Shares of Brainbees Solutions Ltd. surged by over 4% on Thursday after Kotak Securities initiated coverage with an 'add' rating and a target price of Rs 630. The brokerage's positive outlook for the company is driven by its dominant position in the Indian multichannel retail sector, strong revenue growth prospects, and the profitability of its brand aggregation business, Globalbees.

Kotak Securities highlighted Brainbees Solutions as India's largest multi-brand platform for products catering to mothers, babies, and kids, with a gross merchandise value driven by 8.7 million annual unique transacting consumers in financial year 2024. The firm projects a robust 17% revenue compound annual growth rate from financial year 2024 to financial year 2027, primarily driven by the growth in its customer base and average order value.

Brainbees' India multichannel business, which encompasses its popular e-commerce platform, Firstcry.com, and its network of over 1,100 physical stores, is poised to continue expanding.

Additionally, Kotak Securities noted the promising performance of Globalbees, a direct-to-consumer brand aggregator in which Brainbees holds a 50.2% stake. Globalbees, which invests in fast-growing startups across various segments, including beauty, personal care, electronics, and accessories, reported revenues of Rs 12 billion in financial year 2024. The brokerage expects the brand aggregator to grow at a CAGR of 25.9% over the next three years.

While the path to profitability remains complex for Globalbees due to its diverse investments, Kotak Securities anticipates an improvement in Ebitda margins from 0.2% in financial year 2024 to 5.1% by financial year 2027.

Kotak Securities forecasts a 30% CAGR in adjusted Ebitda over the financial year 2024-2027 period, driven by higher gross margins and operational leverage. However, the brokerage warned that higher Employee Stock Ownership Plan expenses could result in a net loss for Brainbees in financial year 2025 and financial year 2026, with profitability expected to return by financial year 2027.

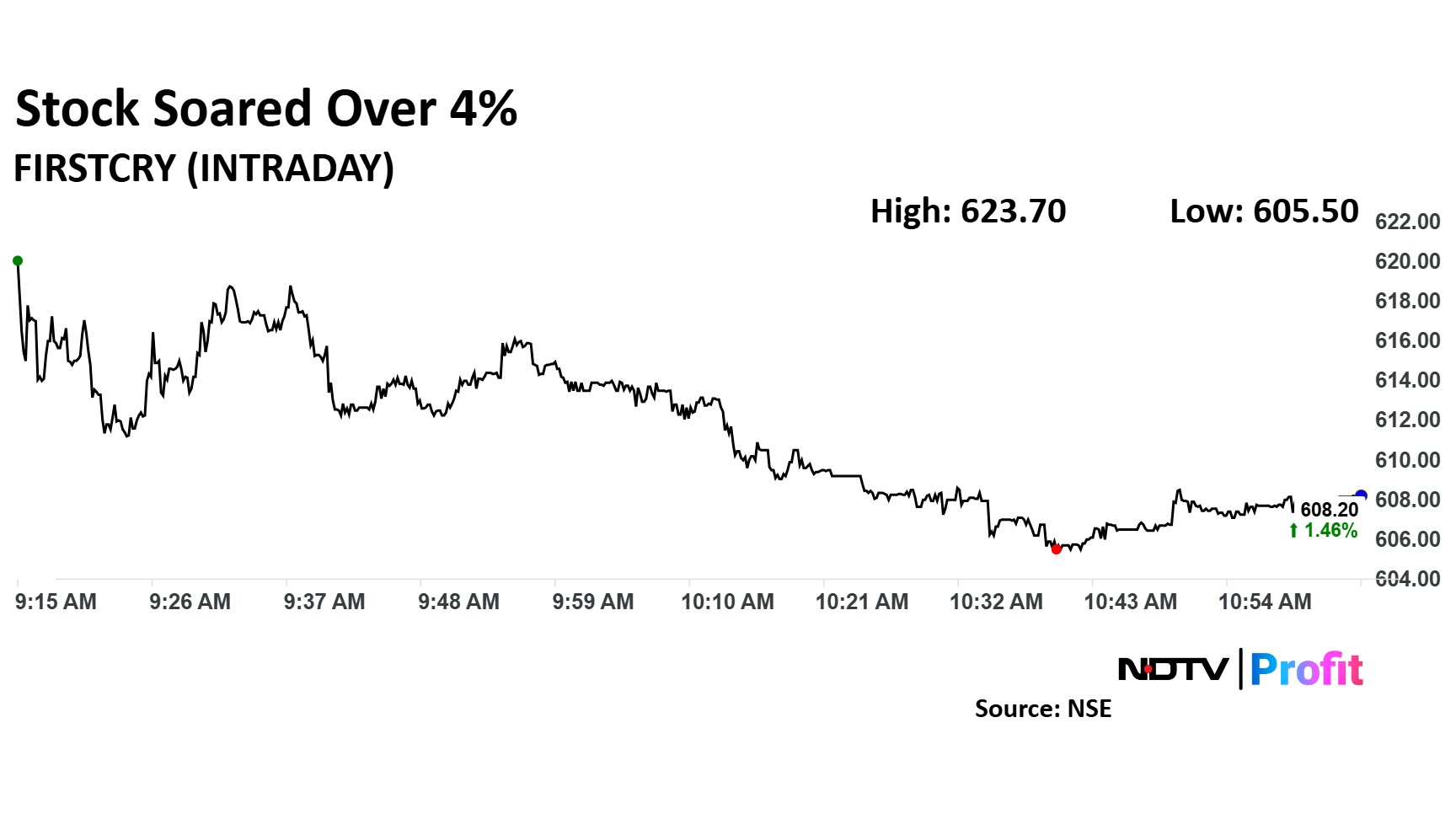

Brainbees Solutions Share Price Today

The scrip rose as much as 4.05% to Rs 623.70 apiece. It pared gains to trade 1.22% higher at Rs 606.75 apiece, as of 10:57 a.m. This compares to a 0.14% advance in the NSE Nifty 50.

It has fallen 10.65% in the last 12 months. Total traded volume so far in the day stood at 1.9 times its 30-day average. The relative strength index was at 54.

All three analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 25.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.