Analysts expect Hindustan Aeronautics Ltd., Bharat Electronics Ltd., Larsen & Toubro Ltd. and Solar Industries Ltd., among others, to benefit as India banned import of certain defence equipment to boost local manufacturing.

The Indian government released its "third positive indigenisation list" of 101 items on Thursday, with a special focus on equipment/systems that are likely to translate into orders in the next five years.

This list comprises highly complex systems, sensors, weapons and ammunition like lightweight tanks, and guided extended range rocket for naval utility helicopters, among others.

Earlier, it had banned imports of 101 and 108 items under the first and second lists, respectively, in August and May 2021.

CLSA expects "indigenisation" to trigger rerating for HAL. The light weight tank is seen as an opportunity for L&T. The research firm reiterated 'buy' on HAL, BEL and raised targets.

Analysts at ICICI Securities reiterated HAL and BEL as its top picks. It cited opportunities from the thrust for indigenisation of ammunition for Solar Industries.

Here's what brokerages have to say:

CLSA

Sees India's import ban of another 101 defence items as creating visible long-term opportunity worth $28 billion for capable domestic vendors.

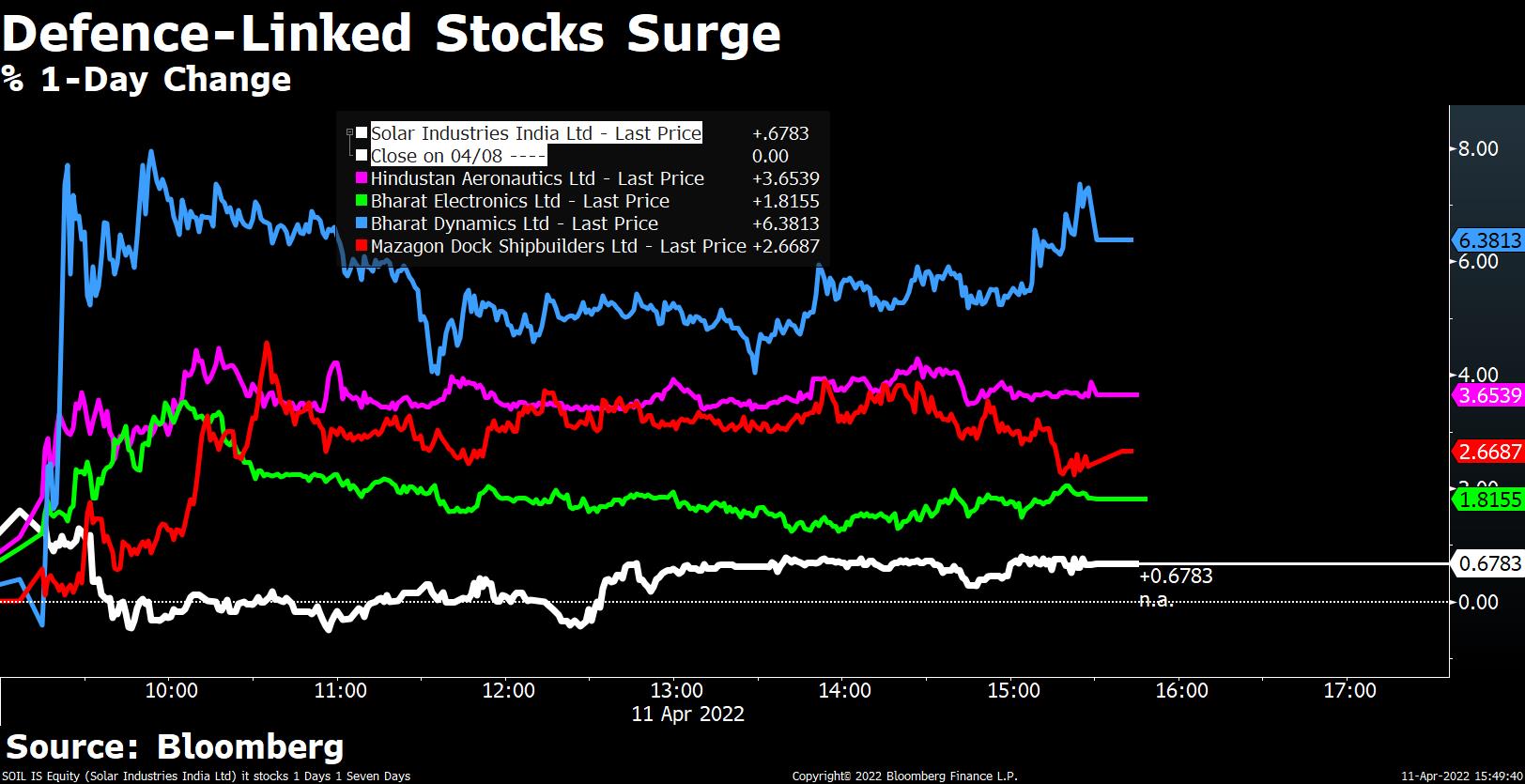

Firms like Hindustan Aeronautics, L&T, Bharat Electronics, Bharat Dynamics and Kalyani Group are likely to benefit from the import ban.

Sees order emerging from FY2023-24 for naval utility helicopters for Hindustan Aeronautics worth $2.8 billion.

Defence minister has estimated an indigenisation opportunity of Rs 6.1 lakh crore for domestic vendors over six years.

All defence majors, especially aerospace, have build capabilities and invested across domains to utilise indigenisation opportunity.

Indigenisation is a rerating catalyst for still orders and earnings become visible.

Maintains 'buy' and raises target price of Hindustan Aeronautics to Rs 1,930 from Rs 1,740.

Maintains 'buy' and raises target price of Bharat Electronics to Rs 282 from Rs 260.

Identifies naval utility helicopters for HAL and lightweight tank, being developed by L&T as two big opportunities.

Import ban lists 1 and 2 have translated into orders already.

ICICI Securities

Third indigenisation list underlines improving fundamentals in the sector.

BEL leads the list of possible country of order inflows from the first two lists, followed by L&T and Solar Industries.

Bharat Dynamics has an impressive possible order inflow count of nine, driven by missiles.

With naval utility helicopters in the indigenisation list, HAL can look forward to a potential order of Rs 20,000-25,000 crore by 2025.

Higher capital budget and thrust towards indigenisation is likely to lead to better order book and execution visibility.

Focus on import substitution for ammunition in the third indigenisation list could lead to order inflow for Solar.

Reiterates HAL and BEL as top picks in the sector and raises target price of BEL to Rs 300.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.