011123-2.jpg?downsize=773:435)

Shares of HDFC Bank Ltd. rose for the second consecutive day on Thursday as analysts remained positive on the lender, citing a mix of consistent performance, promising growth potential, and cautious optimism about future prospects. However, analysts have cut the private bank's earnings estimate, even as it delivered a strong December-quarter performance in a tough macroeconomic environment.

Macquarie has maintained an 'outperform' rating, with a target price of Rs 2,300 per share. The brokerage remains confident about the bank's ability to improve return on assets over the next two years, driven by a potential expansion in net interest margins. While, BofA highlighted that the bank's performance has been more positive than negative, and asset quality is a key strength, offering reassurance for the sector as a whole.

Analysts from Dolat Capital Research and Citi are similarly optimistic, with Dolat maintaining an 'accumulate' rating and a target price of Rs 1,950. While, Citi kept a 'buy' rating with a target of Rs 2,080 per share, both noting strong credit quality, stable margins, and growth potential.

Dolat Capital Research also tweaked its earnings forecast for the bank, factoring in lower growth and slightly improved operational expenses. Motilal Oswal Financial Services has also cut the bank's earnings estimate by 3% each for the next two financial years, reflecting slower loan growth and moderation in current and savings accounts.

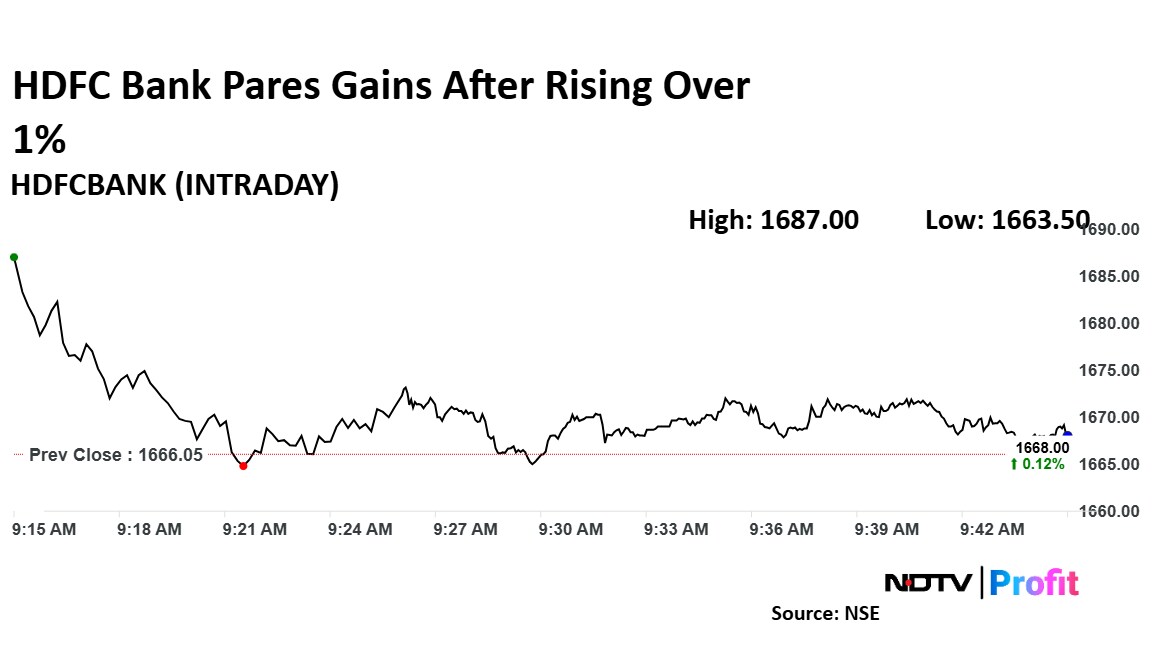

HDFC Bank Shares Rise Over 1%

HDFC Bank share price rose as much as 1.26% to Rs 1,687 apiece, the highest level since Jan. 9. It pared gains to trade 0.29% higher at Rs 1,670.85 apiece, as of 9:39 a.m. This compares to a 0.07% advance in the NSE Nifty 50.

The stock has risen 17.06% in the last 12 months. Total traded volume so far in the day stood at 2.6 times its 30-day average. The relative strength index was at 40.

Out of 48 analysts tracking the company, 41 maintain a 'buy' rating and seven recommend a 'hold', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 19.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.