India's benchmark indices continue to scale new peaks as investors bet on improving economic growth and corporate earnings. The benchmark Nifty 50 rose 7.6 percent in the quarter ended December—trailing the 17 percent gains in the mid-cap index and nearly 20 percent rise in the small-cap gauge.

Well-known value investors either bet on new stocks or added shares of companies already in their portfolios, mostly from the small- and mid-cap indices, during the quarter. There were also a few exits.

Here's what Rakesh Jhunjhunwala, Dolly Khanna, Ashish Kacholia, Ramesh Damani and Radhakishan Damani bought and sold in the three months ended December based on company disclosures to exchanges on shareholders with 1 percent or more stake.

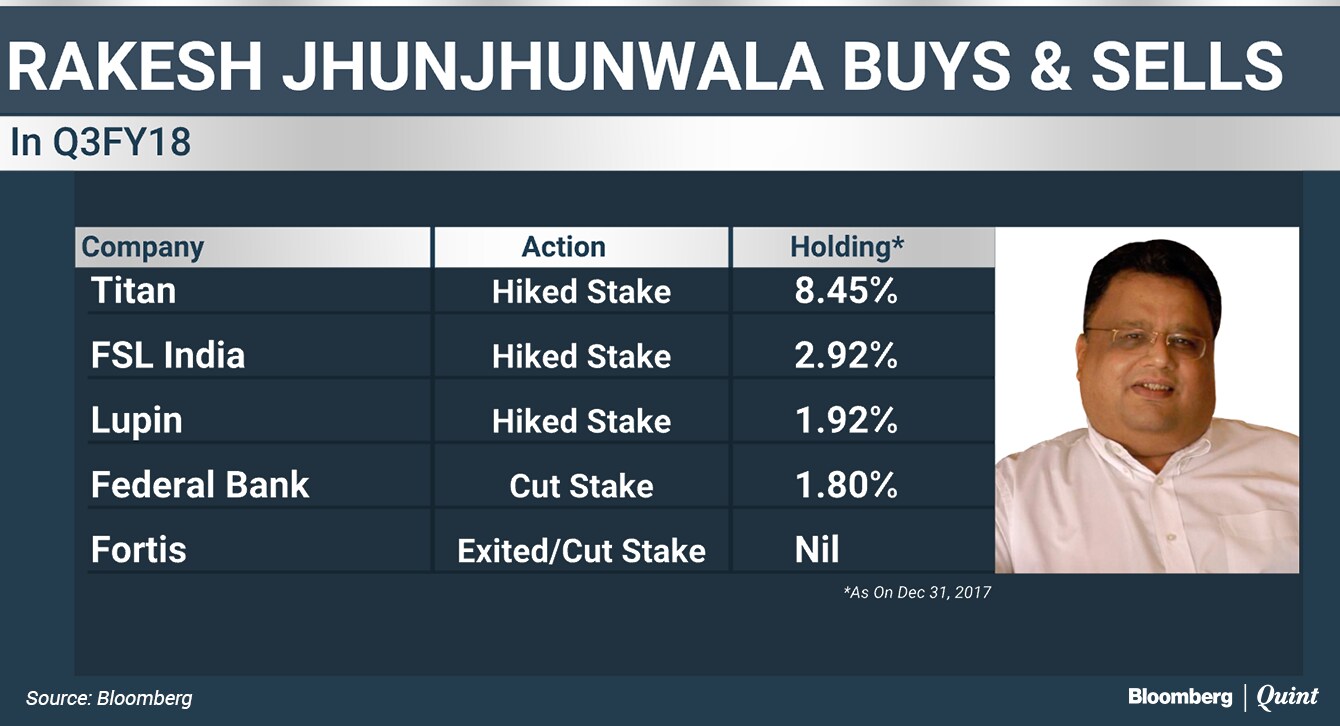

Rakesh Jhunjhunwala

The billionaire investor added to his biggest holdings like jewellery-to-watchmaker Titan Company Ltd. and drugmaker Lupin Ltd., according to stock exchange filings. He also bought 15 lakh more shares in Sanjiv Goenka-promoted IT outsourcer Firstsource Ltd. Solutions. His holding in Fortis Healthcare Ltd. was not reported in the December quarter—Jhunjhunwala owned 1.54 percent in the hospital chain in the three months ended September.

