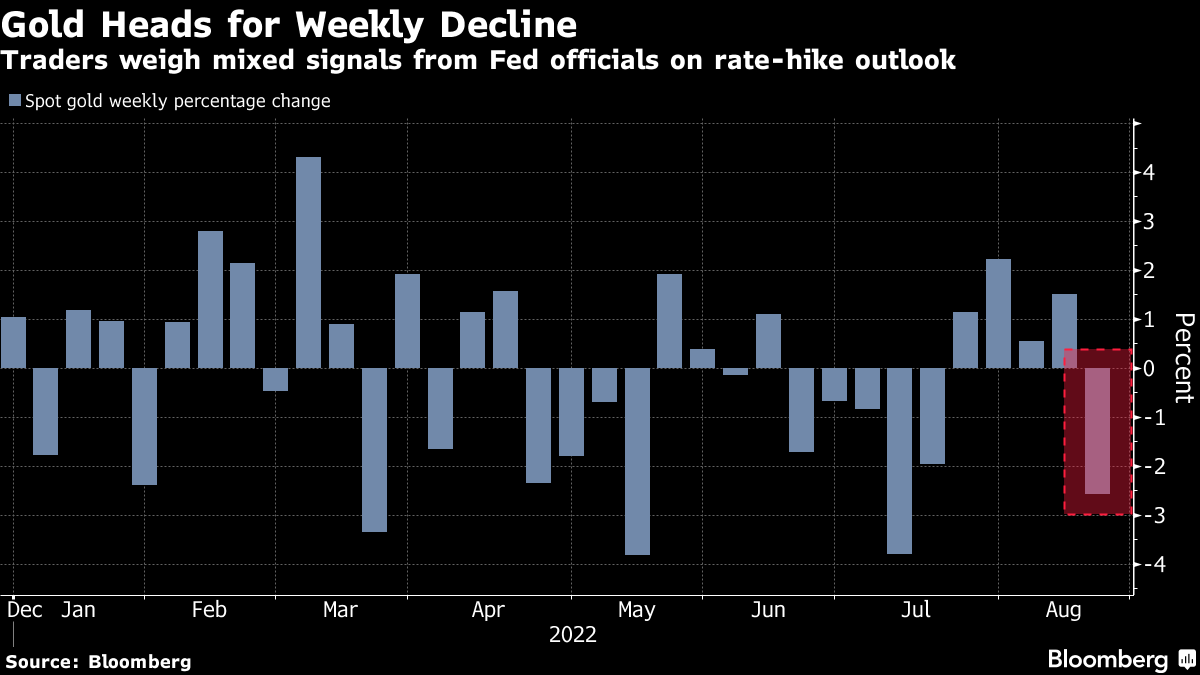

(Bloomberg) -- Gold headed for the first weekly decline in five as traders weighed reiteration from Federal Reserve officials that they're determined to hike interest rates to fight inflation.

Policy makers offered divergent views on the size of the next interest-rate increase, but they agreed on the need to keep raising interest rates. St. Louis's James Bullard urged another 75 basis-point move while Kansas City's Esther George struck a more cautious tone. Richmond's Thomas Barkin echoed that resolve on Friday, noting the risk those efforts could cause a recession.

Bullion dropped to a three-week low as the dollar and Treasury yields strengthened, bringing the precious metal's weekly loss to 3.1%.

The resurgence in the dollar has weighed heavily on the precious metal, which was already seeing profit taking after recently reaching $1,800 an ounce, according to Craig Erlam, a senior market analyst at Oanda Corp. “It may just be more difficult if the dollar continues to drive higher and yields don't ease further,” Erlam said in a note.

Spot gold fell 0.7% to $1,746.56 an ounce by 3:05 p.m. in New York. Bullion for December delivery slipped 0.5% to settle at $1,762.90 on the Comex. The Bloomberg Dollar Spot Index jumped 0.6%. Spot silver, platinum and palladium all declined.

Read more: Barkin Says Fed Will Curb Inflation Even at Risk of Recession

Fed Officials Offer Mixed Signals on Size of September Rate Hike

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.