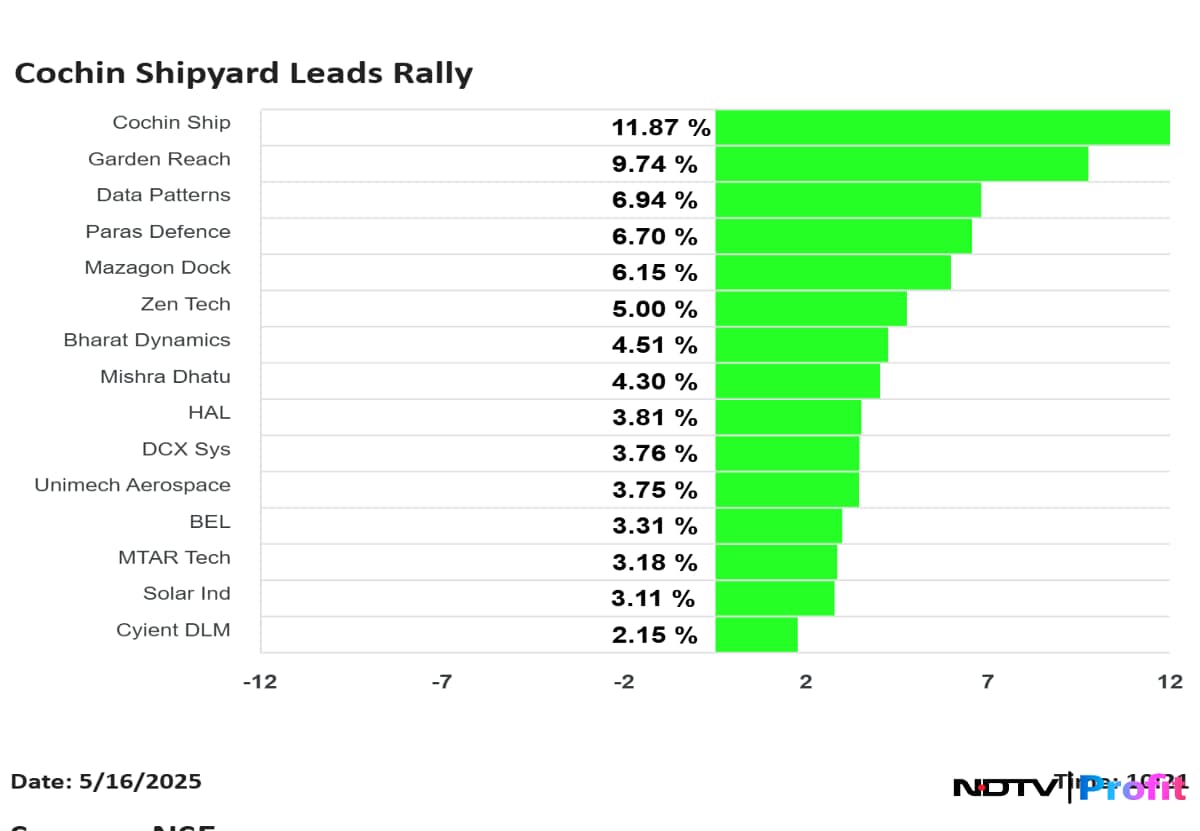

Share price of Cochin Shipyard Ltd. shot upwards in Friday's trading session, up as high as 13%, leading the defence stocks rally after the company posted its financial performance for the final quarter of fiscal 2025, amid a Jefferies note indicating bullish sentiment on the sector.

Cochin Shipyard's fourth quarter net profit and revenue saw growth. However, its margin contracted. The company's consolidated net profit was up 11% to Rs 287.19 crore, while revenue rose 36.6% to Rs 1,757.65 crore.

Ebitda experienced a decline of 8%, falling to Rs 265.78 crore from Rs 289.19 crore. The Ebitda margin contracted to 15.1%, compared to 22.5% last year. Jefferies has marked this miss in their latest report.

However, the brokerage is overarchingly positive on the sector and chose HAL, Data Patterns, and BEL as its top picks.

On optimism over order book visibility of the defence counters, Jefferies sees a pipeline-backed double-digit compound growth in earnings per share in the medium-term horizon, alongside healthy returns on equity and capital employed.

Cochin Shipyard Share Price Today

The scrip rose as much as 12.85% to Rs 2,045 apiece, the highest level since Aug. 28, 2024. It pared gains to trade 12.25% higher at Rs 2,034 apiece, as of 10:28 a.m. This compares to a 0.27% decline in the NSE Nifty 50 Index.

It has risen 32.33% on a year-to-date basis and 51.34% in the last 12 months. Total traded volume so far in the day stood at 13 times its 30-day average. The relative strength index was at 79.47.

Out of five analysts tracking the company, three maintain a 'buy' rating, one recommends a 'hold', and one suggests 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 31.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.