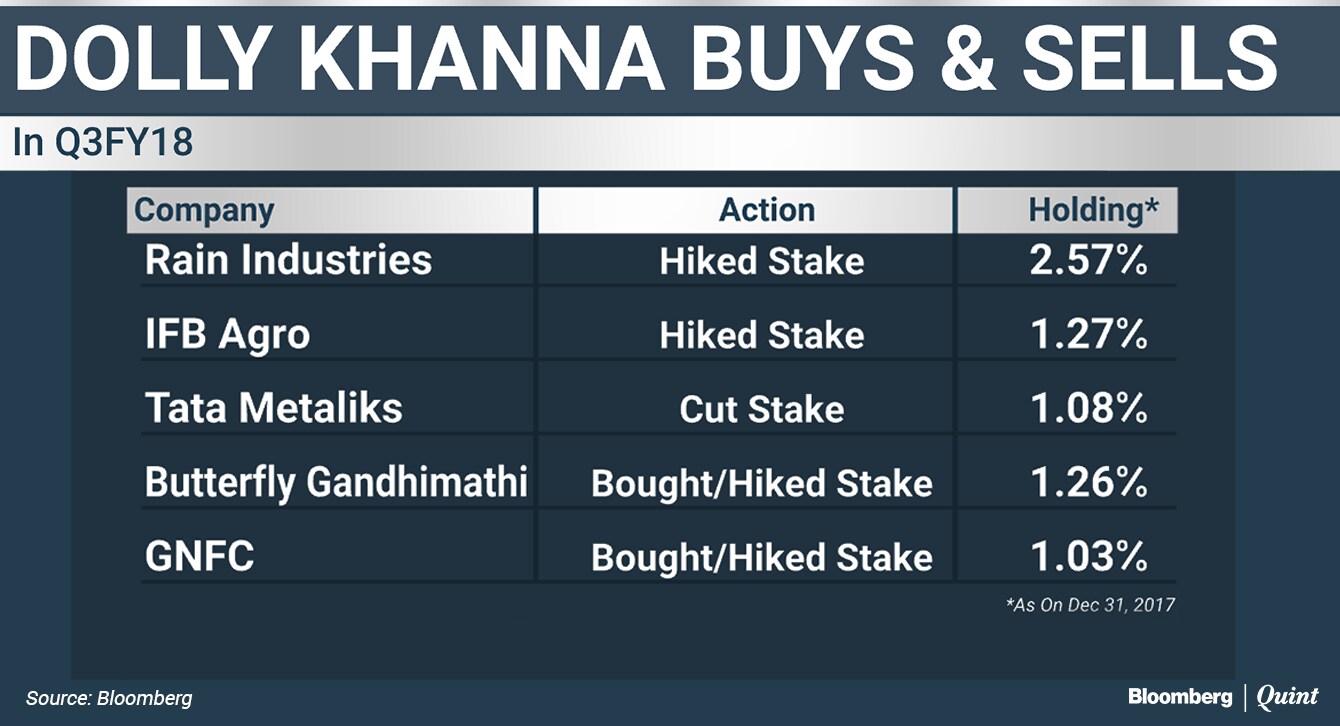

Dolly Khanna

Rajeev Khanna and Dolly Khanna added new stocks to their portfolio. The Chennai-based couple, who invest in the name of Dolly Khanna, reported stakes of over 1 percent in Gujarat Narmada Valley Fertilisers & Chemicals Ltd. and home appliance maker Butterfly Gandhimathi Appliances Ltd, according to filings. The Khannas also added to their largest reported holding Rain Industries Ltd., raising stake from 2.04 percent to 2.57 percent in the quarter-ended December.

