

Further bolstering its international portfolio, L&T has also secured a notable order for a loop reactor to be used in a Propane Dehydrogenation (PDH) Polypropylene (PP) plant in Turkey. Additionally, L&T has received a repeat order from a leading oil and gas customer in Saudi Arabia for the revamp of a Fluid Catalytic Cracking Unit (FCCU).

On the domestic front, L&T Heavy Engineering has won orders for three urea reactors from prominent customers, including Southern Petrochemical Industries Corporation, Indian Farmers Fertiliser Cooperative Ltd, and Indorama India Private Ltd. This brings the total number of urea reactor orders secured by L&T to 17 consecutive orders.

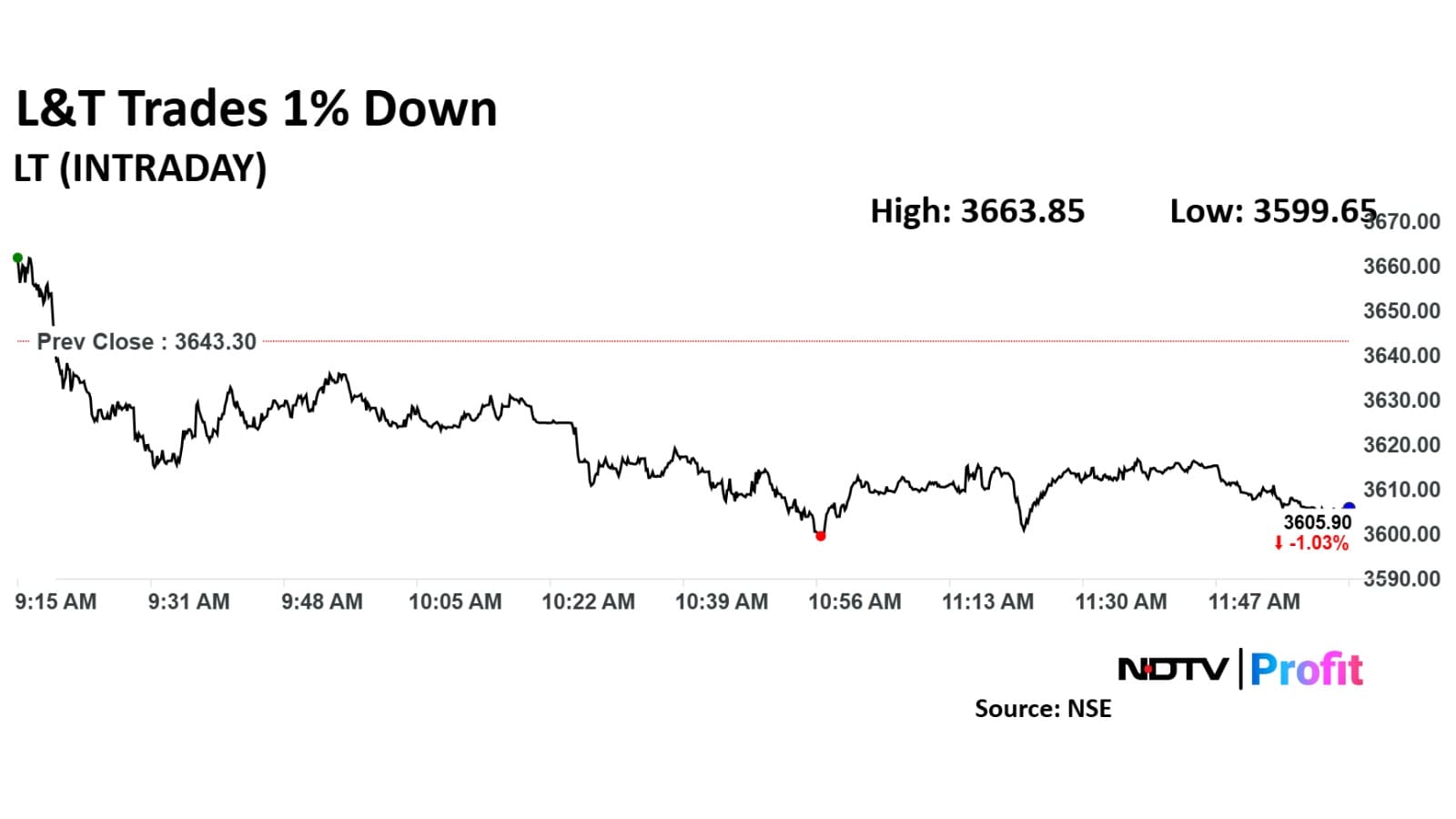

L&T share price fell as much as 1.20% to Rs 3,599.65 apiece. It pared losses to trade 1.02% lower at Rs 3,606.20 apiece as of 12:00 p.m. This compares to a 0.71% decline in the NSE Nifty 50 Index.

It has risen 3% in the last 12 months. Total traded volume so far in the day stood at 0.51 times its 30-day average. The relative strength index was at 42.

Out of 36 analysts tracking the company, 31 maintain a 'buy' rating, two recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 13.1%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.