Shares of Hindustan Aeronautics Ltd. rose to a fresh life-high on Tuesday after Nomura Research and Jefferies raised their target price, following an upgrade by UBS, on the back of a strong order book and robust pipeline.

The public sector aerospace and defence company has a robust order pipeline of Rs 3.9 lakh crore over the next eight years, backed by Indian Air Force's fleet management and prioritisation of legacy fleet and platform replacements, Nomura said. This order book and strong pipeline should provide long-term growth visibility, the brokerage said in a note on May 19.

HAL's capability could be significantly upgraded due to the General Electric Co. deal for manufacturing complex fighter jet engines, it said. The management expects to ramp up manufacturing revenues and the repair, overhaul, and spares segment to deliver secular growth of 9–10% year-on-year, the note read.

India's domestic manufacturing focus on defence and initiatives to promote exports should benefit HAL, according to Jefferies. "The company has access to technology tie-ups, given its standing in defence PSUs, which is also a key advantage," it said in a May 17 note.

The defence PSU's fourth-quarter profit rose 52.2% year-on-year to Rs 4,309 crore for the quarter ended March 2024. As of March 31, the company's order book stands in excess of Rs 94,000 crore, with additional major orders expected during FY25.

Nomura has retained its 'buy' rating on the stock and raised the target price to Rs 5,100 per share, from Rs 4,532 apiece earlier. Jefferies has also maintained 'buy' and raised its target price to Rs 5,725 per share from Rs 3,900 apiece earlier.

Nomura also raised the FY25 and FY26F Ebitda margin estimates by 40 basis points and 77 basis points, respectively, to factor in the healthy guidance.

Here is what brokerages have to say.

Nomura

The brokerage maintains 'buy' on HAL and has raised the target price to Rs 5,100 per share from earlier 4,532 apiece.

Remains positive given its strong order book of Rs 94,000 crore and robust pipeline.

Improved capability could be upgraded significantly due to the General Electric deal, it said.

The brokerage raised FY25/FY26F Ebitda margin estimates to 26%/25.7% factoring in healthy guidance.

Jefferies

Maintained 'buy' and raised target price to Rs 5,725 per share from Rs 3,900 apiece earlier.

Q4 FY24 Ebitda was 15% above expectations at 30.4%.

Management expects sustainable margins driven by cost optimisation.

Operating leverage linked upside to lead 200 bps margin improvement, it said.

Sees revenue visibility over FY25E-28E on back of Rs 1.6-1.7 lak crore pipeline.

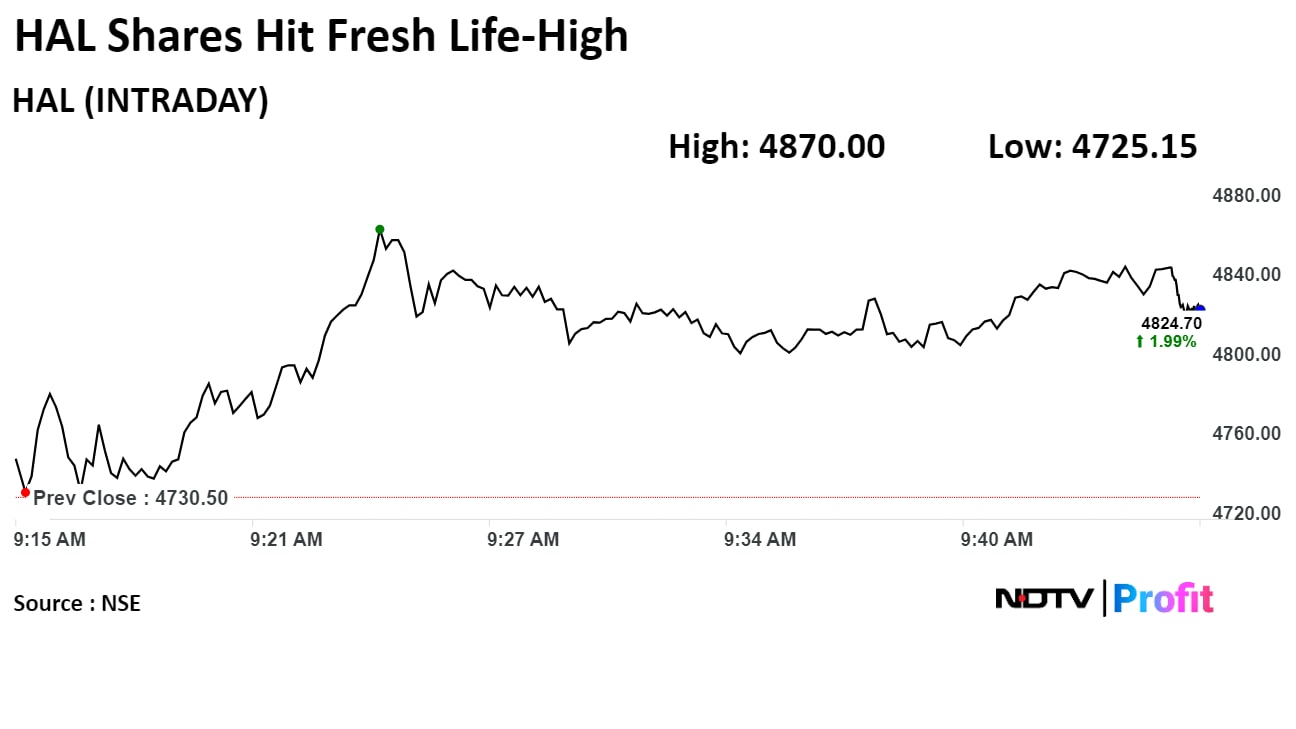

Shares of HAL rose as much as 2.95% during the day to hit a life high of Rs 4,870 apiece on the NSE. It was trading 2.24% higher at Rs 4,836.5 apiece, compared to a 0.12% decline in the benchmark Nifty 50 as of 09:44 a.m.

The stock has risen 212% in the last 12 months and 72% on an year-to-date basis. The total traded volume so far in the day stood at 5.1times its 30-day average. The relative strength index was at 81.

Thirteen out of the 15 analysts tracking HAL have a 'buy' rating on the stock, one recommends a 'hold' and another one suggests a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 0.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.