Hindustan Aeronautics Ltd. saw its share price decline by over 4%, ahead of its third quarter earnings announcement, scheduled for Wednesday. The company, in a stock exchange filing on Jan. 27, confirmed it would release its October-December 2024 quarter results, following a board of directors meeting on Feb. 12.

In the previous quarter, HAL reported a profit increase of 22% year-on-year, reaching Rs 1,510 crore for the quarter ended September 2024. Revenue for the same period rose by 6% to Rs 5,976 crore, compared to Rs 5,636 crore in the corresponding period last year.

HAL is renowned for designing and manufacturing a wide range of aerospace products, including fighter jets, helicopters, jet engines, marine gas turbine engines, and avionics.

Earlier, the company also announced a revised date for its first interim dividend. “We would like to inform that, based on the advice of the stock exchanges, the revised record date for the purpose of first interim dividend for the financial year 2024-25, if declared, will be 18th February, 2025," it had said.

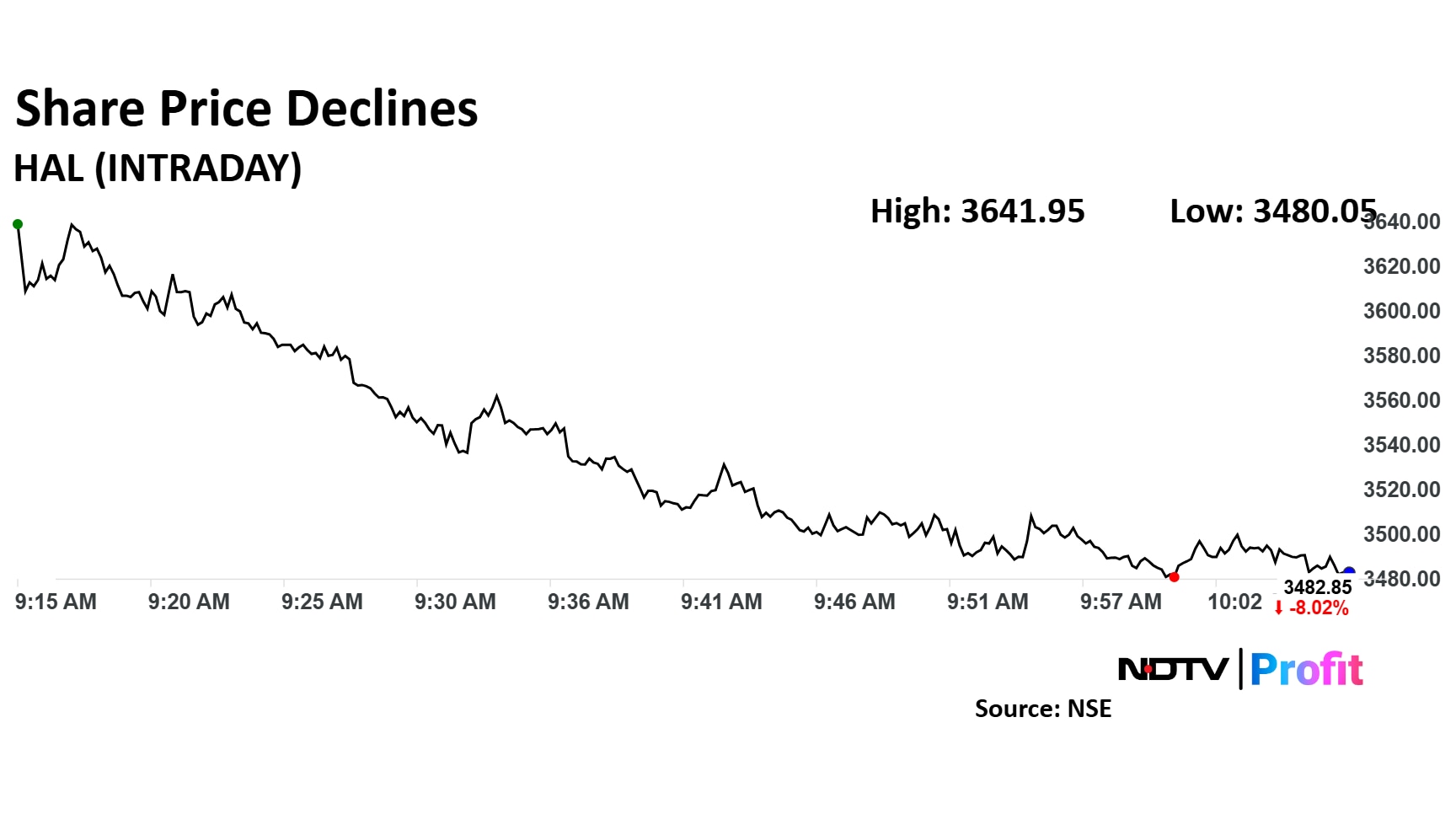

HAL Share Price Today

Shares of HAL fell as much as 4.64% to Rs 3,480 apiece. They pared losses to trade 4.22% lower at Rs 3,495 apiece, as of 10:03 a.m. This compares to a 1.10% decline in the NSE Nifty 50.

The stock has risen 22.82% in the last 12 months. Total traded volume so far in the day stood at 1.3 times its 30-day average. The relative strength index was at 36.

Out of 16 analysts tracking the company, 15 maintain a 'buy' rating and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 50.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.