Greaves Cotton Ltd. has announced that its subsidiary, Greaves Electric Mobility Ltd., has approved plans to launch an initial public offering. The decision was made during a board meeting held on Dec. 1, 2024, subject to approval from GEML's shareholders.

The IPO will consist of a fresh issue of equity shares, along with an offer for sale by certain existing shareholders. While the size of the IPO, the price range, and other key details are yet to be finalised, these will be disclosed once determined in consultation with the book running lead managers.

The IPO is also contingent on market conditions and the receipt of necessary regulatory approvals. This move marks a significant step for GEML, as it seeks to raise capital to support its growth and expansion in the electric mobility sector. Further updates on the IPO will be provided once the specifics are settled.

Greaves Electric Mobility, part of Greaves Cotton Ltd., has been operating in India's electric vehicle space for over 16 years, as per the company website. The company focuses on designing and manufacturing electric vehicles, with the goal of providing affordable, sustainable, and smart mobility solutions.

Greaves Electric Mobility has a customer base of over 3 lakh users. Its product range includes electric two-wheelers, three-wheelers, and associated services like showrooms, spare parts, support, and financing.

The company's flagship brand, Ampere, manufactures electric scooters. Other products include Ele, an electric three-wheeler and Greaves 3W, a three-wheeler that serves both the commercial and passenger segments.

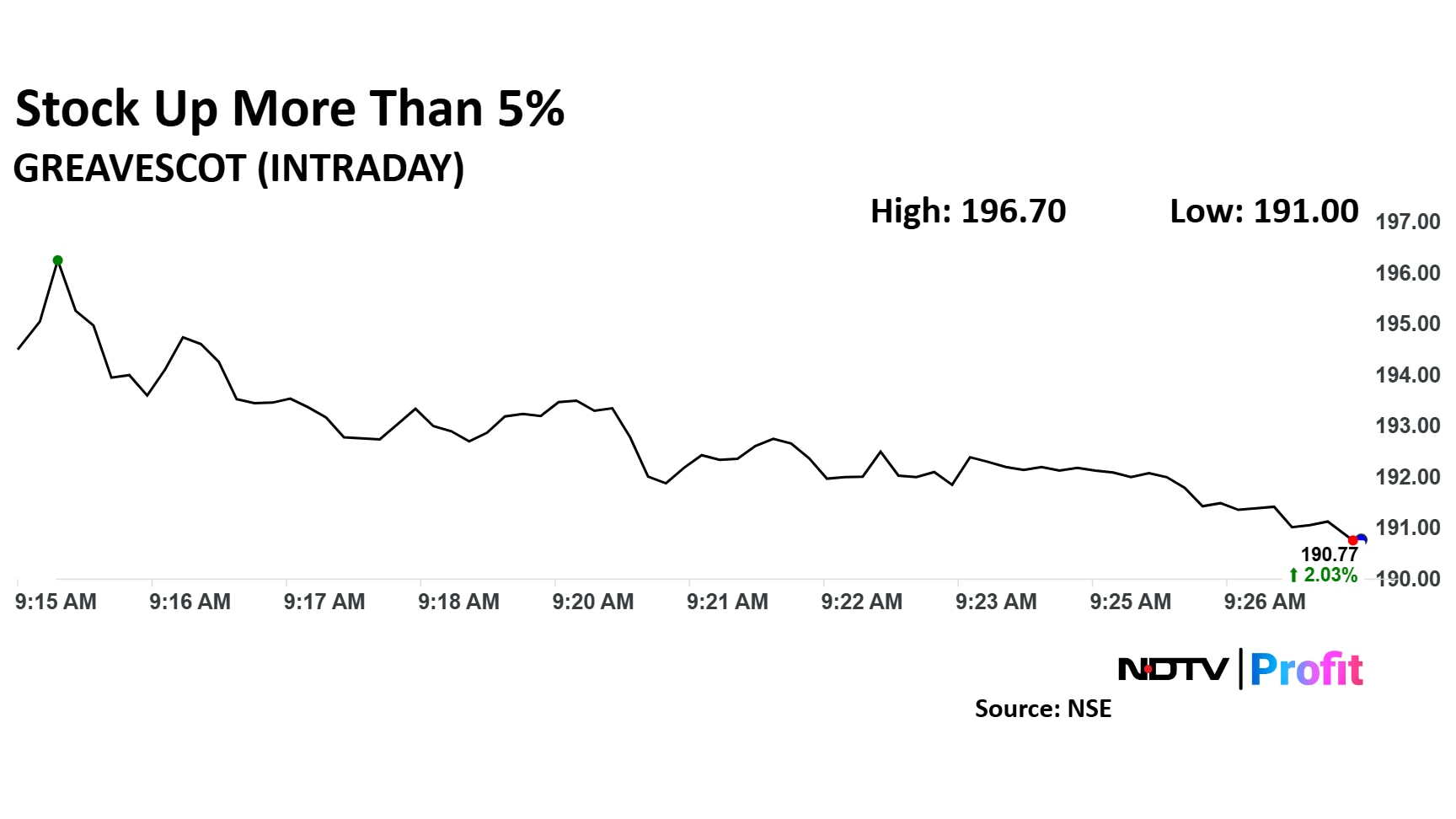

Greaves Cotton Share Price

Share price of Greaves Cotton rose as much as 5.20% to Rs 196.70 apiece. It pared gains to trade 2.80% higher at Rs 192.21 apiece, as of 09:25 a.m., compared to a 0.41% decline in the NSE Nifty 50.

The stock has risen 37.88% in the last 12 months. Total traded volume so far in the day stood at 42 times its 30-day average. The relative strength index was at 59.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.