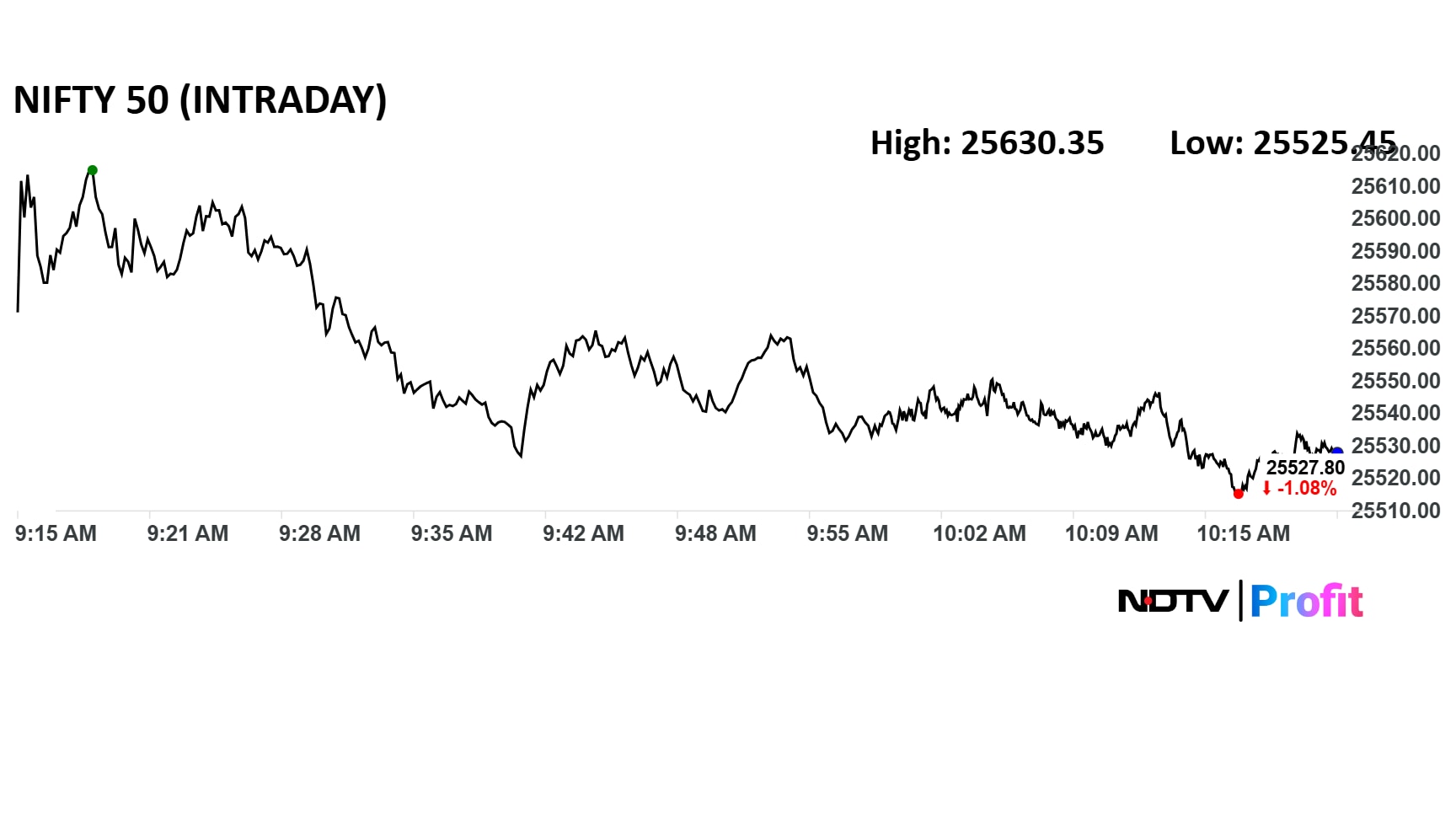

- Indian markets faced heavy losses with Nifty 50 down over 1% and Sensex losing 800 points

- Nifty IT index dropped nearly 5% as IT stocks entered bear market after US tech selloff

- Broader markets also declined with Nifty Smallcap 250 down 2% and Midcap 150 down 1.8%

The Indian markets faced intense pressure during Friday's trade, with the Nifty 50 trading with cuts of more than 1.%, and Sensex losing out on over 800 points. All sectors were trading in the red, with Nifty IT falling almost 5%.

