Shares of Coforge Ltd. rose on Wednesday after the company signed a $1.56 billion (approximately Rs 13,593 crore) long-term deal with US-headquartered travel technology player Sabre Corp.

The partnership will be for a period of 13 years, the software service provider said in an exchange filing on Tuesday. It has an annual contract value of approximately $120 million.

What Brokerages Say

This deal is expected to add $80-120 million in incremental revenue to financial year 2026, representing a 5-8% growth, depending on the ramp-up schedule, the brokerages said.

Jefferies has raised its target price to Rs 10,350, maintaining a 'buy' rating, as the deal strengthens Coforge's growth outlook, particularly in the travel vertical, and opens doors for future large deal wins. Jefferies also raised its financial year 2026-2027 revenue estimates by 3-5%.

On the other hand, Macquarie maintained an 'underperform' rating with a target price of Rs 5,220. While acknowledging the deal as a landmark, Macquarie said the partnership with Sabre may not lead to significant additional revenue, as it involves an existing customer.

Axis Capital, maintaining a 'sell' rating with a target price of Rs 7,900, views the deal as important but not transformative. Sabre currently contributes less than $20 million in revenue, and the new deal represents around 8% of Coforge's expected financial year 2025 revenue, it noted. While the deal is significant, Axis sees limited upside from it in the near term.

Stock Split

Coforge approved a stock split in the ratio of 1:5 to improve liquidity in the market. Each fully paid-up equity share of face value of Rs 10 will be sub-divided into five fully paid-up equity shares of face value of Rs 2 each.

The record date for the same will be intimated in due course, the company said in an exchange filling on Wednesday. The stock split is expected to be completed within three months from the approval of members.

Coforge Share Price

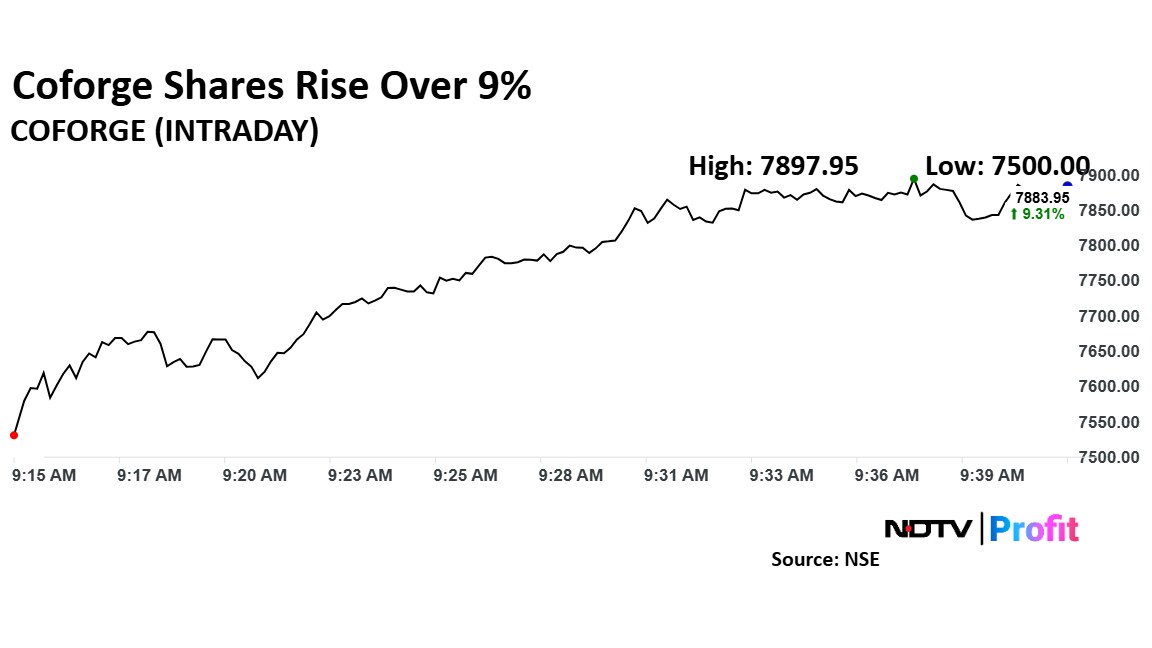

Coforge shares rose as much as 9.32% to Rs 7,884.30 apiece, the highest level since Feb. 14. They pared gains to trade 9.24% higher at Rs 7,878.75 apiece, as of 9:38 a.m. This compares to a 0.56% advance in the NSE Nifty 50.

The stock has risen 24.61% in the last 12 months. Total traded volume so far in the day stood at 9.6 times its 30-day average. The relative strength index was at 49.

Out of 38 analysts tracking the company, 24 maintain a 'buy' rating, four recommend a 'hold' and 10 suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 21.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.