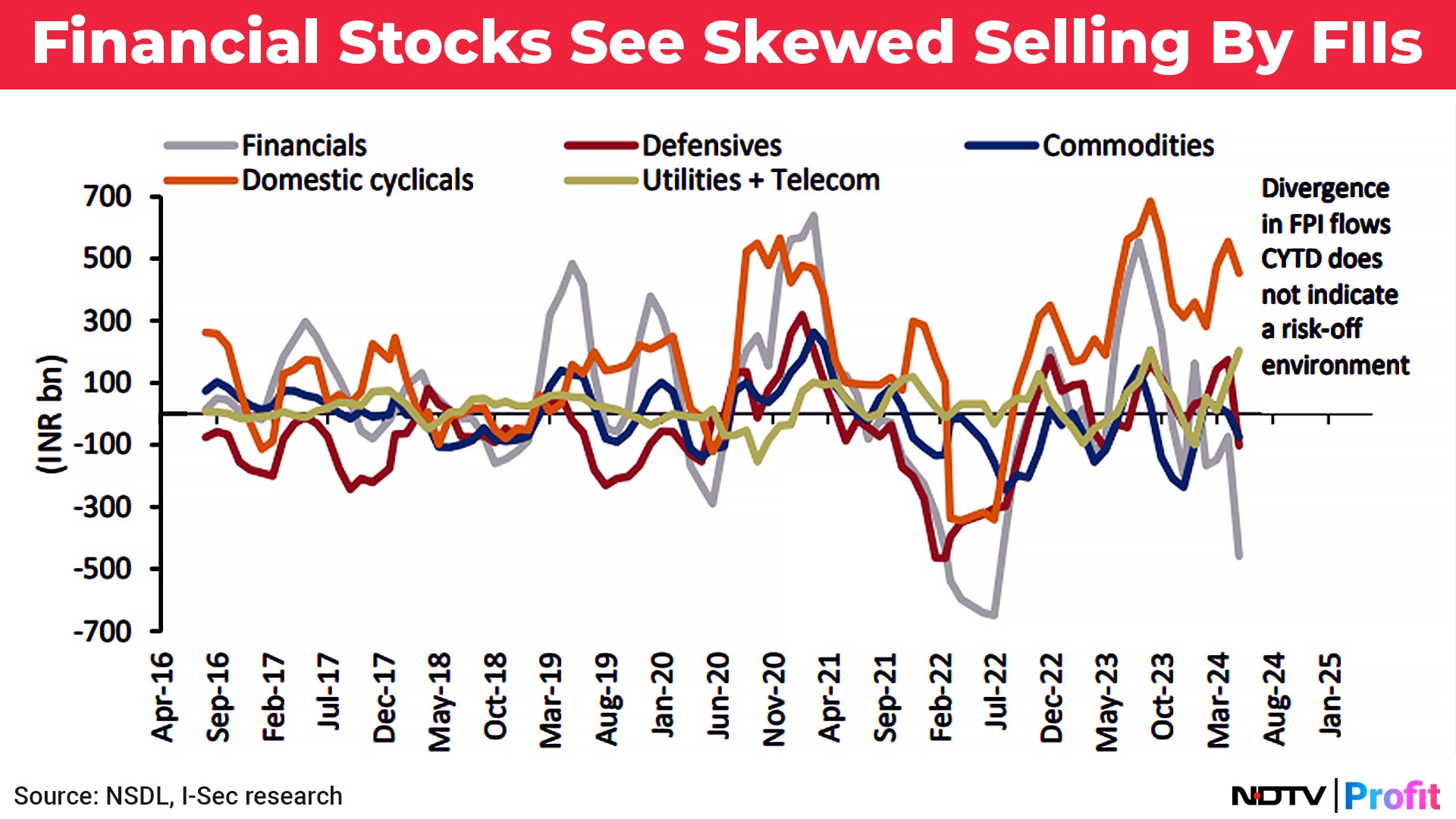

Foreign flows have been negative so far this year, with a skewed selloff in the financial space, while their inflows into domestic cyclical stocks remain robust, according to ICICI Securities.

Foreign investors have offloaded Indian equities worth Rs 25,397 crore so far this year, according to the NSDL data. However, sectoral flows till April paint an uneven picture for FPI flows rather than a typical risk-off environment-led selling, ICICI Securities said in a May 16 report.

The note stated that financials, concentrated in a few private sector banks, drive the disproportionately high contribution to sales. "Even within financials, PSU banks witnessed buying."

Foreign flows indicate elevated levels of buying in domestic cyclicals and capital-intensive stocks, according to the report's data. Stocks in the defensives and commodities markets experienced an outflow.

FPI behaviour reflects heightened confidence in the domestic investment cycle and premium consumption, contrasting with fading confidence in the tenacity of the global environment and broad-based mass consumption categories, the note said.

The report also noted that the FPI holdings of Indian equities continue to be at a decadal low.

Overseas investors extended there selling of Indian equities for the 11th straight day on Thursday amid election volatility.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.