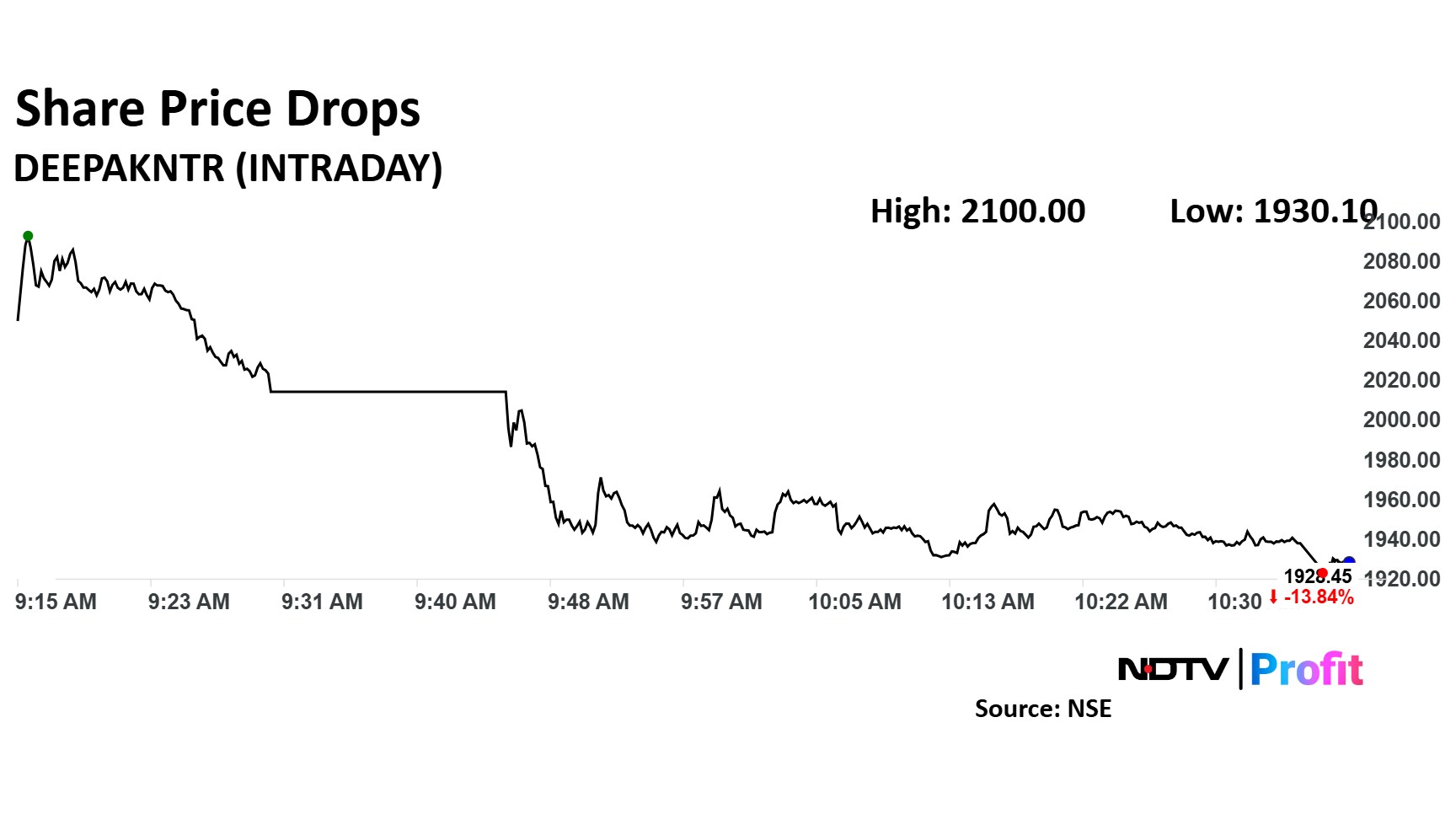

Shares of Deepak Nitrite Ltd. plummeted to a 15-month low on Friday, hitting the lower circuit limit, after the company reported disappointing third-quarter earnings. The stock initially fell by 10%, triggering the lower circuit, which was subsequently revised, allowing the stock to decline further to 13%. This sharp drop reflects investor concerns about the company's financial performance.

Deepak Nitrite's third-quarter results revealed a significant decline in both profitability and revenue. Revenue decreased by 5.3% year-on-year, falling from Rs 2,009 crore to Rs 1,903 crore. The company's Ebitda suffered a much steeper drop, plunging 44.7% to Rs 168 crore compared to Rs 305 crore in the same period last year. This decline was reflected in a substantial contraction of Ebitda margin, which shrunk from 15.2% to just 8.9%. Finally, net profit also saw a sharp reduction, falling by 51.5% year-on-year to Rs 98 crore from Rs 202 crore.

The substantial decrease in Ebitda and net profit, coupled with the shrinking margins, appears to have triggered the sharp sell-off in the company's stock.

Investors are likely reacting to concerns about the factors driving this decline and their potential impact on the company's future performance.

The lower circuit limit prevented further immediate selling, but the revised circuit level suggests significant downward pressure on the stock.

The scrip fell as much as 13.47% to 1,936.75 apiece. It pared losses to trade 12.44% lower at Rs 2,238.25 apiece, as of 10:35 a.m. This compares to a 0.31% decline in the NSE Nifty 50 Index.

It has fallen 14.75% in the last 12 months. Total traded volume so far in the day stood at 17.93 times its 30-day average. The relative strength index was at 52.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.