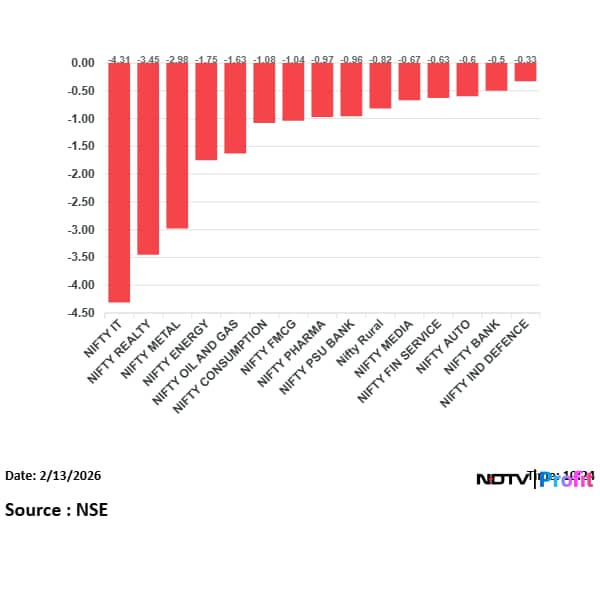

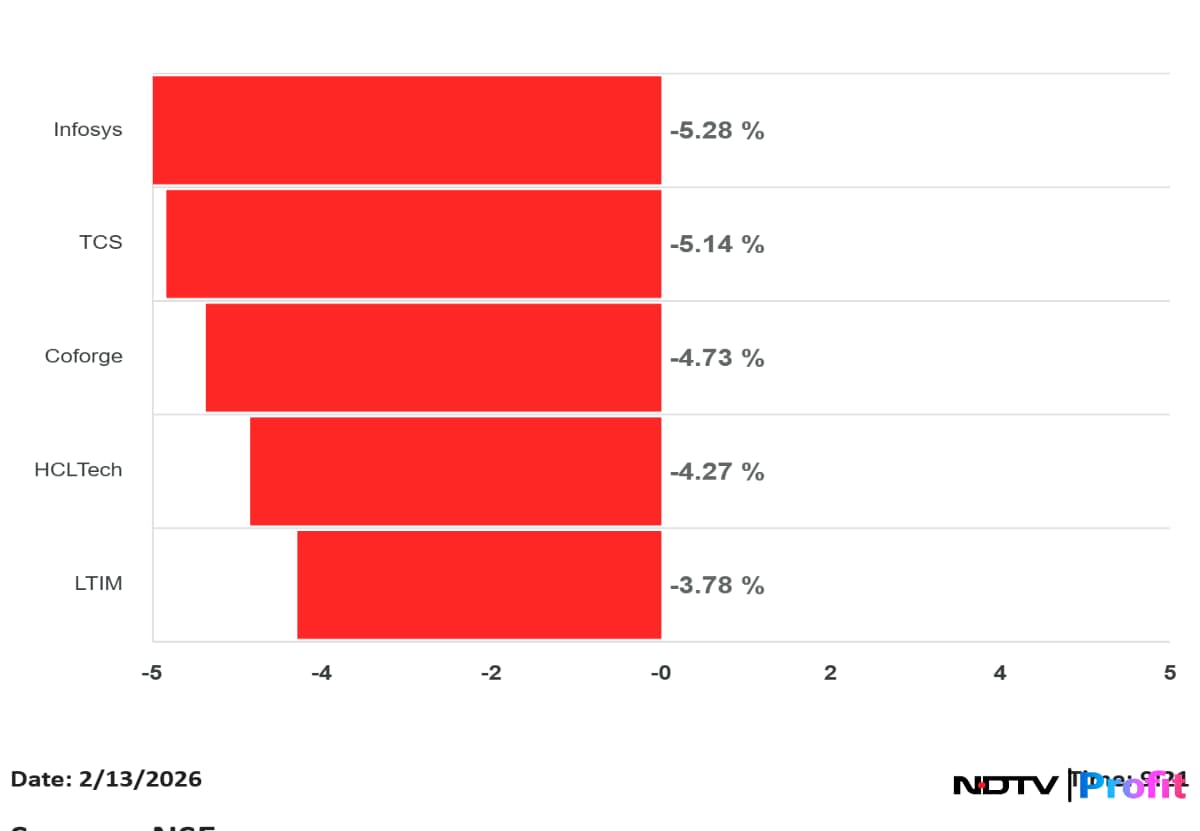

Indian equity benchmarks resumed weekly losses after a breather last week, led by the declines in the information technology stocks cause by the global tech rout over AI fears. The BSE Sensex fell nearly 1.2% lower to end the week at 82,626.75, while the NSE Nifty 50 settled below 25,500. On Friday, the 30-stock index fell over 1,000 points, while the 50-stock index fell 1.3%.

