JPMorgan has maintained its 'overweight' stance on Infosys Ltd. despite pressure on discretionary spending due to tariff uncertainty. The firm stated sectors such as retail, consumer, CPG and manufacturing had been impacted the most. Financial services remained strong, while Infosys' growth was robust into fourth quarter, the brokerage firm stated in its report.

"While discretionary spend projects face uncertainty, cost take-out signings have remained on track. That said, clients have paused on innovation spending since CY23, and there could be pent-up demand once the macro clears. Infosys' investments and exposure to digital services keep it best positioned to benefit from the pent-up spend and discretionary demand recovery," JPMorgan said.

While the demand trend has been unchanged so far, according to the firm, due to, "lack of clarity on eventual tariffs during the 90-day delay, impacting enterprise clients' ability to take decisive action", it has not worsened and cost take-out deal signings remain on track.

Demand is weakest in the retail, consumer, CPG and manufacturing verticals, whereas it is strongest in the financial services sector.

Infosys is prepared for eventual discretionary spending recovery due to the digital mix, according to the brokerage. "Enterprises haven't spent meaningfully on innovation agendas over the last couple of years, which is driving up tech debt and potentially creating pent-up demand. Infosys' high mix of digital services keeps it well positioned to capture demand from pent-up spending in an eventual recovery," it said.

This, coupled with the company's focus on margin recovery, has contributed to JPMorgan's bullish stance.

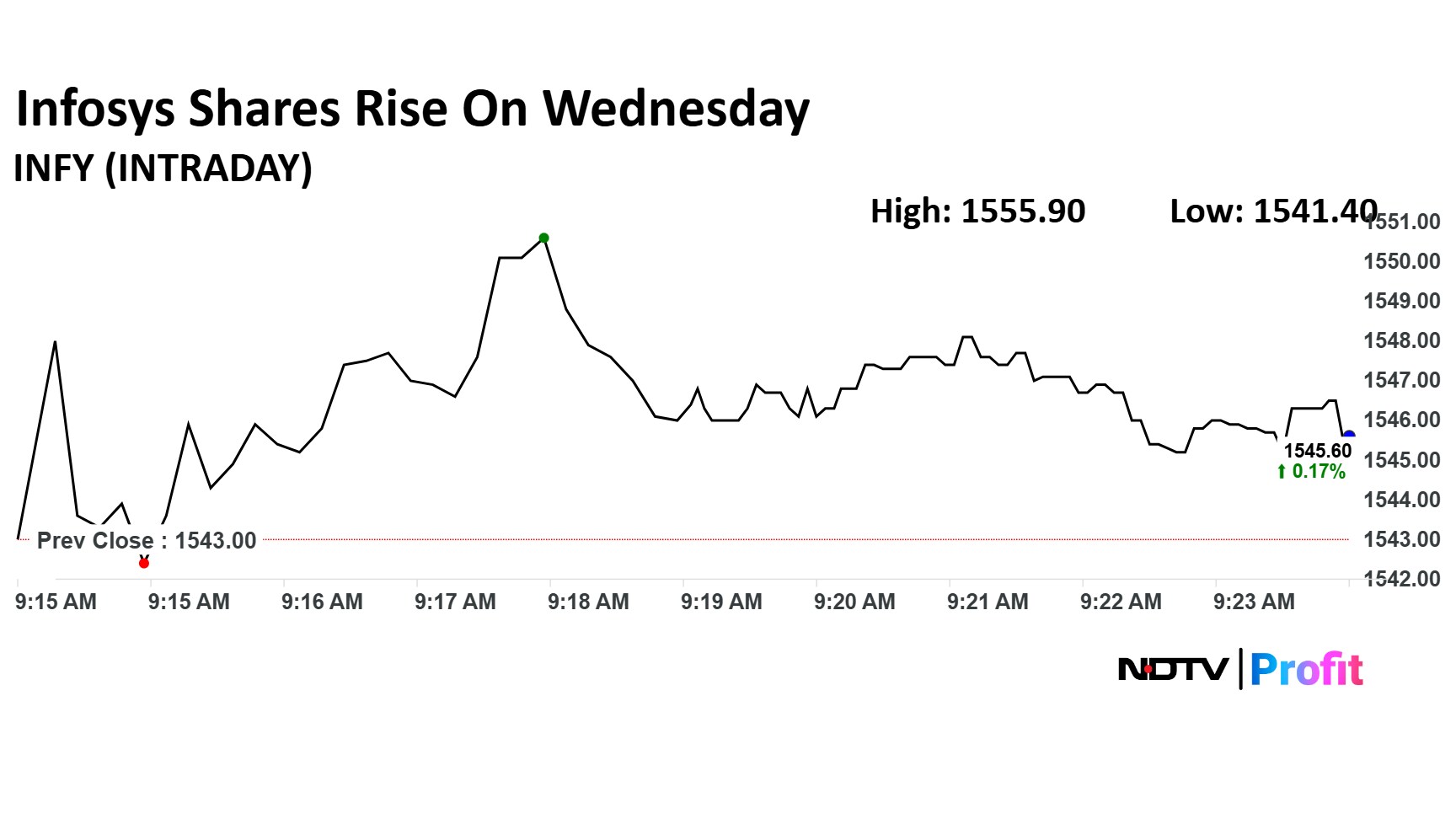

Infosys Share Price Today

The scrip rose as much as 0.84% to Rs 1,555.90 apiece. It pared gains to trade 0.12% higher at Rs 1,544.90 apiece, as of 9:19 a.m. This compares to a 0.14% advance in the NSE Nifty 50.

The stock has fallen 17.72% on a year-to-date basis, and risen 10.98% in the last 12 months. The relative strength index was at 37.95.

Out of 49 analysts tracking the company, 35 maintain a 'buy' rating,12 recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 5.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.