A strategic shift towards its core business and a tax write back of Rs 1,100 crore post merger of two of its subsidiaries into L&T Finance Holdings Ltd. prompted brokerage house HSBC to upgrade its rating on the company from ‘hold' to ‘buy'. The stock subsequently hit an life-time high of Rs 147.50, intraday on Friday.

The tax accruals are spread over a period of five years which will be used as provisioning required for the group's exposure to infrastructure projects, freeing up cash flow, said HSBC.

The Return on Equity (RoE) in its wholesale division, which consists of loans given to big corporates and micro-finance companies has improved from 10 to approximately 15 percent right now, and HSBC expects it to rise to 18 percent by financial year 2018-19.

In our February note, we had highlighted the turnaround underway and our apprehensions on their ability to achieve RoE of 18 percent+ by financial year 2019-20e. These apprehensions are now fading away and 18 percent RoE by financial year 2018-19e is quite possible.HSBC Global Research On L&T Finance Holding

- RoEs gradually improving from ~10 percent to ~15 percent now, more gains to come over financial year 2018-19 estimates.

- Rural and housing will continue to deliver ~20% RoE.

- The asset management business (AMC) has gained critical mass post demonetisation, growing over 50 percent year-on-year to Rs 400 billion in financial year 2016-17.

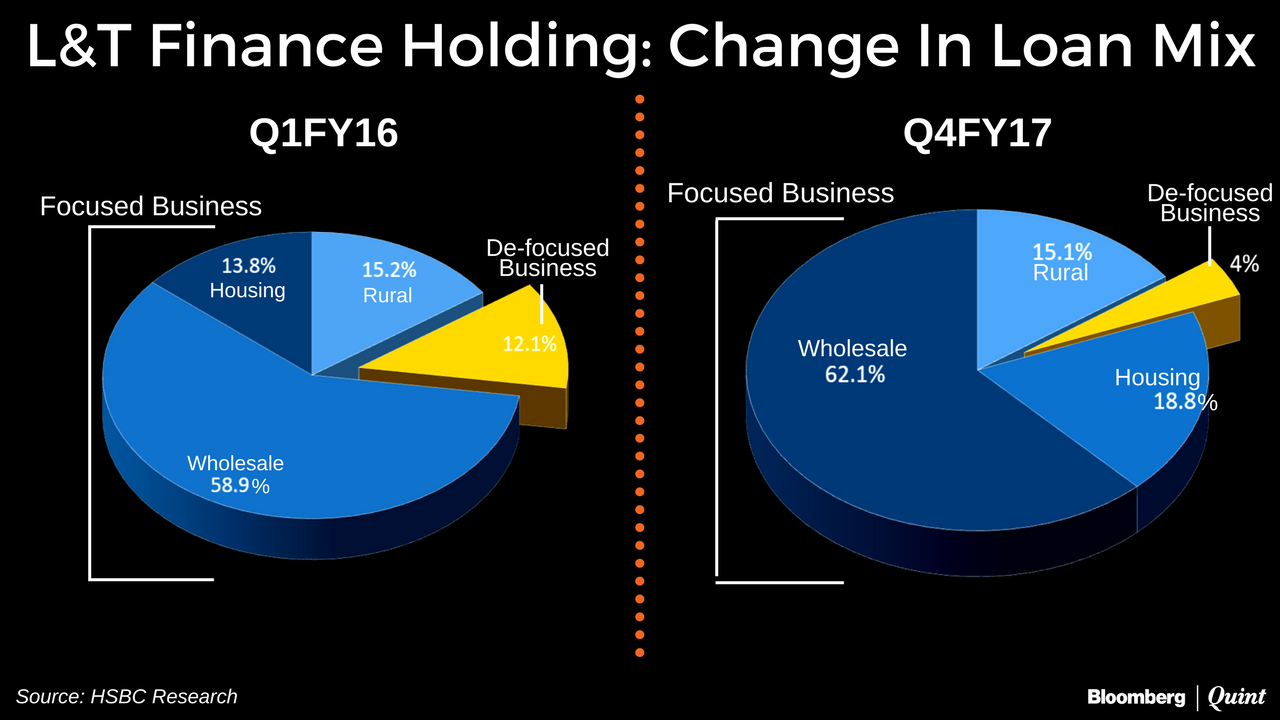

- Over the past eight quarters, the company has been moving away from loss making verticals which include car loans, commercial vehicle loans, construction equipment and loan against shares.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.