- Bajaj Finance shares rose following CLSA's outperform rating and Rs 1,150 target price

- The company is integrating artificial intelligence to enhance operational efficiency

- Credit cost guidance is maintained within the range of 1.85% to 1.95%

Bajaj Finance shares were trading in the green after CLSA maintained its 'outperform' rating with a target price of Rs 1,150. The brokerage is positive about the company's medium-term loan growth and sees positive momentum driven by strategic business decisions.

Bajaj Finance is actively integrating artificial intelligence across its business operations, a move that is expected to enhance efficiency of offerings.

The company also reiterated its credit cost guidance, expecting it to remain within the range of 1.85% to 1.95%. This according to the brokerage provides clarity on the company's approach to managing its loan book quality.

With the repo rate cuts, management expects a 10 basis points expansion in the Net Interest Margin over the year from current levels, which would be a significant boost to profitability.

In a move to address potential asset quality issues, Bajaj Finance has started trimming growth in its Small and Medium-sized Enterprise financing segment. Motilal Oswal notes this as a disciplined approach to risk management, ensuring the company's long-term stability.

Bajaj Finance's remains the brokerage's top pick in the financial sector, with State Bank of India and ICICI Bank.

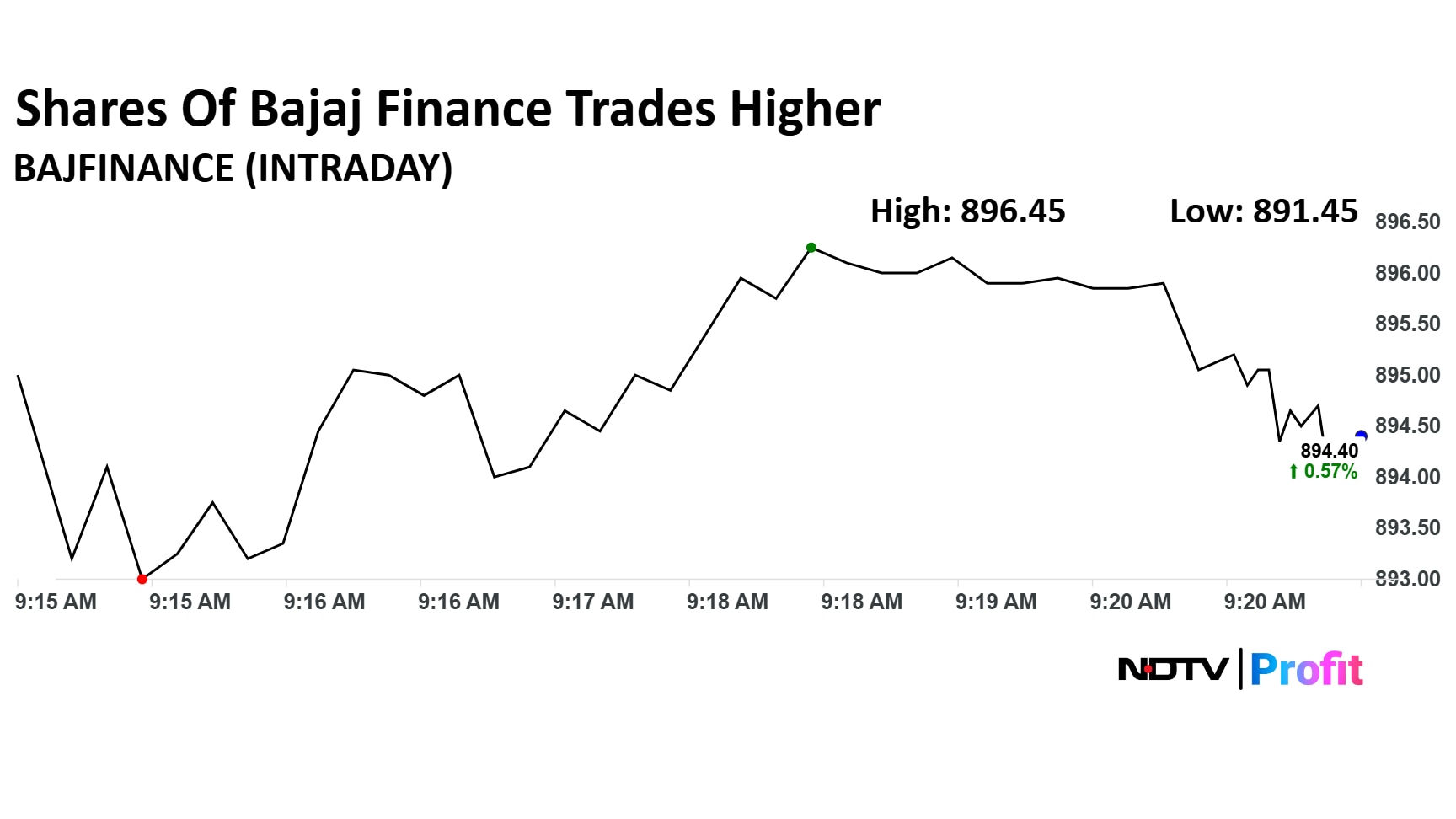

Bajaj Finance Share Price

Bajaj Finance stock rose as much as 0.80% during the day to Rs 896.4 apiece on the NSE. It was trading 0.65% higher at Rs 895.1 apiece, compared to an 0.07% advance in the benchmark Nifty 50 as of 9:26 a.m.

It has risen 20.11% in the last 12 months and 30.95% on a year-to-date basis. The total traded volume so far in the day stood at xx times its 30-day average. The relative strength index was at 39.5.

Twenty one out of the 39 analysts tracking the company have a 'buy' rating on the stock, 13 recommend a 'hold' and five suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 982.7, implying a upside of 9.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.