Glenmark Pharmaceutical Ltd.'s shares rose over 5% during trade on Monday, after the management highlighted a 300.2% sales growth in India in the third quarter. It also reported a profit during the October-December period, against a loss in the same period last year.

Revenue of the pharma firm rose 35% to Rs 3,388 crore, but missed Bloomberg analysts' estimate of Rs 3,489 crore.

Its net profit stood at Rs 348 crore in the third quarter, compared to a loss of Rs 470 crore in the same period last year.

The firm's Europe business grew 14.8% during the period, it said in a post earnings concall earlier in the day. This contributes 22% to overall business, it said.

The company also expects an uptick in business from financial year 2026.

India Revenue A Negative Surprise

India revenue was a negative surprise for Nomura as it missed the brokerage's estimate by 15%. In the third quarter, the company undertook inventory correction in the channel, which significantly impacted revenues.

To an extent, the growth has been impacted by brand divestments, according to the brokerage. The US sales revenues was higher than estimates, but has stagnated.

This is due to the lack of new launches, and regulatory issues at manufacturing sites, according to the brokerage. While, the company expects growth to recover in financial year 2026, on the back of launch of injectable and respiratory products.

The approval of limited competition nasal spray products is delayed, which was earlier expected in the first half of financial year 2025. In terms of international growth, the secondary sales growth in Russia was at 16.6% year on year.

Growth in Europe was 15% against the previous year, but was 1% lower than Nomura's estimate. The growth was driven by respiratory segment, including generic inhalers and Ryaltris across markets, the brokerage said.

The third quarter results were underwhelming, particularly given slower growth in India and likely miss on the company's stated financial year 2025 guidance, according to Nomura.

Upcoming Projects

The company plans to launch Ryaltris, which is a prescription nasal spray in 12 to 15 additional markets over the next few quarters. Glenmark also plans to file Envafolimab, which is a monoclonal antibody in more than 20 markets this year. The first market launch is expected in financial year 2026.

It plans to launch Winlevi, a cream used to treat acne, in financial year 2026. Tislelizumab, a drug that treats certain cancers and Zanubrutinib, used to treat mantle cell lymphoma are to be launched in the next three to four months. This will follow the receipt of the required regulatory approvals in India market.

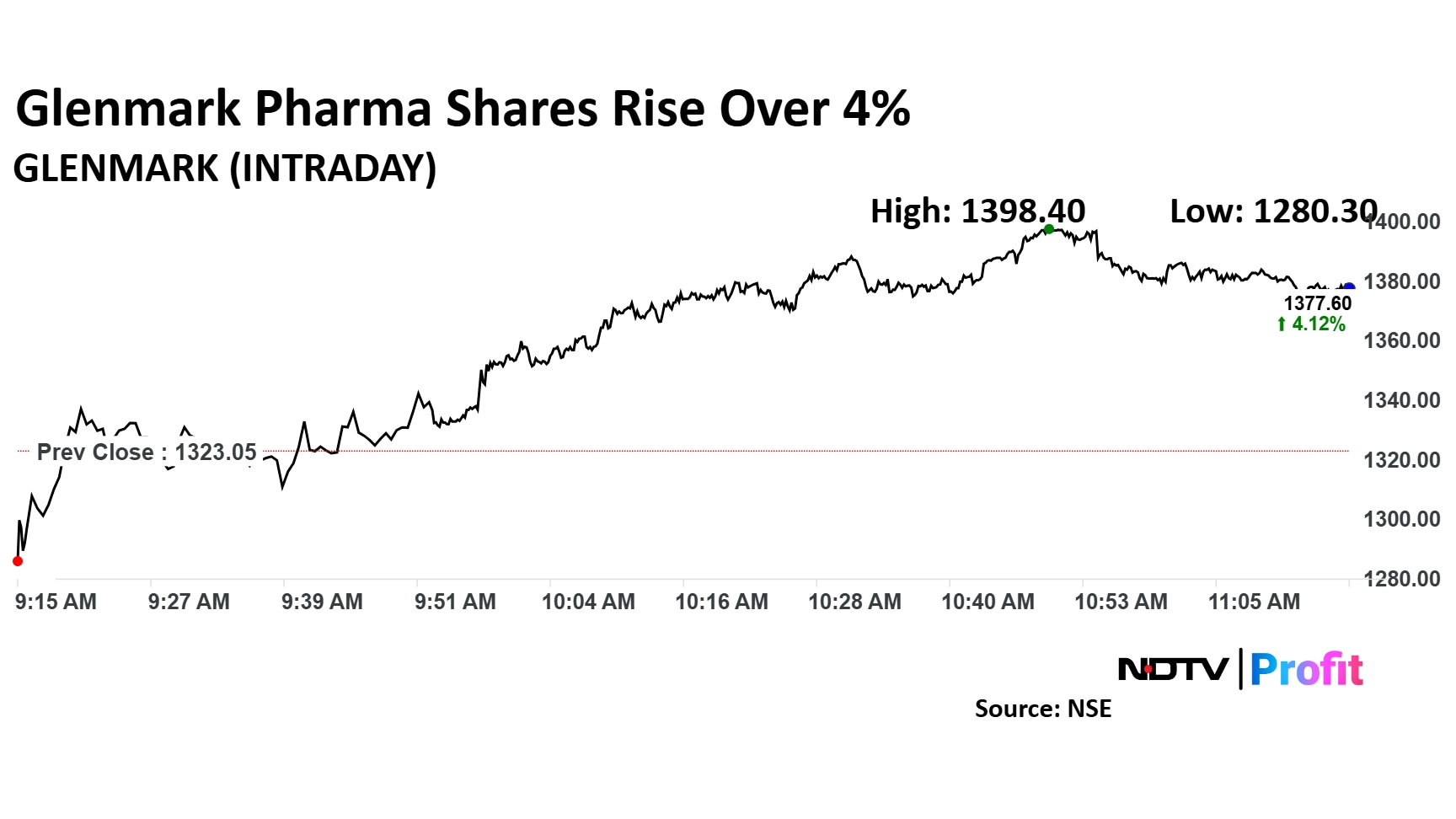

Glenmark Pharma Share Price

Glenmark Pharma stock rose as much as 5.70% during the day to Rs 1,398.40 apiece on the NSE. It was trading 4.20% higher at Rs 1,378.6 apiece, compared to a 0.50% decline in the benchmark Nifty 50 as of 11:14 a.m.

It had fallen 14.43% in the last 12 months. Total traded volume so far in the day stood at 7.3 times its 30-day average. The relative strength index was at 41.63.

Seven of the 13 analysts tracking the company have a 'buy' rating on the stock, four recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock implies an upside of 22.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.