(Bloomberg) -- European stocks hovered near record highs, with investors wary of taking the index much higher before this week's interest rate decisions in the US, Britain and Japan.

The Stoxx 600 Index was largely unchanged by 11 a.m. in London, with autos and rate-sensitive sector real estate leading gains, while telecom shares lagged. Haleon Plc fell after Pfizer Inc. said it plans to sell about £2 billion ($2.5 billion) of its shares.

The main regional benchmark capped its its eighth weekly gain in a row on Friday, the longest such streak since 2018, and investors are looking for signs of how much further can the rally go. However, their eyes for now are firmly on central banks for potential rate-cut signals.

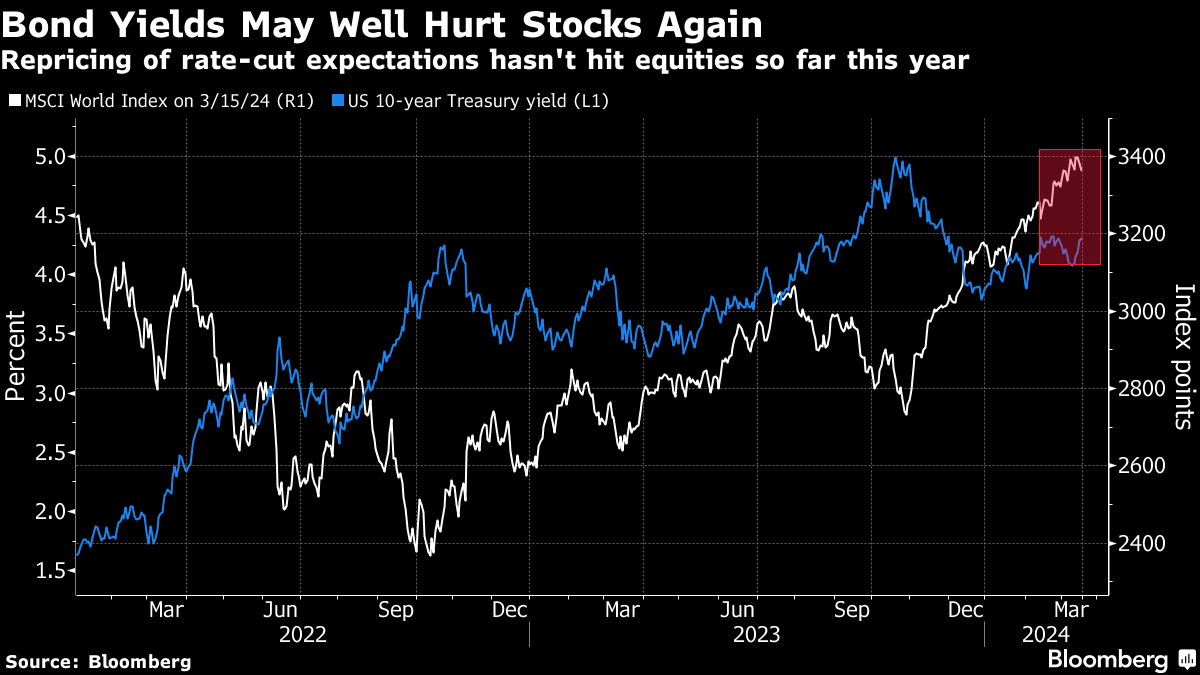

The Federal Reserve's meeting on Wednesday will be key after latest inflation and unemployment data brought back fears of higher for longer rates. The Bank of Japan is expected to raise rates for the first time in 17 years while the Bank of England could signal on Thursday when it may ease policy.

Powell's Silence Frustrates Markets as Post-Covid Economy Shifts

“Our concern is that markets could be disappointed by the Fed,” Vega IM fund manager Olivier David said, arguing that resilient inflation could prompt policymakers to scale down their plans to cut interest rates in 2024.

David said he decided to lock in some profits and reduce his exposure to equities in February given the strength and speed of the rally but that he would consider adding some risk again in the wake of a market correction.

Among other individual moves, Logitech International SA declined after the Swiss manufacturer of computer peripherals said CFO Chuck Boynton will step down after just 13 months in the role. British Land advanced after its creation of a joint venture with Royal London Asset Management to develop 1 Triton Square building at London's Regent's Place.

For more on equity markets:

- The Path Higher Looks Increasingly Tricky Now: Taking Stock

- M&A Watch Europe: Kering, Currys, BAT, Zilch, Haleon, Sanofi

- US Stock Futures Unchanged

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Michael Msika and Julien Ponthus.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.