Kotak Mahindra Bank Ltd.'s share price surged nearly 9% during early trade on Monday after the lender reported better than expected business growth and stable margin in the third quarter of fiscal 2025, leading to ratings upgrade from analysts.

Given its performance in October-December, with higher common equity tier-I and strong liquidity coverage ratio, the bank is better positioned to face the current environment, said Nuvama Institutional Equities.

The brokerage has upgraded the stock to 'buy' from 'reduce' and its target price by 26% to Rs 2,040 per share, as it sees Kotak Mahindra Bank offering both growth and quality.

Motilal Oswal Financial Services Ltd. also raised its rating to 'buy' from 'hold' on the stock and its target price to Rs 2,100 per share from Rs 1,900 apiece, as the bank delivered a healthy operating performance amid challenging macro conditions.

Kotak Mahindra Bank's standalone net profit rose by 10% year-on-year to Rs 3,305 crore in the quarter ended Dec. 31, 2024, slightly below the consensus estimate of Rs 3,338 crore of analysts tracked by Bloomberg. The profit rise was limited due to a sharp climb in provisions, which rose 37% on-year to Rs 794.1 crore during the quarter.

The net interest income rose 10% year-on-year to Rs 7,196 crore. A slight rise in the net interest margins also aided the bank's performance. The NIMs stood at 4.93% as of December-end, higher than 4.91% a quarter ago, but lower than 5.22% a year ago.

The improvement in the NIMs was because of an increase in current accounts and a rate cut in savings account, leading to sustainable benefit on the NIMs, said Group Chief Financial Officer Devang Gheewalla in a post-earnings call.

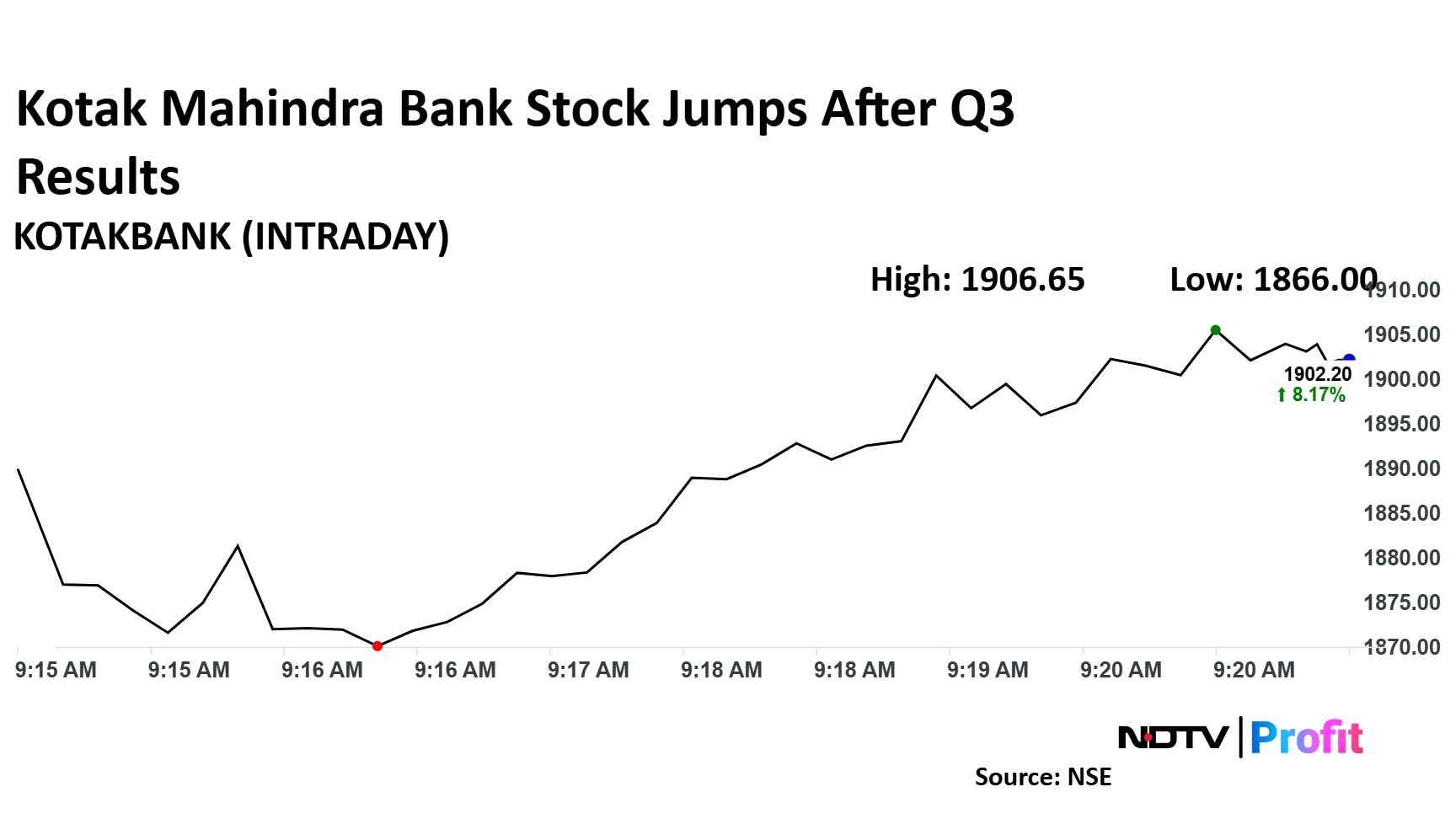

Kotak Mahindra Bank Share Price Movement

Kotak Mahindra Bank share price up.

Kotak Mahindra Bank share price surged 8.8% to Rs 1,913 soon after market open, the highest since Oct. 16. The benchmark Nifty 50 was flat.

The stock has risen 5.6% in the last 12 months. The relative strength index was at 66.

Thirty-five out of the 44 analysts tracking Kotak Mahindra Bank have a 'buy' rating on the stock, four recommend a 'hold' and five suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price target of Rs 2,051 implies a potential upside of 8.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.