(Bloomberg) -- Overseas investors looking to boost returns in India's booming stock market are increasing exposure to small- and mid-cap companies that are outperforming larger peers.

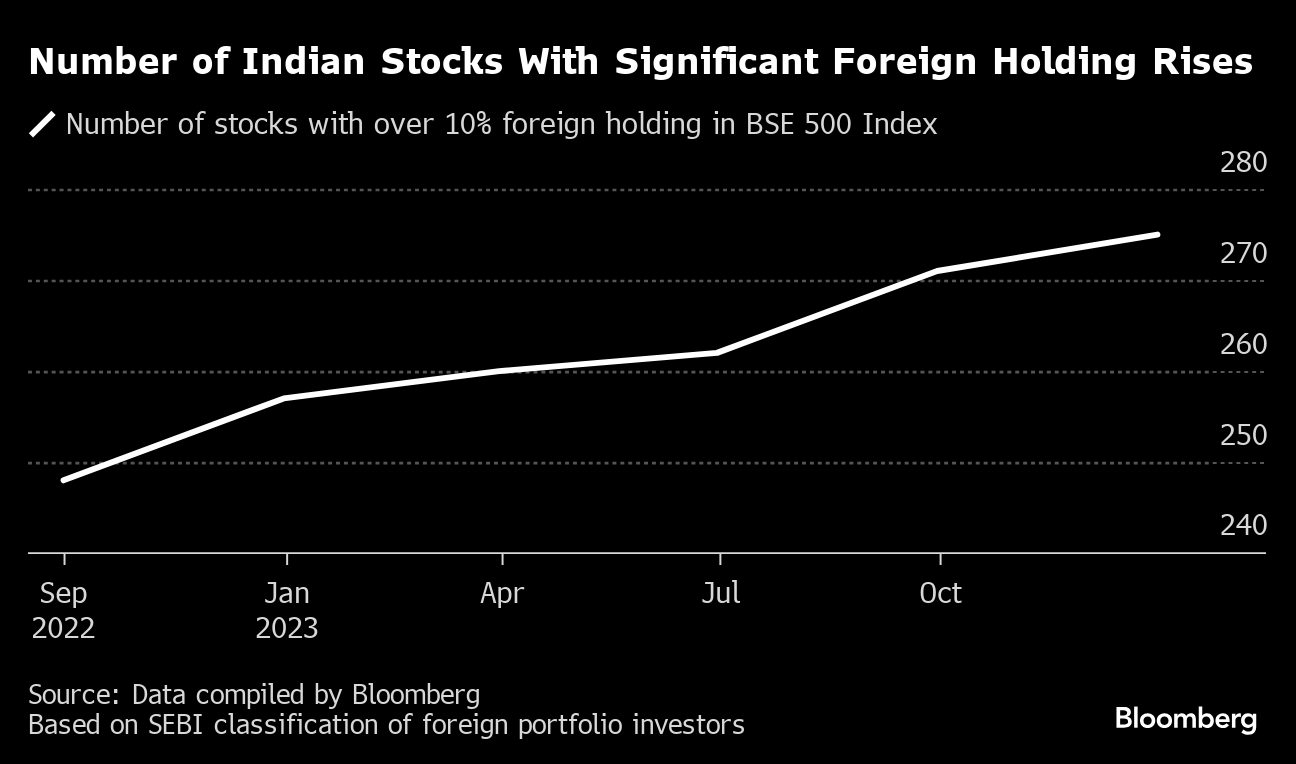

The number of firms with more than 10% overseas shareholding rose to 275 on the BSE 500 Index as of December-end, versus 257 a year ago, according to a Bloomberg analysis of foreign institutional ownership data. The increase was largely fueled by minnows.

Efforts to find the next winners in the world's fastest-growing major economy is prompting global funds to go further down the market-cap ladder, adding to the exuberance that's fueled a relentless rally in this segment. A gauge of small- and mid-cap stocks has returned 60% in the past year, compared with a 23% advance in India's main S&P BSE Sensex Index.

To bulls, the craze is backed by fundamentals. Earnings for this cohort rose 29% in the latest quarter, nearly double the growth in large caps, according to an analysis from Nuvama Institutional Equities.

