Bharat Electronics Ltd.'s share price rose more than 3% in trade on Friday after brokerages raised their target prices on the stock.

The increase in the target price comes after strong third-quarter earnings and the uptick expected in order inflows in the fourth quarter.

Jefferies has raised the target price by 34%, the highest increase, while JP Morgan has raised the price by 23.4%. The company's third-quarter earnings beat estimates on all key metrics.

Q3 Earnings

The net profit of the company increased 53% year-on-year to Rs 1,311 crore for the quarter-ended December. The consensus of analysts' estimates polled by Bloomberg had pegged the bottomline at Rs 942 crore.

Revenue from operations rose 38.7% to Rs 5,771 crore in the October-December period, as against Rs 4,162 crore over the same period last year. This was also higher than the consensus estimate of Rs 5,023 crore, as per Bloomberg.

The order book position of the company as on 1st January, 2025, stood at Rs 71,100 crore as compared to Rs 74,595 crore as of September 2024.

Target Price And Outlook

Jefferies maintains the 'buy', with a target price of Rs 370. The target was increased by 34% as earnings beat estimates and the guidance is intact in the third quarter. The margin strength gives the brokerage confidence on profitability. Jefferies expects exports to rise to 9% of sales from 2 to 3%.

Morgan Stanley maintains 'Overweight" rating with an increased target price of Rs 364. The 30% increase is attributed to strong earnings as revenue, EBITDA and profit beat expectations. The brokerage expects the share price to rise relative to country index over the next 60 days. It estimates more than 80% probability for this scenario.

Macquarie maintains 'Outperform' rating on BEL as it increased the target price by 28.4% to Rs 350. The order inflows are weak, according to the brokerage, but guidance implies a strong pickup. Macquarie expects upside risks to current PAT estimates. It also expects order pickup in the upcoming months.

JP Morgan maintains 'Overweight' rating with a 23.% increase in the target price at Rs 343. It also expects average order inflow of Rs 27,000 crore to 30,000 crore over the next two financial years.

Nomura has a 'buy' with a target price of Rs 363. It expects heavy ordering in the fourth quarter. The stock remains the brokerage's top pick.

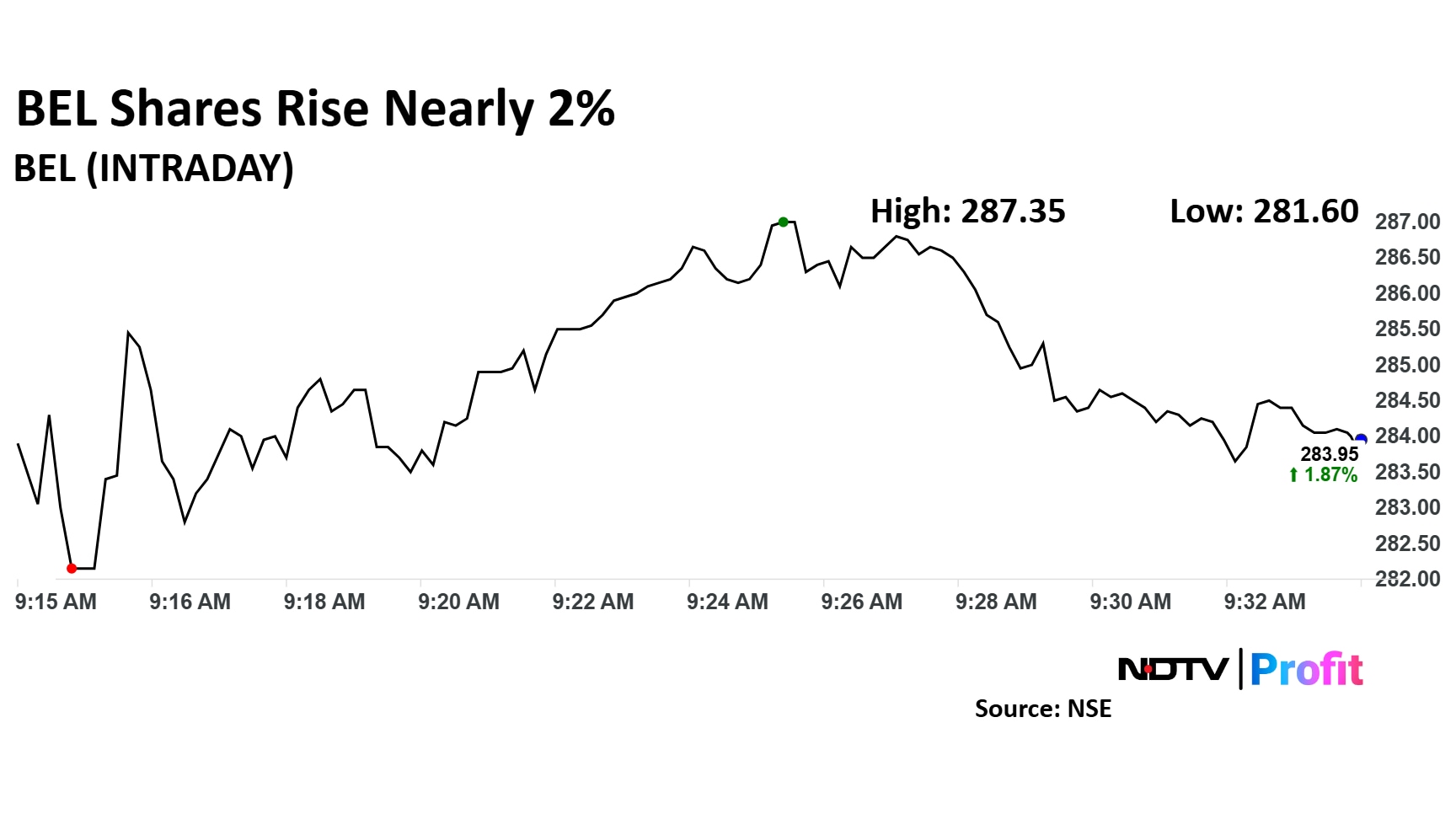

BEL Share Price

BEL share price rose as much as 3.09% during the day to Rs 287.3 apiece on the NSE. However, the stock pared gains later, trading 1.83% higher at Rs 283.85 apiece, compared to an 0.28% advance in the benchmark Nifty 50 as of 9:38 a.m.

It was up 53.07% in the last 12 months. The total traded volume so far in the day stood at 6 times its 30-day average. The relative strength index was at 54.01.

Twenty two out of the 26 analysts tracking the company have a 'buy' rating on the stock, two recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 343.9, implying an upside of 20.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.