AU Small Finance Bank Ltd.'s share price fell to the lowest level in over one month as the private lender's asset quality declined. The stock has been declining for four sessions in a row.

Fresh slippages came in at 3.8% of the loans because of a higher stress in cards, microfinance institution portfolio, and commercial banking portfolio. To add to that, the south-based mortgage portfolio led to a 19-basis-point increase in Gross Non-Performing Asset, Emkay Global Research said.

AU Small Finance Bank's management is expecting delay in the MFI book recovery till the fourth quarter and credit card stress will likely remain high in the second quarter before easing in the second half, the brokerage said.

AU Small Finance Bank Q1FY26 (Standalone, YoY)

Net profit advanced 15.6% to Rs 581 crore versus Rs 503 crore

Gross NPA at 2.47% versus 2.28% (QoQ)

Net NPA at 0.88% versus 0.74% (QoQ)

NII rose 6% to Rs 2,045 crore versus Rs 1,921 crore

Provisions rose 88.6% to Rs 533 crore versus Rs 283 crore

Provisions fell 16% to Rs 533 crore versus Rs 635 crore (QoQ)

Operating profit rose 38% to Rs 1,312 crore versus Rs 952 crore

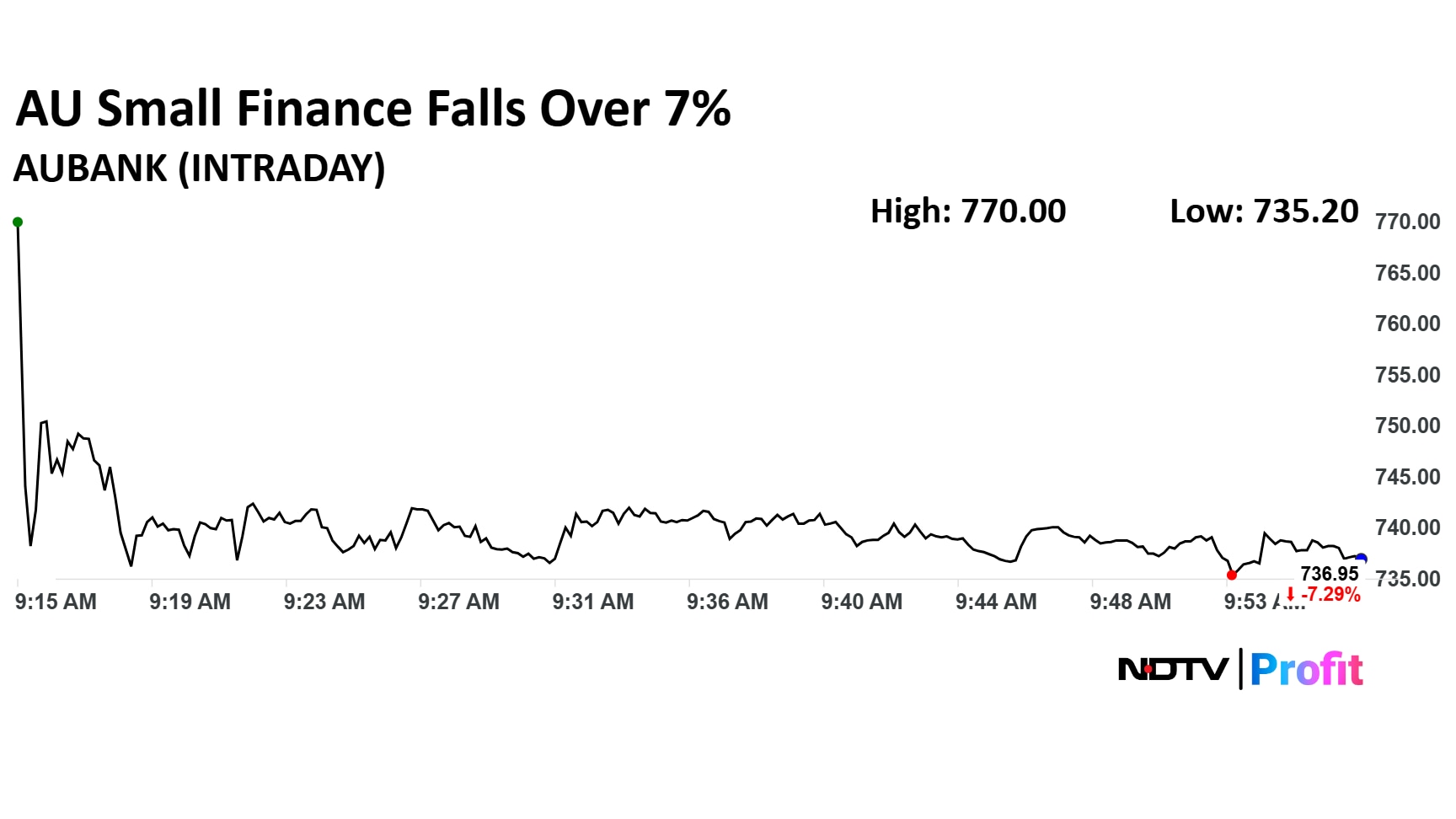

AU Small Finance Bank share price declined 7.51% to Rs 735.20 apiece, the lowest level since June 6. The share price was trading 7.24% lower at Rs 737.35 apiece as of 9:59 a.m., as compared to 0.29% advance in the NSE Nifty 50 index.

The stock advanced 16.25% in 12 months, and 32% on year-to-date basis. Total traded volume so far in the day stood at 3.4 times its 30-day average. The relative strength index was at 32.82.

Out of 34 analysts tracking the company, 19 maintain a 'buy' rating, seven recommend a 'hold' and eight suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 6.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.