.jpeg?downsize=773:435)

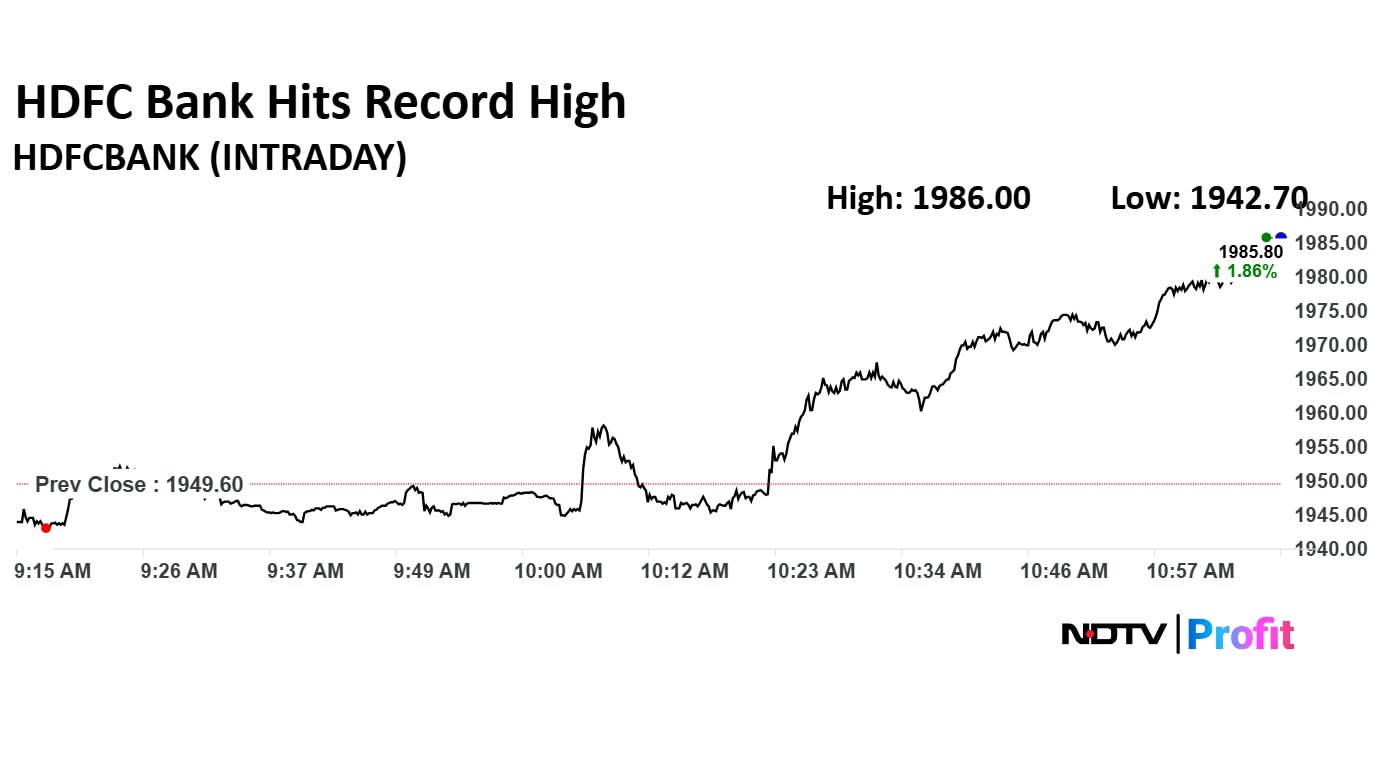

HDFC Bank Ltd.'s share price hit a fresh high in Friday's session after Reserve Bank of India's reduction in the benchmark repo rate which surpassed expectations, and the 100 basis points cut in the cash reserve ratio.

The stock has emerged as the top contributor to the benchmark NSE Nifty 50, Nifty Bank, and Nifty Financial Services indices. It has taken Nifty Bank and Nifty Financial Services indices to its record high in Friday's session.

RBI's unexpected policy moves are expected to increase liquidity in the banking system and support policy transmission. The current repo rate stands at 5.5%, and the CRR stands at 3%. The central bank has changed the stance to 'neutral' from 'accommodative'.

Track updates related to RBI Monetary Policy Committee here.

Market-cap of HDFC Bank rose Rs 30,225.57 crore to Rs 15.23 lakh crore as of 11:24 a.m.

HDFC Bank Share Price Today

HDFC Bank's share price rose as much as 2.40% to a record high of Rs 1,996.3 apiece. It was trading 2.07% higher at Rs 1,989.5 apiece as of 11:25 a.m., as compared to a 0.88% advance in the NSE Nifty 50.

The stock rose 27.59% in 12 months, and 12.27% on year-to-date basis. Total traded volume so far in the day stood at 1.8 times its 30-day average. The relative strength index was at 65.78.

Out of 49 analysts tracking the company, 45 maintain a 'buy' rating, four recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 9.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.