The declines were caused by the rout in IT stocks, which tracked the losses in the tech share in Wall Street since last two days.

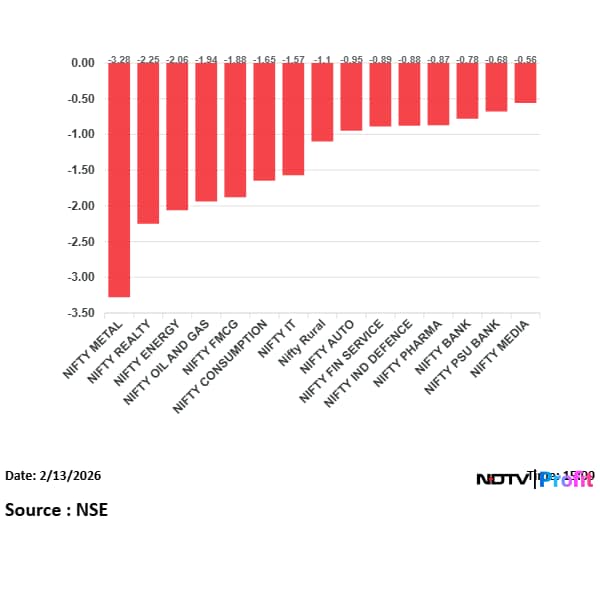

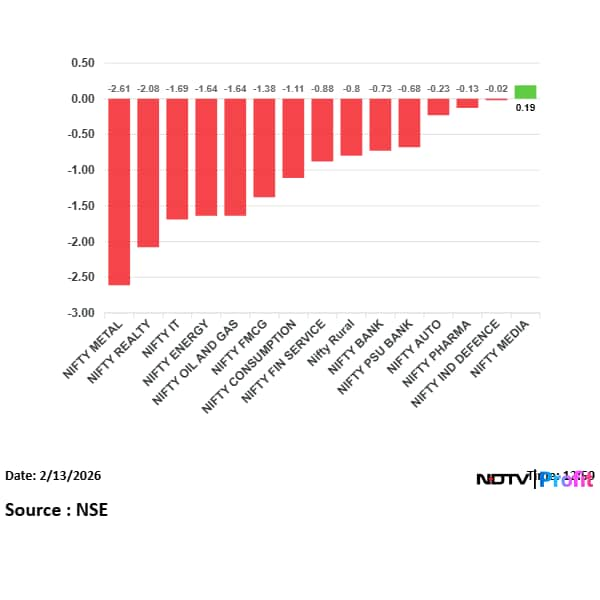

On Friday, the declines in the benchmarks were led by the shares in HDFC Bank and Reliance Industries. All the sectoral gauges tracked by NSE ended lower, led by the NSE Nifty Metal Index's 3.3% losses.

The market breadth was firmly tilted in favour of sellers. About 2,885 shares declined and 1,315 stocks advanced on BSE.

Elsewhere around the world, Asian shares pulled back from record highs as concerns about tech sector margins hit US stocks. Japan's Nikkei fell 1% and the S&P 500 futures were down 0.2%. European shares opened lower after an overnight sell-off on Wall Street linked to AI fears. The Stoxx 600 was down 0.1% shortly after the open, with most sectors and major markets in the red. The FTSE 100 rose 0.3%, while France's CAC 40 fell 0.3%, Italy's FTSE Mib slipped 0.3%, and Germany's DAX was down 0.1%.

