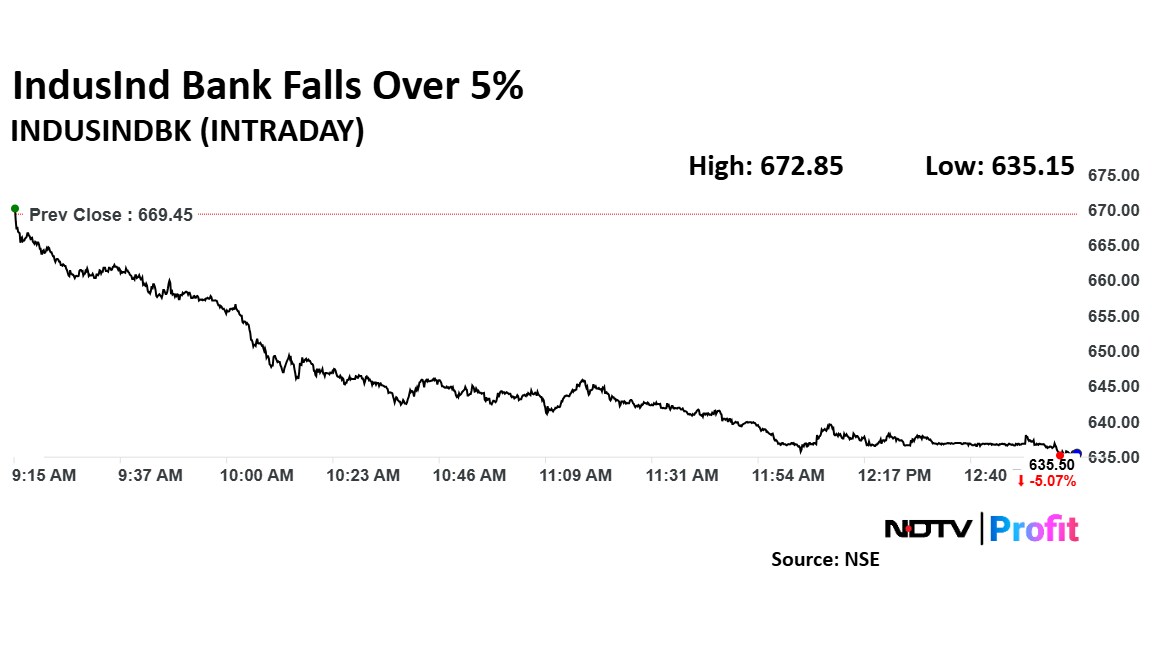

IndusInd Bank Ltd. share price fell over 5% on Tuesday as external auditor PWC prepares to submit its report on the lender's accounting discrepancies. The 'Big Four' consulting firm is likely to present its findings on Friday, sources told NDTV Profit.

According to IndusInd Bank's estimates shared with exchanges, the discrepancies can have an impact of Rs 2,100 crore, or 2.35% of its net worth.

The report will be submitted to all stakeholders involved, including the board and Reserve Bank of India, according to the aforementioned people in the know.

The PwC report will get into details of impact on the balance sheet and core issues.

Meanwhile, IndusInd Bank has appointed Grant Thornton to conduct a review of the discrepancies. It's audit will focus on root cause analysis and accountability of bank staff, the sources told NDTV Profit.

In a statement to the exchanges last week, the lender said that it has appointed an independent firm to conduct a comprehensive investigation to identify the root cause of the recently disclosed accounting discrepancies. This firm will assess the correctness and impact of the accounting treatment of the derivative contracts with regard to the prevailing accounting standards.

The RBI is awaiting an accountability exercise to be completed before taking action, two people familiar with the matter had told NDTV Profit on the condition of anonymity. In case any serious accounting lapses are found at IndusInd Bank, the regulator will then take action against those responsible.

The people quoted above added that the lender's board has to adopt the independent agency's report before submitting it to the country's central bank. RBI would take action on the basis of what the board accepts as reasons behind the lapse.

The development came after the bank disclosed on March 10, that it had discovered certain discrepancies in its derivatives portfolio.

IndusInd Bank Share Price Rise

The shares of IndusInd Bank fell as much as 5.36% to Rs 633.60 apiece, the lowest level since March 12. It pared losses to trade 4.47% lower at Rs 639.50 apiece, as of 1:33 p.m. This compares to a 0.10% advance in the NSE Nifty 50 Index.

The counter has risen 57.89% in the last 12 months and 34% year-to-date. Total traded volume so far in the day stood at 1.2 times its 30-day average. The relative strength index was at 19, indicating it is oversold.

Out of 48 analysts tracking the company, 21 maintain a 'buy' rating, 18 recommend a 'hold,' and nine suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 60.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.