The pain was witnessed in the broader market as well, with Nifty Smallcap 250 trading with cuts of almost 2%. Nifty Midcap 150 was also down more than 1.8%.

Add image caption here

Here, we are taking a look at three key reasons dragging the markets on Friday.

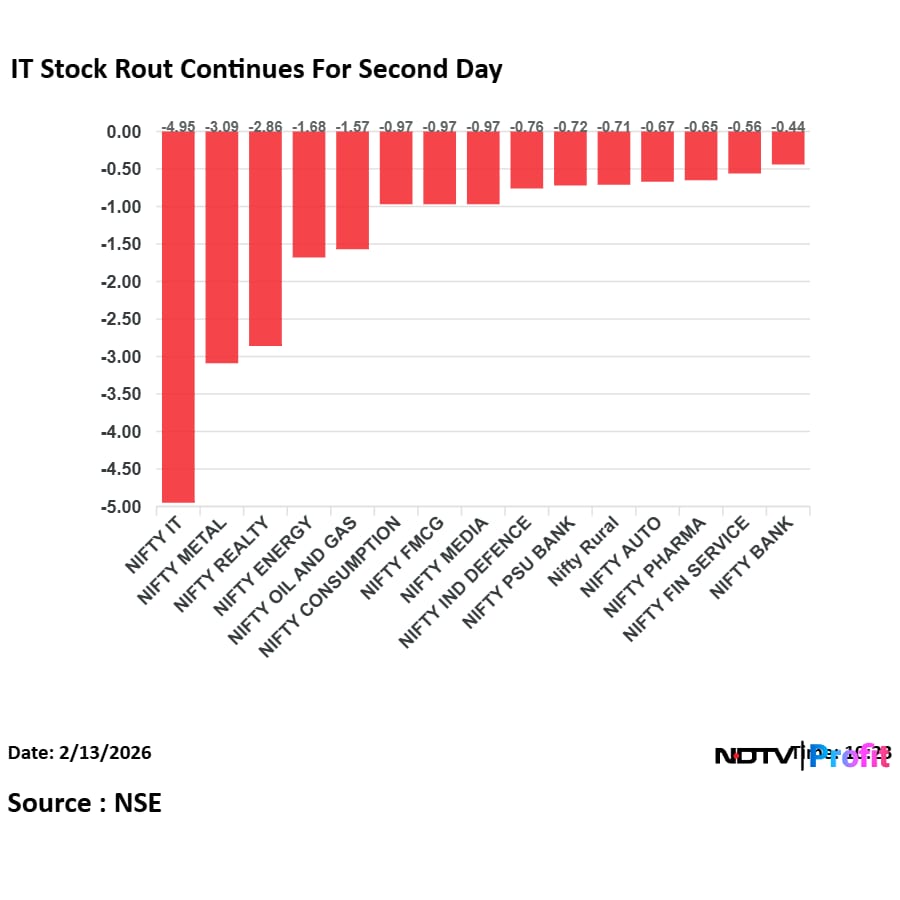

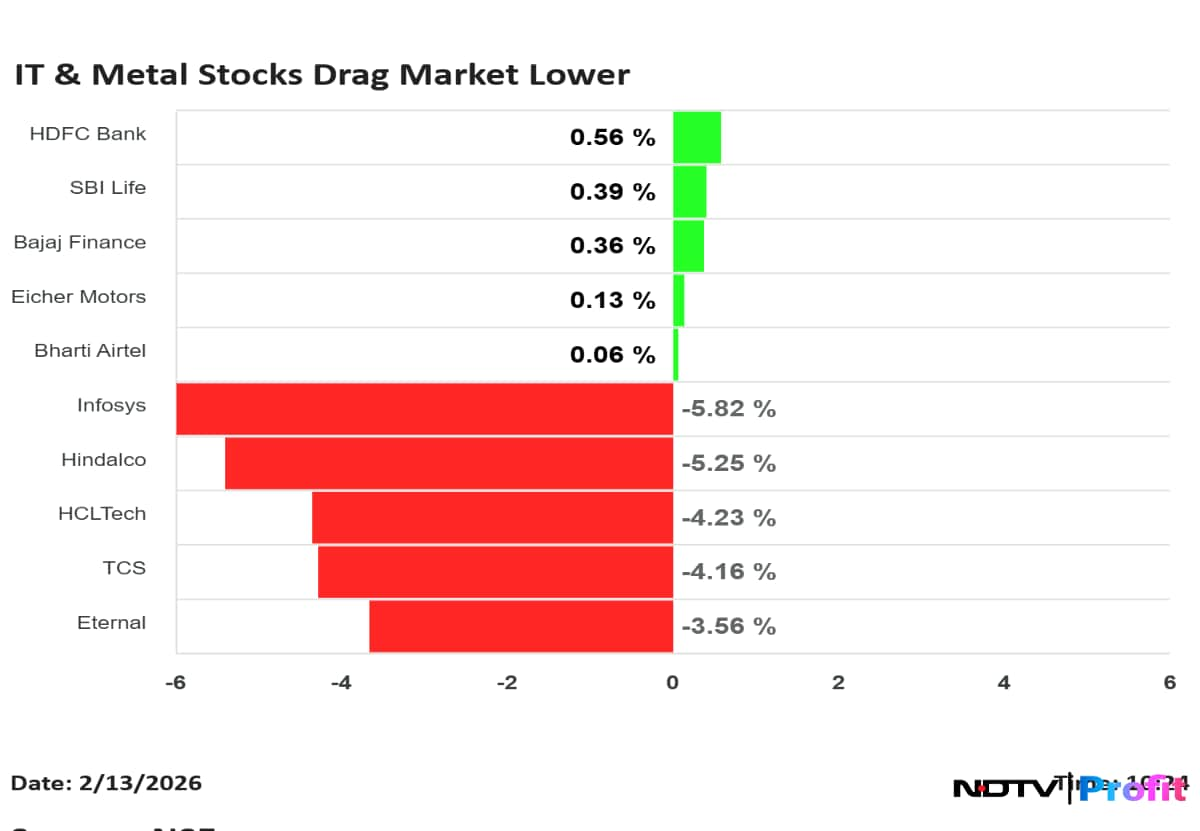

IT Index Extends Losses

The IT sell-off has continued to teh second day, with HCLTech, Infosys, Tech Mahindra, Wipro, and TCSall falling up to 6%. This is after IT stocks entered bear market territory on Thursday, following a selloff in US tech shares on Wednesday.

Over the last year, global markets have been fueled largely by optimism surrounding artificial intelligence. Companies viewed as frontrunners in the AI space drew heavy investor interest, sending their valuations soaring. That trend is now seeing a correction.

The issue isn't the viability of AI itself, but whether earnings can genuinely match the lofty expectations that were priced in. When doubts emerge about future profitability supporting current valuations, investors tend to pull back. Indian IT shares often move in line with US tech sentiment, as a substantial share of their business depends on clients based in the United States.

Market Breadth Remains Bearish

Market breadth remains extremely weak at current levels, with almost 2,500 BSE-listed stocks trading in the red compared with fewer than 1,000 advancing.

So far in today's session, 118 stocks have slipped to their 52-week lows, while another 62 counters have hit their lower circuits.

Upcoming US CPI Data

Ahead of key inflation readings, the 10‑year US Treasury yield slipped seven basis points to 4.10%. A $25 billion auction of 30‑year bonds attracted exceptionally strong demand, as per reports from Bloomberg.

Bitcoin fell below $66,000, while gold dropped under $5,000 amid a sharp, algorithm‑driven selloff. Silver collapsed 11%, and oil prices declined around 3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.