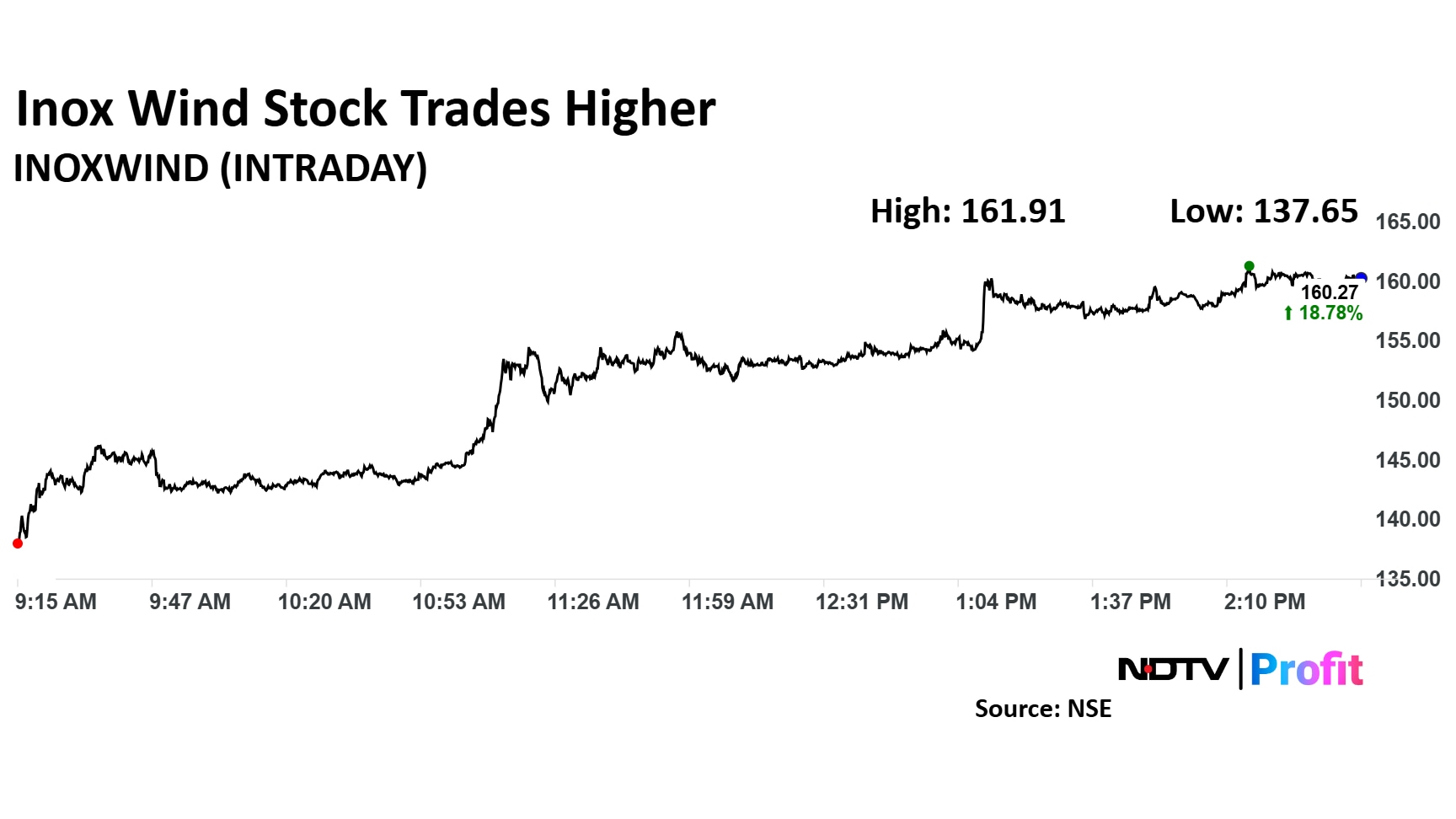

Inox Wind Ltd.'s stock hit the 20% upper circuit on Wednesday as trading volumes surged. The share price hit Rs 161.91 intraday.

Multiple large trades occurred around noon. The stock's total trading volume was 11 times its 30-day average, whereas the relative strength index was 36.

Inox Wind is scheduled to report its third quarter earnings on Jan. 31. The company beat estimates three times in the past five years.

The wind turbine manufacturer is expected to report a net profit of Rs 102 crore in the October-December quarter, a 9% growth over the year-ago period, as per the consensus estimate of analysts tracked by Bloomberg. The revenue is projected to grow 110% to Rs 1,062 crore.

Inox Wind's shares have risen by 30.5% over the past 12 months. The stock trades at 25.8 times its estimated forward earnings per share compared to 38.2 times for two-year historical average, according to Bloomberg. The company is priced at 11.3 times book value.

Of the six analysts tracking Inox Wind, five have 'buy' rating on the stock and one recommends a 'hold', according to Bloomberg data. The average of 12-month analyst price target of Rs 251 represents a 56% return potential.

In the quarter ended September 2024, Inox Wind had swung into profit, as it logged a consolidated bottom line of Rs 90 crore versus net loss of Rs 27 crore in the year-ago period. The revenue during the same period soared 97.6% year-on-year to Rs 732 crore.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.