CreditAccess Grameen Ltd.'s share price advanced on Wednesday as the company secured $100-million foreign-currency loan facility. The microfinance company secured a multi-currency social credit facility, which is qualified as extra-commercial borrowing under the automatic route of the Reserve Bank of India.

The lender deems the ECB as first of its kind in India's microfinance sector. The multi-currency credit facility entails the Japanese yen, US dollar currencies which are predominantly raised from banks in South Asia and the far east, the company said in a exchange filing on Tuesday.

It's the second syndicated loan facility led by Standard Chartered Bank for CreditAccess Grameen.

The company will use the proceed of the foreign-currency loan for social development goals, and governance, adhering to the lender's Social Loan Framework, it said.

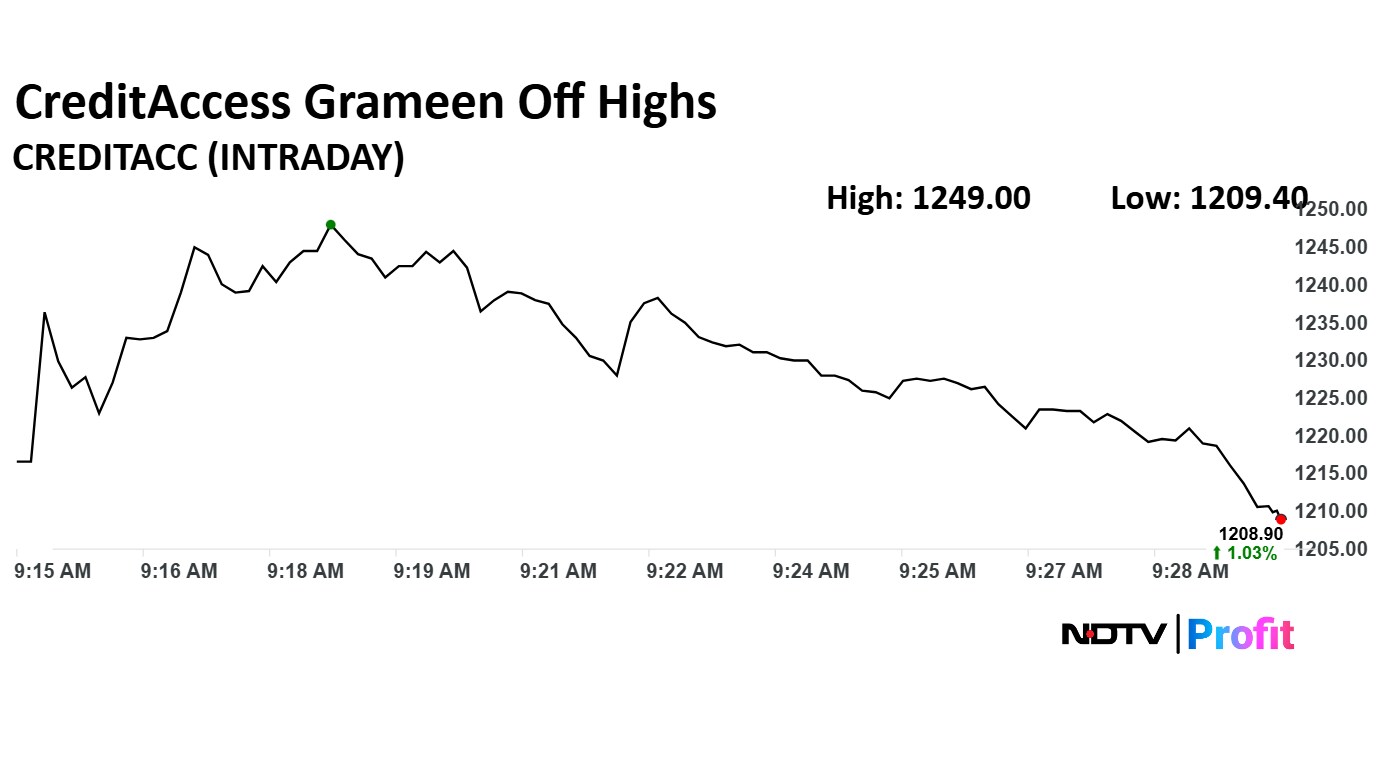

CreditAccess Grameen Share Price Today

CreditAccess Grameen's share price rose 4.38% to Rs 1,249 apiece, the highest level since June 6. It was trading 2.74% higher at Rs 1,229.50 apiece as of 9:58 a.m., as compared to a 0.05% advance in the NSE Nifty 50.

The stock has declined 18.01% in 12 months, and 38.38% on year-to-date basis. Total traded volume so far in the day stood at 4.2 times its 30-day average. The relative strength index was at 64.51.

Out of 18 analysts tracking the company, 11 maintain a 'buy' rating, four recommend a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 2.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.