Bharat Electronics Ltd.'s share price climbed 3.90% on Wednesday, reaching an all-time high. This upward momentum followed the company's strong fourth-quarter earnings report and positive evaluations from various brokerages.

BEL's earnings growth in Q4 is likely a key driver behind the stock's performance. The company's consolidated net profit rose by 18.4% to Rs 2,127 crore in the January-March quarter, compared to Rs 1,797 crore in the same period last year. This result exceeded Bloomberg analysts' consensus estimate of Rs 1,752 crore.

Macquarie has reiterated its 'outperform' rating on BEL, raising its target price to Rs 400 from Rs 365. The brokerage's optimism is based on BEL's strong fourth-quarter performance, improved guidance for FY26, and a healthy order pipeline.

Macquarie has also increased its FY26E and FY27E EPS estimates by 7% each, driven by higher margin assumptions. They expect BEL to deliver a 15% EPS CAGR and 27% ROE over FY25–28, supported by a robust domestic order book, emerging export opportunities, and strong government support for defence manufacturing.

JPMorgan has also weighed in positively, noting that BEL's fourth-quarter results beat estimates due to better margins. The aerospace company reported a 30.8% Ebitda margin, surpassing JPMorgan's estimate of 26% and the consensus estimate of 25.3%. JPMorgan maintained an 'overweight' rating on BEL, with a target price of Rs 396.

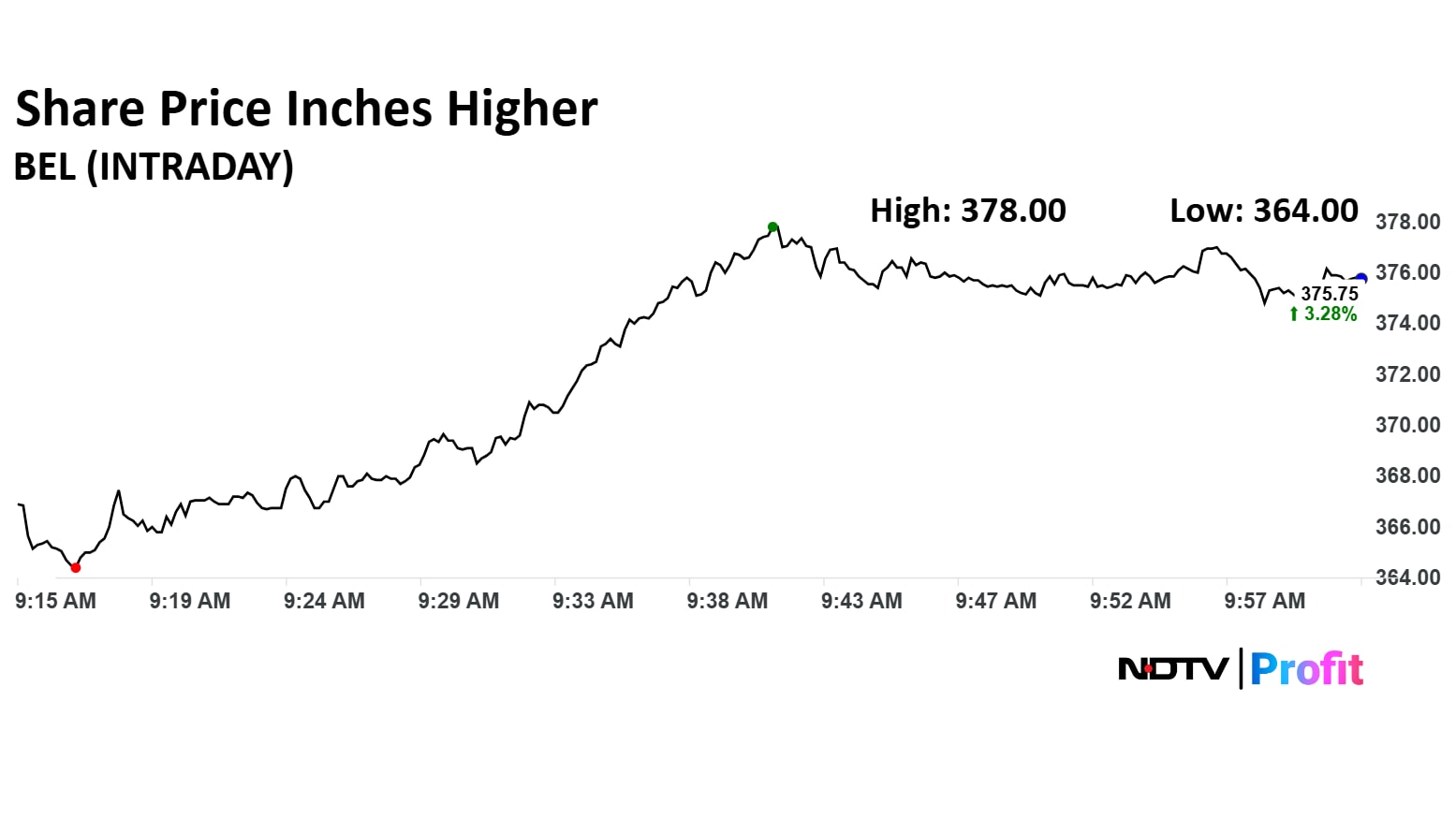

BEL Share Price Today

Shares of BEL rose as much as 3.90% to Rs 378 apiece. It pared gains to trade 3.34% higher at Rs 375.95 apiece, as of 10:07 a.m. This compares to a 0.665% advance in the NSE Nifty 50.

The stock has risen 37.92% in the last 12 months. Total traded volume so far in the day stood at 0.97 times its 30-day average. The relative strength index was at 76.

Out of 28 analysts tracking the company, 24 maintain a 'buy' rating, two recommend a 'hold', and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 1.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.