Coforge Ltd. and IndiGo airline parent InterGlobe Aviation Ltd. have been added in Morgan Stanley's 'focus list', replacing Infosys Ltd. and Mahindra & Mahindra Ltd.

Coforge offers a compelling growth story with scalability potential, driven by a strong management team, large deal momentum, and an expanding addressable market, analysts Ridham Desai and Nayant Parekh said in a recent note.

Despite delivering strong results and announcing a mega deal win, the stock has underperformed its peers year-to-date, presenting a buying opportunity. With a valuation premium of 30% over larger-cap peers, like Tata Consultancy Services Ltd., Morgan Stanley expects this premium to expand as the growth gap widens.

Morgan Stanley's Focus List has now excluded Infosys and Mahindra & Mahindra.

IndiGo Outlook

India's aviation market is poised for rapid growth, and IndiGo is well-positioned to capitalise on this trend.

The budget airline, with more than 65% domestic market share, has a strong cost advantage, with a 15% lower cost per seat kilometer than peers, Morgan Stanley noted. In the international market, IndiGo has 18% share and this could rise sharply in coming years.

The brokerage expects yield growth to catch up with higher fuel prices and a more efficient fleet mix by fiscal 2027. IndiGo's valuation of eight times its normalised FY27 earnings estimate appears reasonable, especially compared to its pre-Covid median of 8.5 times, the note said.

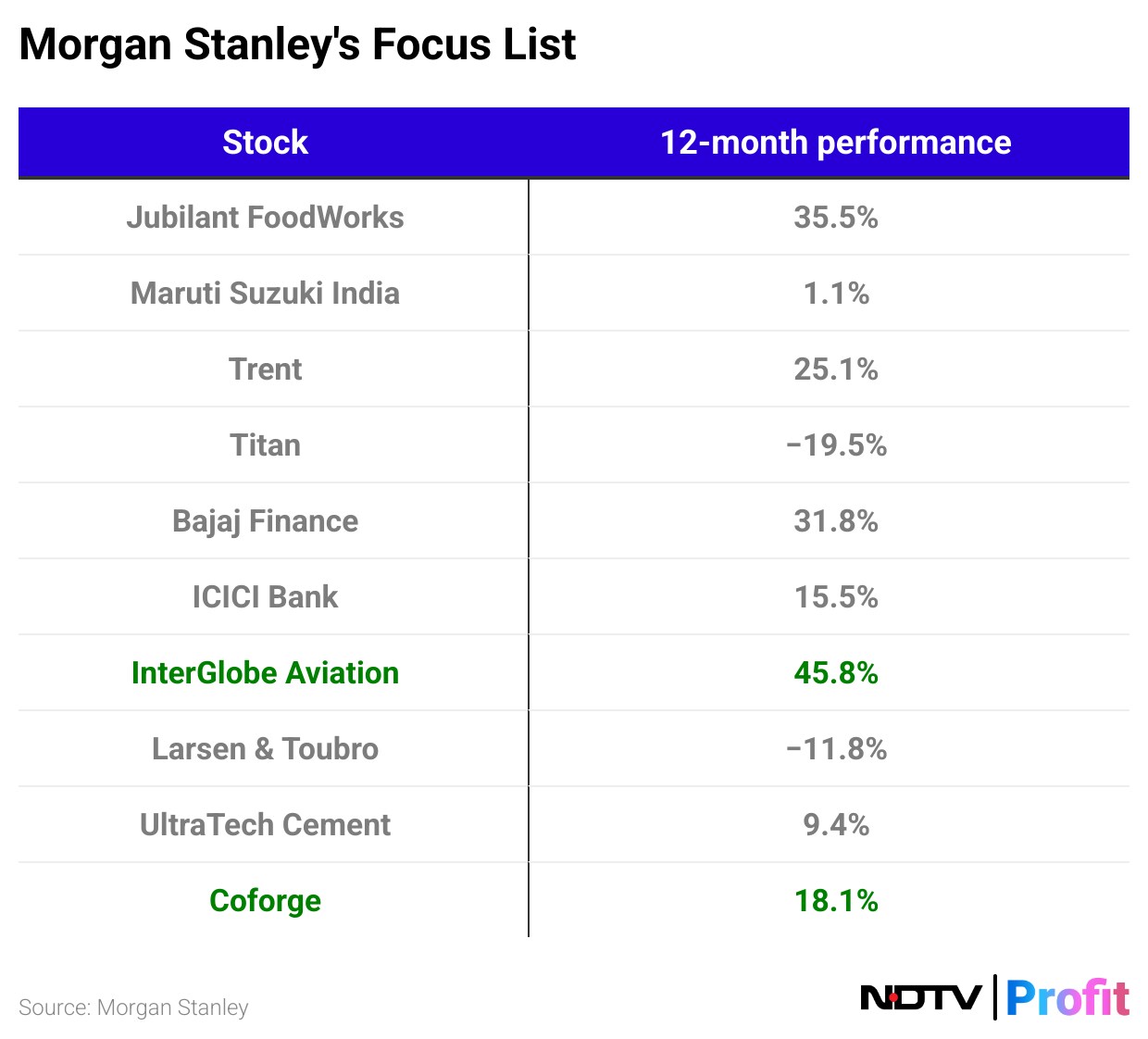

Morgan Stanley's focus list also includes Jubilant FoodWorks Ltd., Maruti Suzuki India Ltd., Trent Ltd., Titan Co., Bajaj Finance Ltd., ICICI Bank Ltd., Larsen & Toubro Ltd., and UltraTech Cement Ltd.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.