JPMorgan cautioned investors to brace for volatility and low returns in the run-up to the next general election amid geopolitical tensions and global monetary tightening.

“By June next year, I see the Nifty at 12,500-12,700,” said Bharat Iyer, head of India equity research at JPMorgan. Structural drivers are still in place, especially with earnings growth beginning to recover, he said on the sidelines of the JPMorgan India Summit. The group expects corporate India's earnings to grow 15 percent for the year, which would support the market since valuations are already high.

Yet, global cyclical headwinds mean that the next 12 months will be a phase where return expectations should be modest, he said. “We are looking at about 10 percent returns for Indian equities in local currency terms and, of course, there will be volatility because of the election year.”

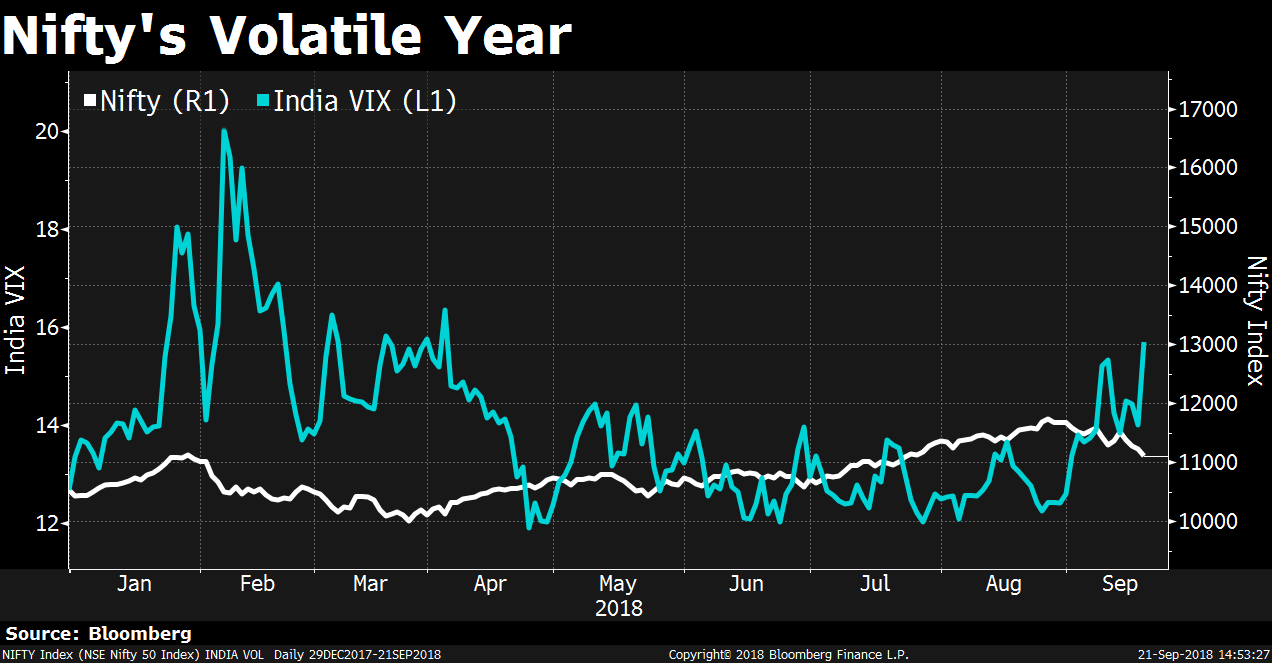

India's benchmark indices — S&P BSE Sensex and NSE Nifty 50 — have both dropped over 2 percent in the last one month. The volatility index jumped as much as 25 percent during the period, before cooling partially to trade 14 percent higher. That came as the Indian currency weakened as higher fuel prices widened the current account deficit. What added pressure was the escalating trade war between the U.S. and China.

General investor sentiment towards India remains positive, Iyer said, given that it's still the fastest-growing major country in the world. “Investors are very enthused at an economy which is even growing at 7 percent plus, leave alone at 8 percent plus,” he said. “If we can maintain growth in the 7-percent handle and at the same time maintain macro stability, I think it would be a very good outcome and something investors would appreciate.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.