Indian Hotel Co.'s share price fell 4% during early trading hours on Monday despite its third quarter profit beating analyst estimates and management's confidence in meeting double-digit revenue growth target for the year.

The profit of the hospitality firm, which operates the Taj brand, increased 33% to Rs 633 crore in the quarter ended December, while analysts tracked by Bloomberg estimated the bottomline at Rs 588 crore.

Revenue increased by 29% to Rs 2,533 crore, in-line with the estimated Rs 2,476 crore.

On the operating side, Ebitda rose by 31% to Rs 962 crore, compared to a forecast of Rs 939 crore. Margin expanded to 38% from 37.3%, exceeding the projection of 37.9%, despite consolidation of lower margin Taj SATS business.

Revenue Per Available Room surged 13% led by higher Average Room Rate and occupancies.

IHCL remains optimistic about achieving double-digit revenue growth for fiscal 2025, with the 'Ginger' brand expected to maintain over 50% growth, executives said in a post-earnings conference call.

March quarter performance is likely to mirror the previous trends, with demand continuing to outpace supply despite potential slowdowns. Revenue from Foreign Tourist Arrivals (FTAs) has yet to materialise, but their return is expected to benefit the luxury portfolio significantly.

Jefferies maintained a "Buy" rating on Indian Hotels with a target price of Rs 1,000, citing a strong performance and healthy RevPAR growth. The positive outlook on RevPAR is supported by currency tailwinds as a new growth driver. New business segments are expanding steadily, and the company remains committed to its accelerated expansion plans, the brokerage said.

Dolat Capital observed that as fiscal 2025 will be the third year of industry outperformance, it may pose a challenge for the next two years. Inherent cyclicality, economic slowdown, high base, competition and high valuations are some of the key risks, it said while reiterating a ‘Sell' rating.

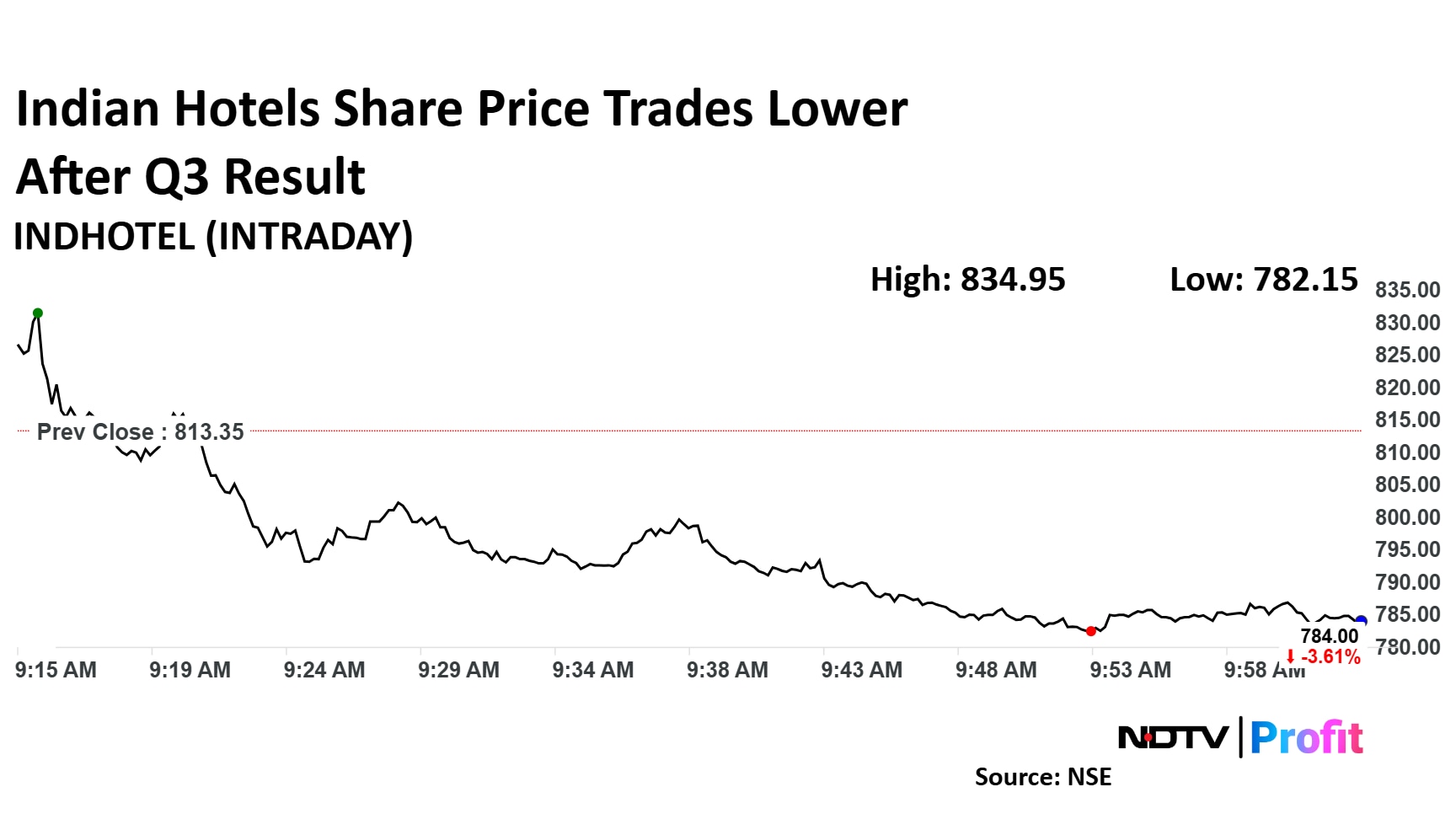

Indian Hotels Share Price Movement

Indian Hotels share price trades lower.

IHCL share price fell 4.3% intraday to Rs 834.95 apiece. The scrip was trading 3.6% lower by 10:05 a.m. The benchmark NSE Nifty 50 was up 0.12%.

The stock has risen 63% in the last 12 months. It has made a downward move since hitting a life-high on Dec. 30. The total traded volume so far in the day stood at 8.7 times its 30-day average. The relative strength index was at 40.

Thirteen out of the 22 analysts tracking Indian Hotels have a 'buy' rating on the stock, six recommend a 'hold' and three suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price target of Rs 835.57 implies a potential upside of 5.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.