Share price for Hero MotoCorp Ltd. rose 6% to Rs 4,309.70 apiece, its highest price since January this year, on high volume on Thursday.

In its fourth-quarter results for fiscal 2025, Hero MotoCorp reported a 4.4% increase in standalone revenue, reaching Rs 9,939 crore, compared to Rs 9,519 crore in the same period last year. This figure slightly exceeded Bloomberg's estimate of Rs 9,756 crore.

The company's net profit also saw a 6.4% rise, amounting to Rs 1,081 crore, up from Rs 1,016 crore, though it fell short of the Bloomberg estimate of Rs 1,124 crore.

Earnings before interest, taxes, depreciation, and amortisation grew by 4.1% to Rs 1,416 crore, compared to Rs 1,359 crore in the previous year, aligning closely with Bloomberg's estimate of Rs 1,390 crore. The Ebitda margin stood at 14.2%, slightly down from 14.3% last year but matching Bloomberg's forecast.

Additionally, Hero MotoCorp Ltd. has declared a final dividend of Rs 65 per share on the face value of Rs 2 per equity share. For the fiscal year 2025, the total dividend declared by Hero MotoCorp stands at Rs 165 per share.

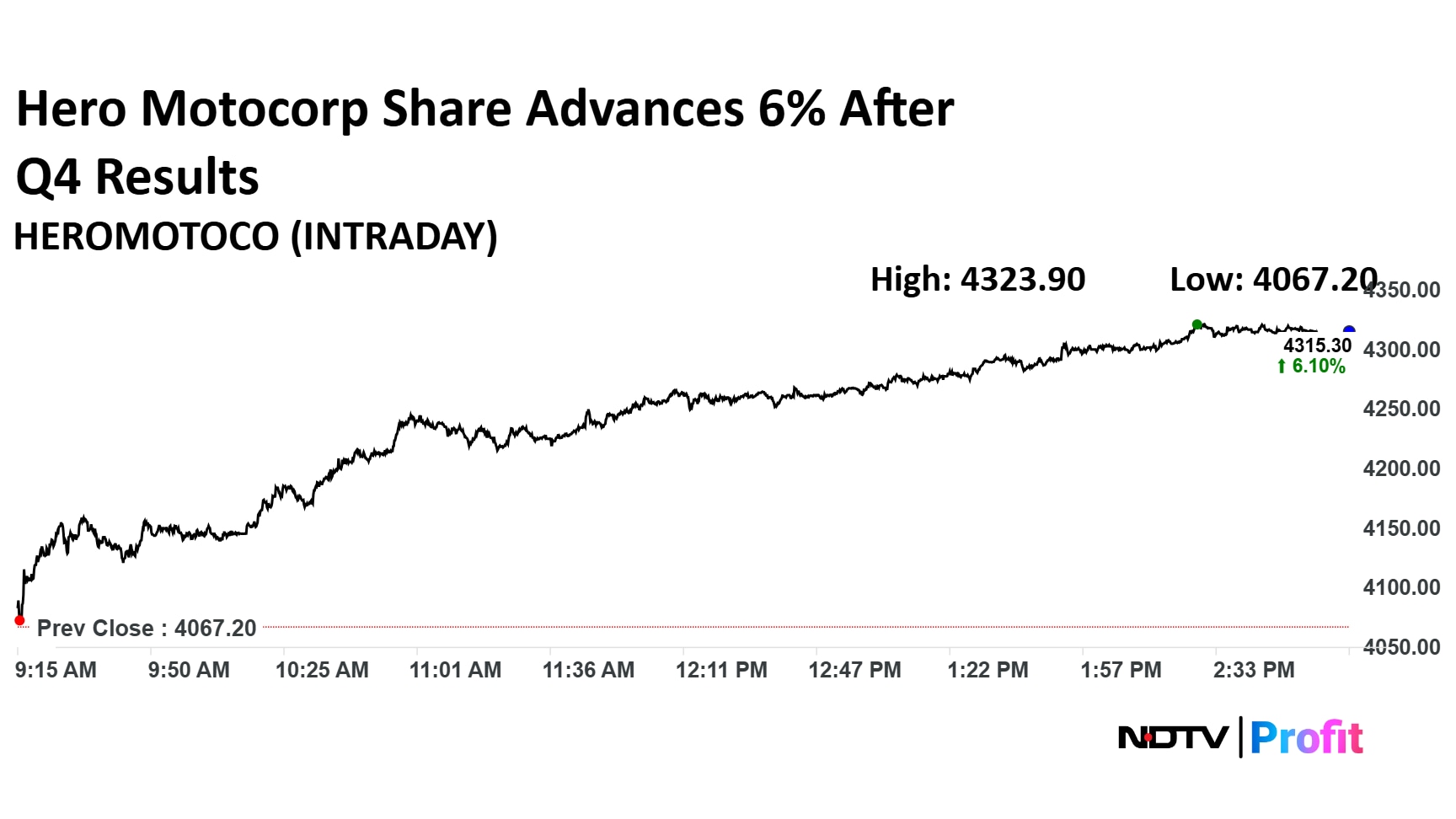

Hero Motocorp Share Price

The scrip rose as much as 5.96% to Rs 4,323.90 apiece, the highest level since January 2025. It pared gains to trade 5.86% higher at Rs 4,305.60 apiece, as of 3:00 p.m. This compares to a 1.71% advance in the NSE Nifty 50.

It has risen 3.72% on a year-to-date basis, and is down 14.67% in the last 12 months. Total traded volume so far in the day stood at 3.7 times its 30-day average. The relative strength index was at 51.56.

Out of 42 analysts tracking the company, 25 maintain a 'buy' rating, 10 recommend a 'hold' and seven suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 5.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.