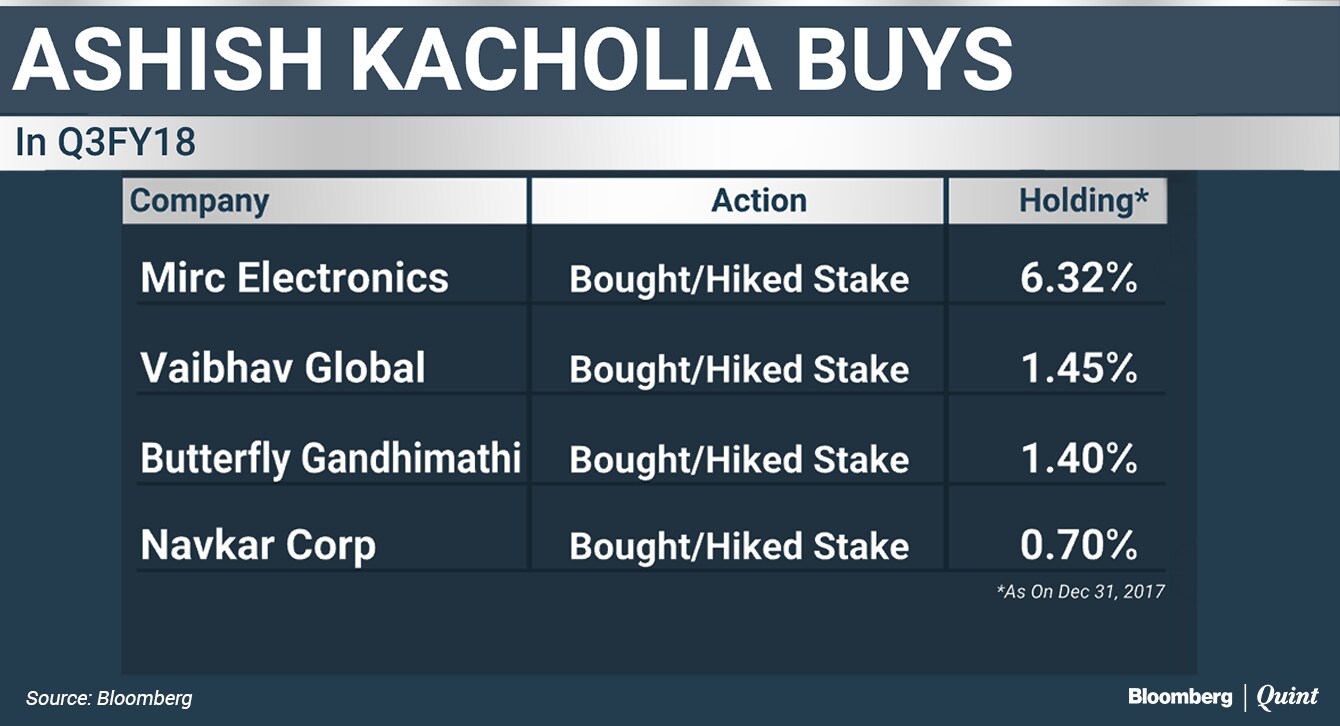

Ashish Kacholia

Ashish Kacholia added more mid-cap stocks to his portfolio. The exchange data on bulk deal indicates that the Mumbai-based investor bought nearly 0.70 percent in logistics major Navkar Corp Ltd. He also acquired shares in Butterfly Gandhimathi and electronics and lifestyle retailer Vaibhav Global—also backed by Dolly Khanna and Mumbai-based investor Vijay Kedia.

Kacholia also participated in the warrant and preferential issue of Mirc Electronics Ltd., promoted by the Mirchandanis of the Onida Group. Once completed, Kacholia's stake in the company is expected to touch 6.32 percent.

Ramesh Damani

Ramesh Damani's name features among individual shareholders having more than 1 percent stake in Quick Heal Techonologies, the maker of anti-virus software. His stake stood at 1.06 percent as on Dec. 31.

Radhakishan Damani

The billionaire promoter of Avenue Supermarts Ltd,. the parent of D-Mart retail chain, now holds 1.08 percent stake in Century Textiles Ltd,. according to the latest disclosures.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.