Physicswallah

Eternal

SpiceJet

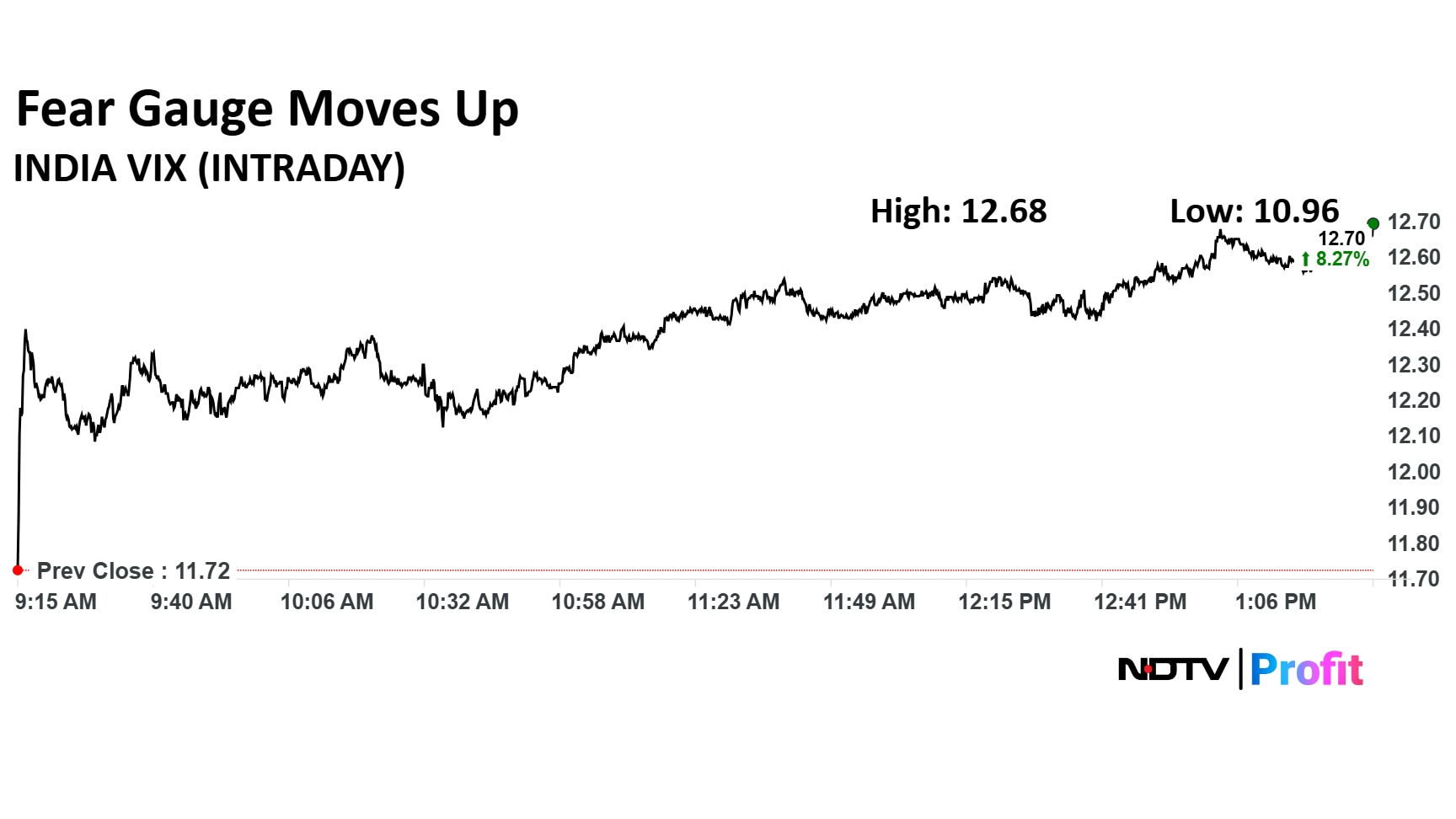

India VIX, derived by the NSE to measures volatility in the market using data from Nifty options, surged as much as 8.6% intraday.

Info Edge Q3 Highlights (Consolidated, QoQ)

