JSW Energy Ltd., shares soared after Morgan Stanley initiated coverage on the stock on a bullish note. The brokerage rated the counter 'overweight' with a target price of Rs 545, marking a 20% upside from the previous close, citing well-integrated business model of the company.

The company has seen strong market share gains in recent bids at reasonable tariffs, Morgan Stanley pointed out.

Further, the brokerage said that JSW Energy is one of the best among Indian utility companies to balance energy transition and energy security as it grows its renewable energy business, invests in power storage, and expands thermal business inorganically.

JSW Energy is also equipped with high operational efficiency, and investing in emerging businesses, Morgan Stanley said. The newer branches that the company is investing into includes energy storage as well as green hydrogen and its derivatives.

The brokerage also notes that the company has a smart and experienced management team at the helm. They have a strong execution track record of growth that is paired with a remarkably strong balance sheet.

The company enjoys steady cash flow from operations, along with a recent equity fund raise. Both provide it with adequate equity to fund growth capital for its asset pipeline, Morgan Stanley said.

The key risks noted by the brokerage to its positive initiation include delays in commissioning, and possibility of lower profitability, and new projects facing heightened competition.

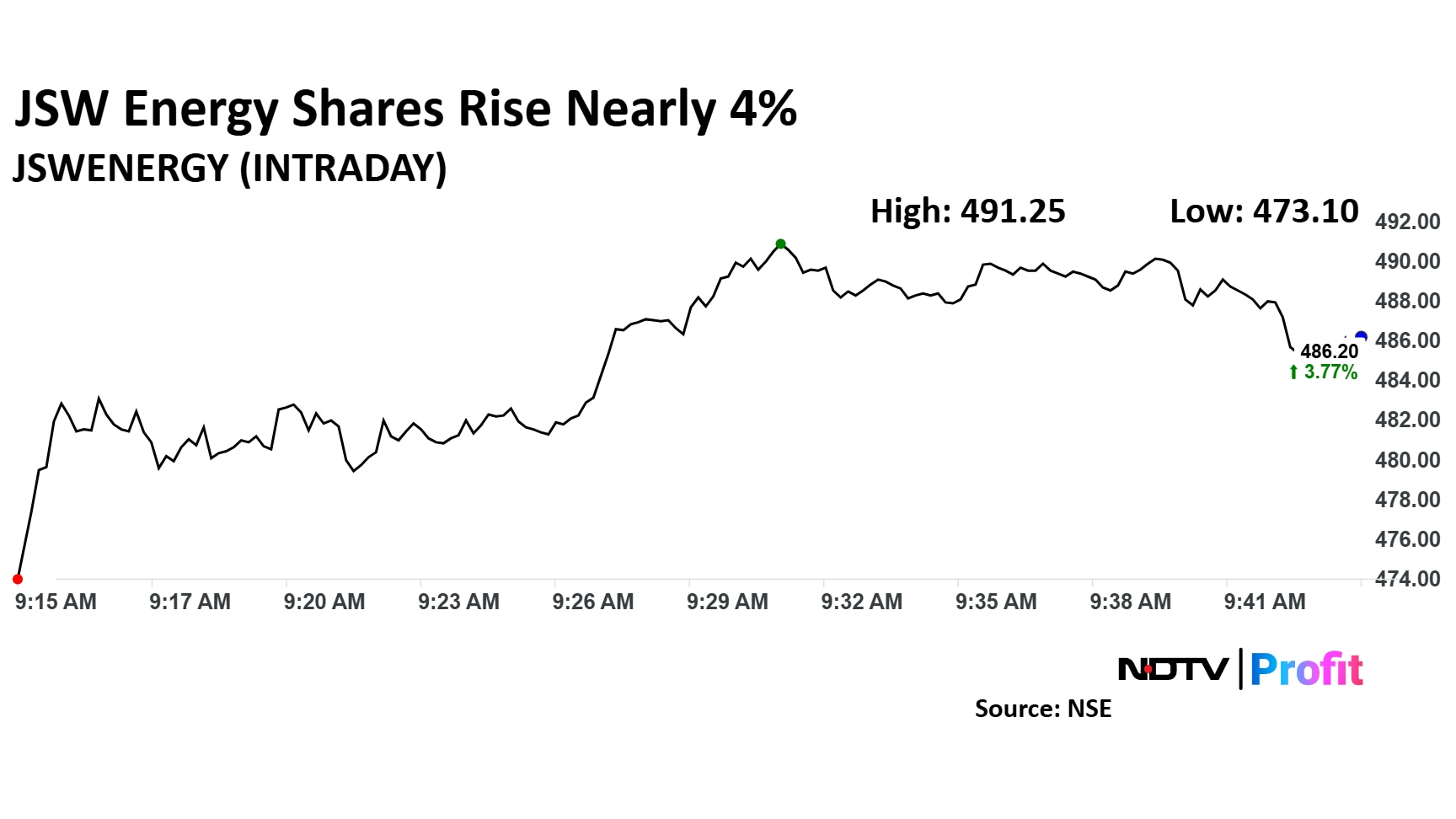

JSW Energies Share Price

JSW Energy stock rose as much as 4.84% during the day to Rs 491.25 apiece on the NSE. It was trading 4.7% higher at Rs 490.55 apiece, compared to an 0.39% decline in the benchmark Nifty 50 as of 10:06 a.m.

It was down 23.85% in the last 12 months. The total traded volume so far in the day stood at 2 times its 30-day average. The relative strength index was at 49.03.

Nine out of the 13 analysts tracking the company have a 'buy' rating on the stock, two recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 614.69, implying a upside of 27.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.