The Indian Renewable Energy Development Agency Ltd.'s shares fell over 2% on Friday, after its board approved a fundraising initiative of up to Rs 5,000 crore through a qualified institutional placement. The board has set the floor price at Rs 173.83 per share, with the possibility of offering a discount of up to 5% on this price.

On Thursday, Ireda board also approved the preliminary placement document and the draft application form related to the QIP.

The merchant bankers for this QIP include IDBI Capital Market Services Ltd., BNP Paribas, SBI Capital Markets Ltd., Emkay Global Financial Services Ltd., and Motilal Oswal Investment Advisors Pvt.

Ireda is a government-owned financial institution working towards promoting, developing, and extending financial assistance for renewable energy and energy efficiency projects in India.

Established in 1987, Ireda operates under the Ministry of New and Renewable Energy, the agency offers a range of financial products, including loans and grants, to facilitate the growth of solar, wind, biomass, and small hydro projects.

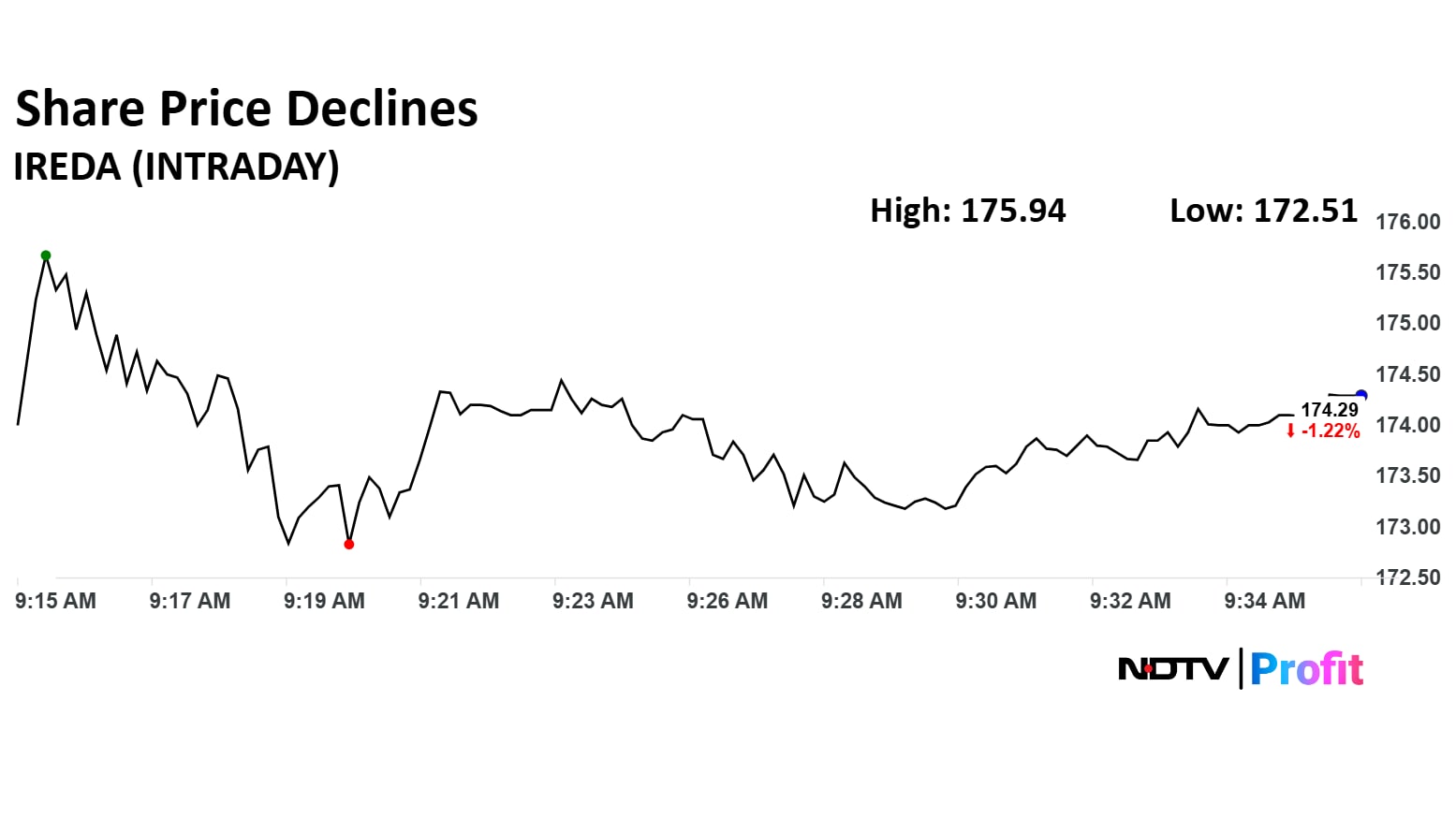

IREDA Share Price Today

The scrip fell as much as 2.23% to Rs 172.51 apiece. It pared losses to trade 1.44% lower at Rs 173.90 apiece, as of 09:34 a.m. This compares to a flat NSE Nifty 50.

It has fallen 2.47% in the last 12 months. Total traded volume so far in the day stood at 4 times its 30-day average. The relative strength index was at 54.

Out of two analysts tracking the company, one maintains a 'buy' rating and the other one recommends a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an downside of 13.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.