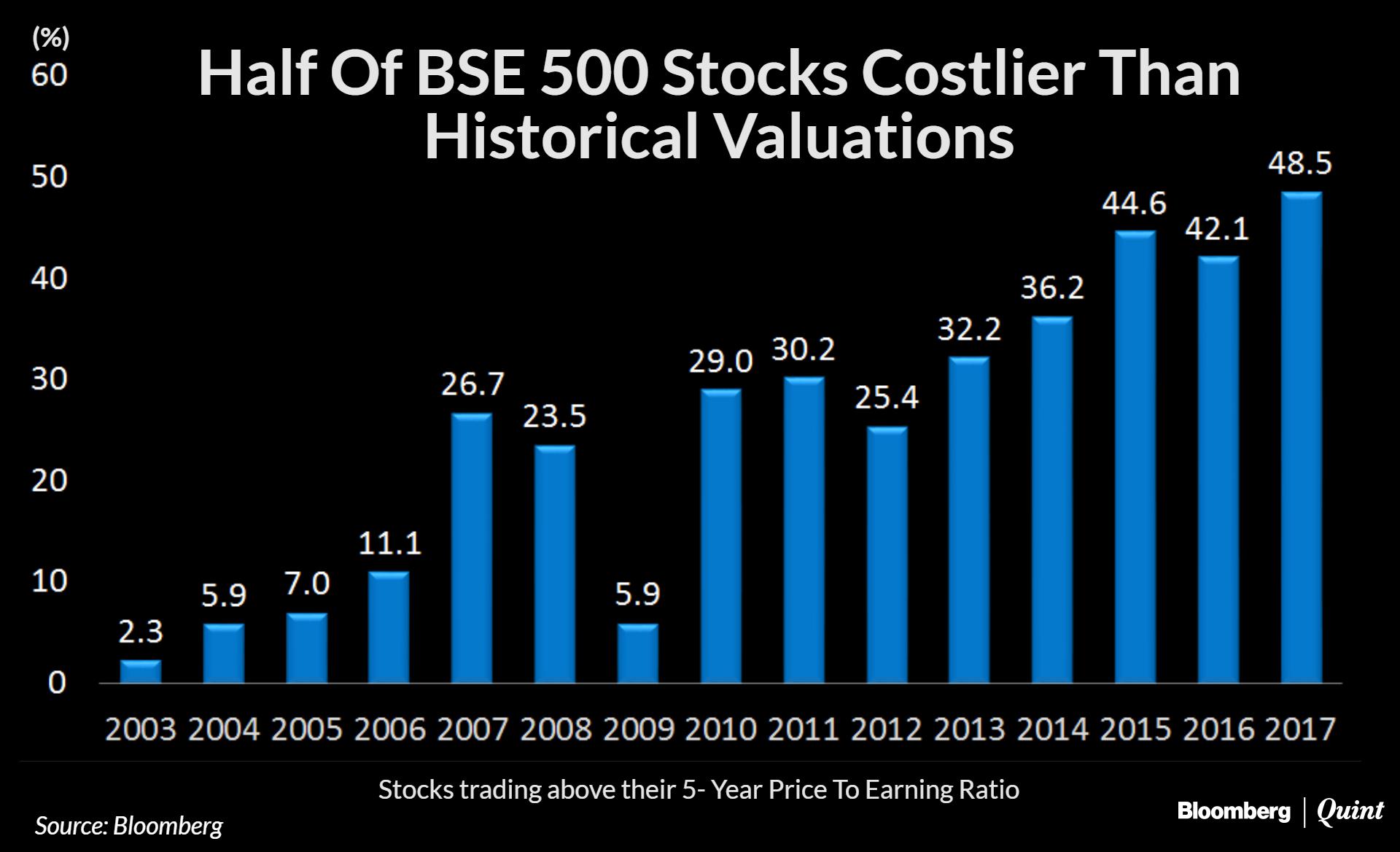

Nearly half of the stocks in the S&P BSE 500 Index are costlier than their average five-year price-to-earnings. That's the highest proportion of stocks trading above their historical valuations in 15 years, according to data tracked by Bloomberg.

As the markets trade near their all-time peak, BSE 500 Index itself is trading at 26.06 times its earnings in the last 12 months, a 31 percent premium over its five-year average.

What Does This Mean?

Such high valuations do not necessarily mean a steep fall in stock prices but indicate lower returns, said a report from brokerage IIFL. It is almost a given that future returns for these stocks will be far lower in nominal terms than what some of these stocks have seen in the recent past, the report said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.