Besides, many emerging themes can only be found in smaller companies, Rajat Agarwal, Asia equity strategist at Societe Generale, said by phone Wednesday. “If you want to own a pure-play EV company or a new-age technology company in India, you won't find them among large caps.”

Kaynes Technology India, KFin Technologies and Home First Finance Co. India, are among the companies in which foreign investors' holding is now more than 10%.

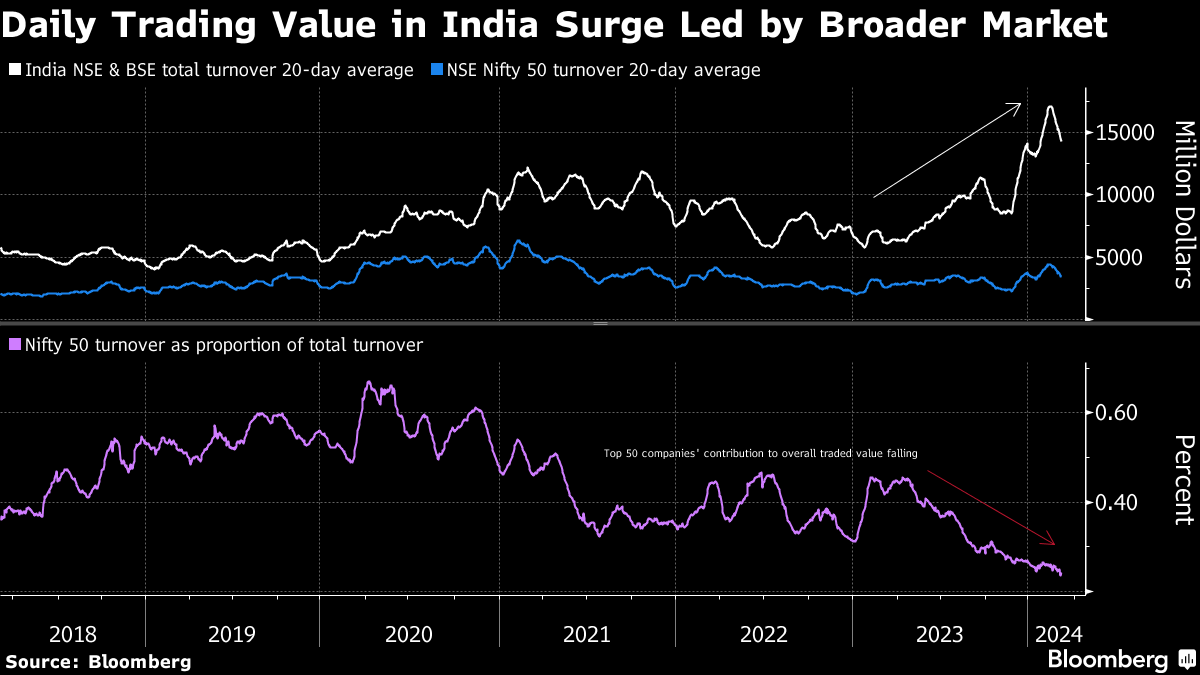

The increasing turnover in Indian equities is also luring investors. Daily trading value touched a record last month compared to that of Hong Kong, with smaller stocks grabbing a larger proportion of activity than their larger counterparts.

“Foreign investors look for adequate liquidity, and the recent performance of the market has brought many more stocks into that criteria,” Agarwal said.

To be sure, overseas investors' holding in India's biggest companies exceeds that in the smaller names. Last week the nation's market regulator urged mutual funds to safeguard investors against excessive froth in small-cap stocks.

The aggregate foreign holdings in the nation's mid-cap stocks rose to 17% as of December, from 14% a year earlier, according to ICICI Securities. Their stake in small caps climbed to 9% from 8% earlier, with financials, industrials and IT stocks attracting the largest inflows.

“The India growth story is captured in these stocks. They are the beneficiaries of rising per capita income, formalization of the economy and rising discretionary spending,” said Souvik Saha, a strategist with DSP Asset Managers. “I don't see the small-cap craze ending anytime soon.”

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.