Biocon Biologics Commentary

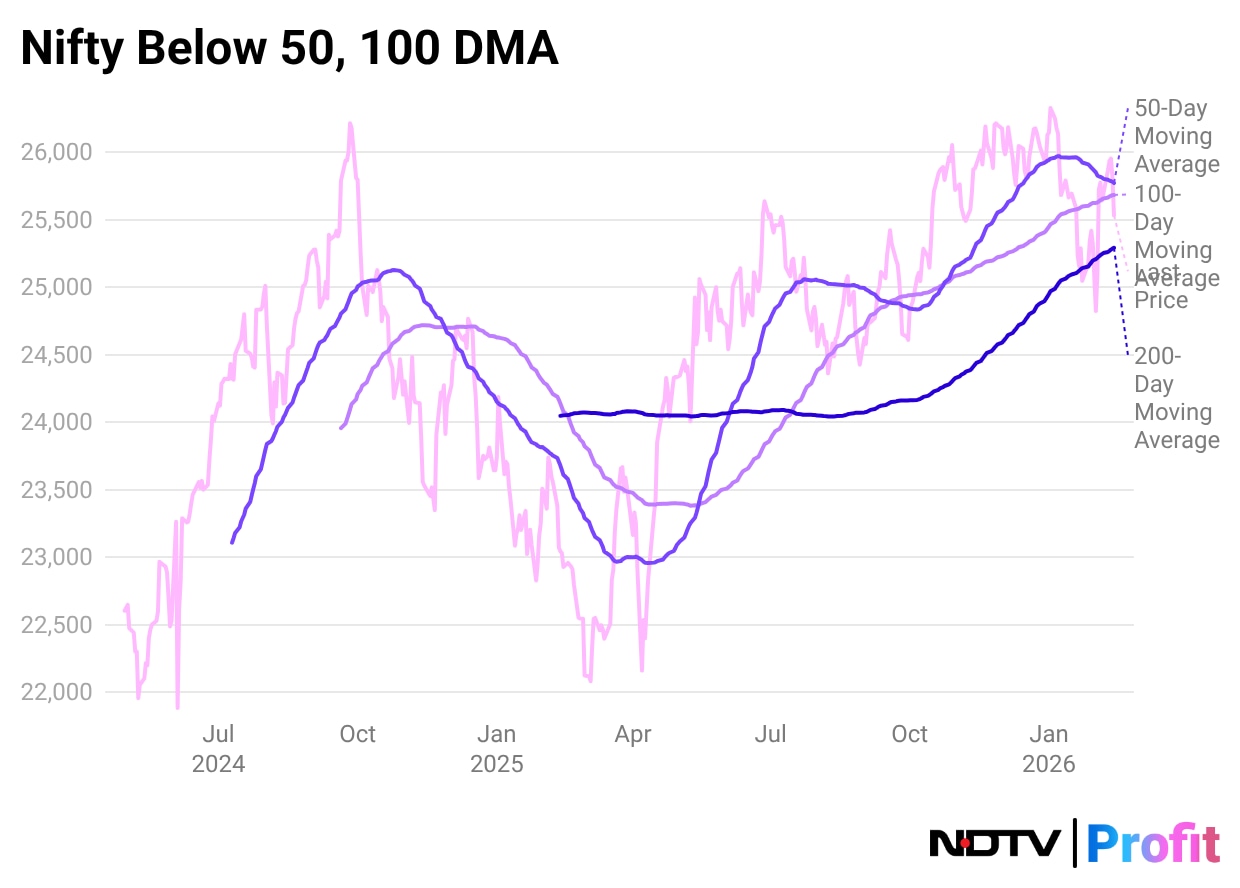

The Nifty fell below its 50-day and 100-day moving averages in trade.

Bajaj Finance is rapidly scaling its AI deployment across customer engagement, operations and internal processes, marking a shift from experimentation to measurable business impact. The lender has already processed 20 million customer calls using AI and plans to scale this to 100 million calls over the next year, Vice Chairman Rajeev Jain said during the company's third-quarter earnings call.

AI-driven call centre interactions have already contributed significantly to business volumes. Loan disbursements originating from AI-assisted calls stood at Rs 1,600 crore, while insights derived from call data generated an additional Rs 325 crore in lending.

Honasa Consumer (Mamaearth) (Consolidated, YoY)

Shares of Muthoot Finance 12.1% to Rs 3,676.

Muthoot Finance (Standalone, YoY)

Engineers India

Billionbrains Garage Ventures (Groww)

Honasa Consumer

Puravankara

The Indian rupee strengthened at the open against the US dollar. The local currency appreciated to 90.59 against the greenback compared to Thursday's close of 90.67.

Indian equity benchmarks declined in the pre-market trade, extending declines for the second consecutive trading session. The BSE Sensex fell over 500 points while the NSE Nifty 50 traded below 25,600 in the pre-market session.

Everything does not have to dramatized so much.

— Samir Arora (@Iamsamirarora) February 13, 2026

Disruption does not mean extinction. Whatsapp disrupted SMS but you still use SMS. OTT disrupted TV and theatres but you still see TV and go to movies.

Fear of disruption can mean lower valuations, lower growth expectations, lower… https://t.co/Y4cNRp3vwo

Who would have thought 5 year back that SBI will have more market cap then TCS and Infy…

— Gurmeet Chadha (@connectgurmeet) February 12, 2026

Great turnaround in PSU banks as they become better risk mangers and digitise.

I would not write off Indian IT cos .. they have the ability to pivot & convert this into an opportunity..

IRCTC Q3FY26 (Consolidated) Results

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.