Shares of Laurus Labs Ltd. fell nearly 15% to hit an over two-month low on Monday, snapping the green streak that was buoyed by the company's better-than-expected third quarter result.

However, volumes rose to 21 times the 30-day average.

The fall in shares also follows news reports that the US has ordered a pause in foreign aid. This pause in foreign aid funding for the President's Emergency Plan for AIDS Relief will impact Laurus Labs' antiretroviral sales, which constitute about 46% of its total revenue, said Motilal Oswal in a note on Monday.

The note pointed that approximately 20% of Laurus' ARV sales are tied to PEPFAR funding, representing around Rs 500 crore, or 9% of the company's consolidated sales. However, the ARV business is relatively less profitable compared to Laurus' other segments.

MOSL estimates the potential impact on Ebitda to be around 4-5% for financial year 2026. Laurus had already ceased investment in the ARV segment nearly a year ago and continues to focus on its more profitable CDMO business in human health, animal health, and crop science, the note said.

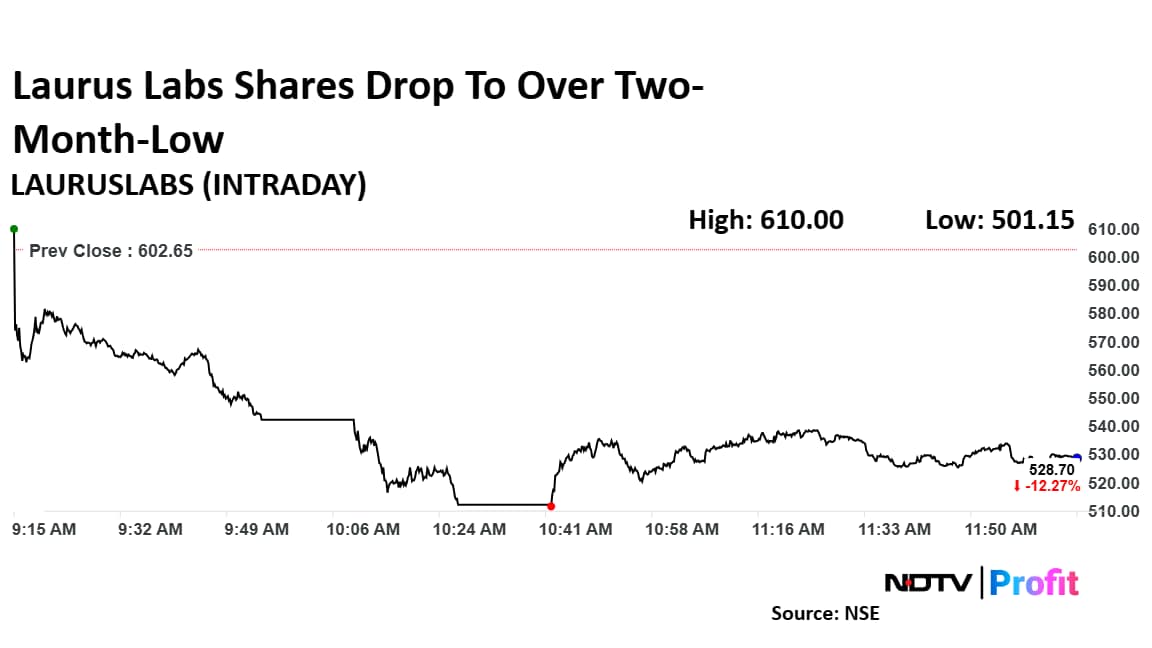

Laurus Labs Shares Drop To Over Two-Month-Low

Shares of Laurus Labs had risen nearly 4% in the last one week. However, the fall on Monday reversed the previous day's gain. The stock fell as much as 16.81% to Rs 501.15 apiece, the lowest level since Nov. 22. It pared losses to trade 12.40% lower at Rs 527.90 apiece, as of 12:05 p.m. This compares to a 0.66% decline in the NSE Nifty 50 Index.

It has risen 41.07% in the last 12 months. Total traded volume so far in the day stood at 21 times its 30-day average. The relative strength index was at 38.

Out of 16 analysts tracking the company, six maintain a 'buy' rating, four recommend a 'hold,' and six suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 6.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.