The share price of controversy-ridden IndusInd Bank Ltd. fluctuated in Thursday's trade, paring losses to trade higher after the Securities and Exchange Board of India banned the lender's ex-CEO Sumant Kathpalia and four others from dealing in the share market, alleging they were aware of unpublished price-sensitive information about the bank's derivative trades.

IndusInd Bank's former executive director and deputy CEO, Arun Khurana, along with head of treasury operations Sushant Sourav, head of GMG operations Rohan Jathanna, and chief administrative officer of consumer banking operations Anil Marco Rao, are the other officials named in the order.

The individuals have been restrained from buying, selling or dealing in securities, either directly or indirectly, in any manner until further orders, the SEBI said in an interim order on Wednesday.

According to the SEBI order, Kathpalia was aware of the accounting discrepancies in IndusInd Bank's derivative trades and their significant impact by December 2023.

The bank's internal team estimated the financial impact of the derivative discrepancies at Rs 2,362 crore in March 2024.

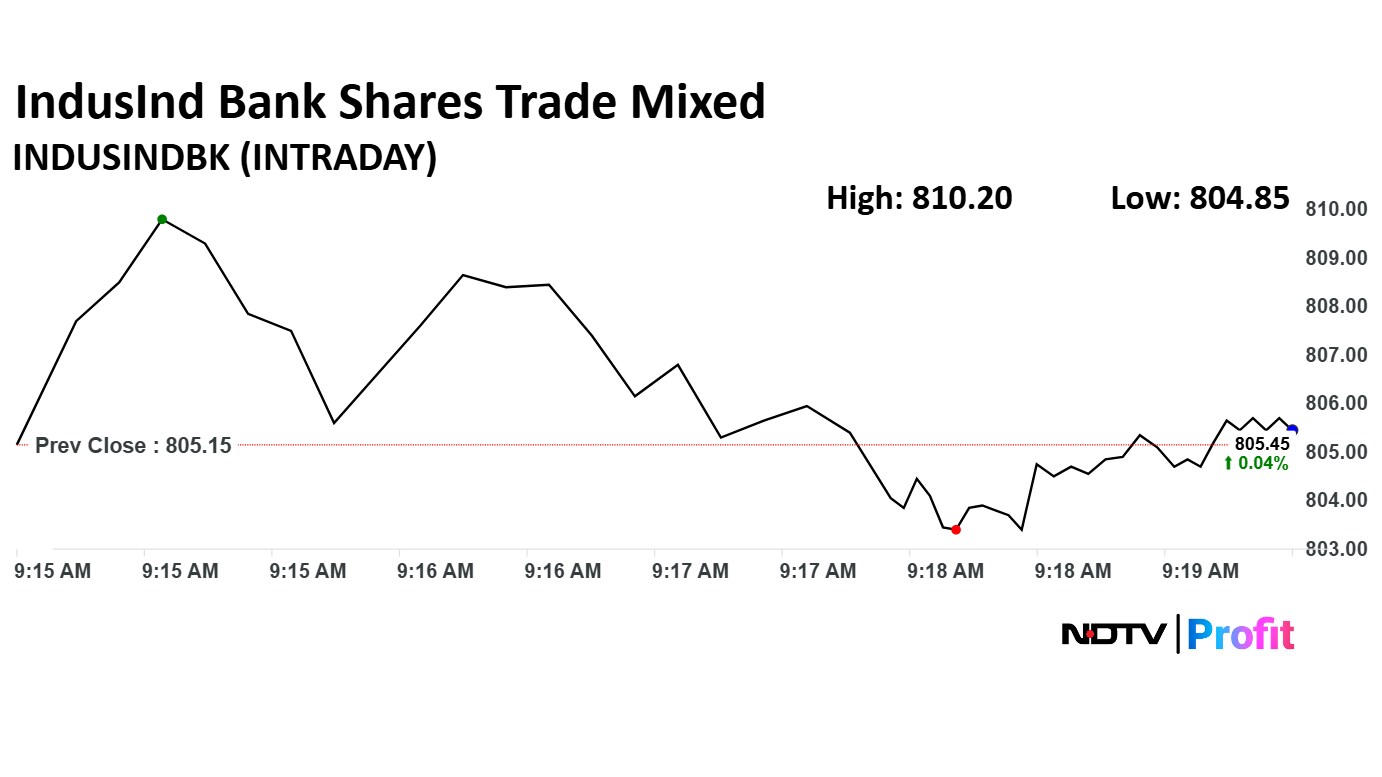

IndusInd Share Price Today

The scrip rose as much as 0.50% to Rs 809.20 apiece. It pared gains to trade 0.41% higher at Rs 808.45 apiece, as of 09:22 a.m. This compares to a 0.36% advance in the NSE Nifty 50 Index.

It has fallen 18.78% on a year-to-date basis, and 44.86% in the last 12 months. The relative strength index was at 53.2.

Out of 47 analysts tracking the company, 10 maintain a 'buy' rating, 15 recommend a 'hold,' and 22 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 6.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.